As expected, the market froze as it awaits the publication of the report of the United States Department of Labor, and does not respond to any macroeconomic data. Which, by the way, was practically nonexistent.

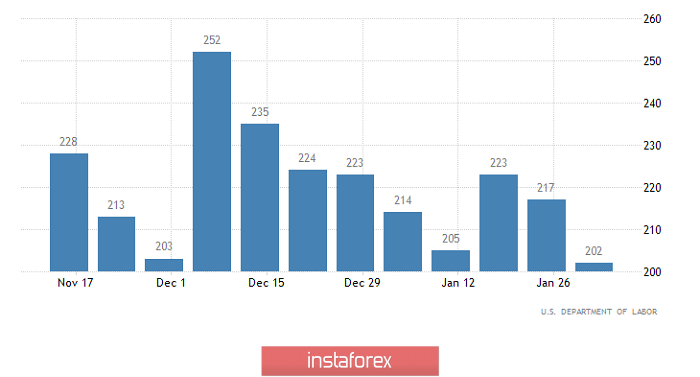

Investors had cause for concern, since the data on applications for unemployment benefits came out much worse than forecasts. Their total number was to be reduced by 6 thousand, but in fact, it increased by 33 thousand. On the one hand, the number of initial applications for unemployment benefits did not increase by 2 thousand, but decreased by 15 thousand. However, the number of repeated applications, unexpectedly increased by 48 thousand instead of decreasing by 8 thousand. Nevertheless, the market ignored this news, as it has high hopes for the contents of the report of the United States Department of Labor.

Number of Initial Unemployment Claims (United States):

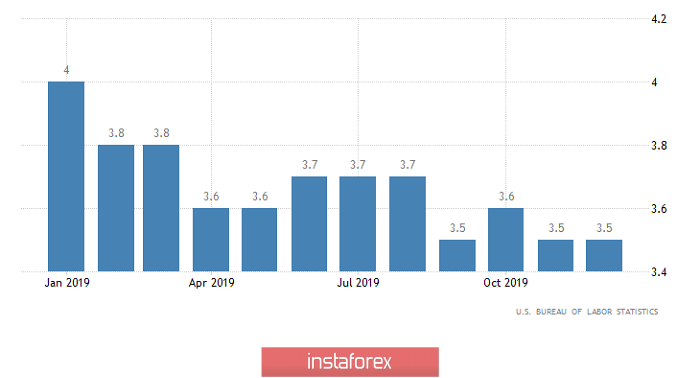

Indeed, expectations regarding the contents of the report as a whole are quite optimistic. Yes, the unemployment rate should rise from 3.5% to 3.6%. However, this should happen by increasing the level of economic activity from 63.2% to 63.3%. That is, due to the dull increase in the share of people in good health in the total population. In addition, 148 thousand new jobs should be created outside agriculture. Last month, 145 thousand of them were created. The growth rate of the average hourly wage can accelerate from 2.9% to 3.0%, and the average working week should increase from 34.3 hours to 34.4 hours. Thus, all indicators should show some improvement, and even a possible increase in unemployment is associated exclusively with a positive factor, such as an increase in the number of healthy citizens. So investors have really something to hope for, and given the reaction of the market to applications for unemployment benefits, it seems that these data are already included in the value of the dollar. Therefore, if the forecasts are confirmed, then the growth of the dollar will be significantly limited. However, it is worth paying attention to the fact that absolutely all the data came out completely different from what was predicted over the past couple of days. Moreover, United States labor market data may not be an exception to this rule and if they turn out to be worse than forecasts, then the dollar will rapidly lose its position.

Unemployment Rate (United States):

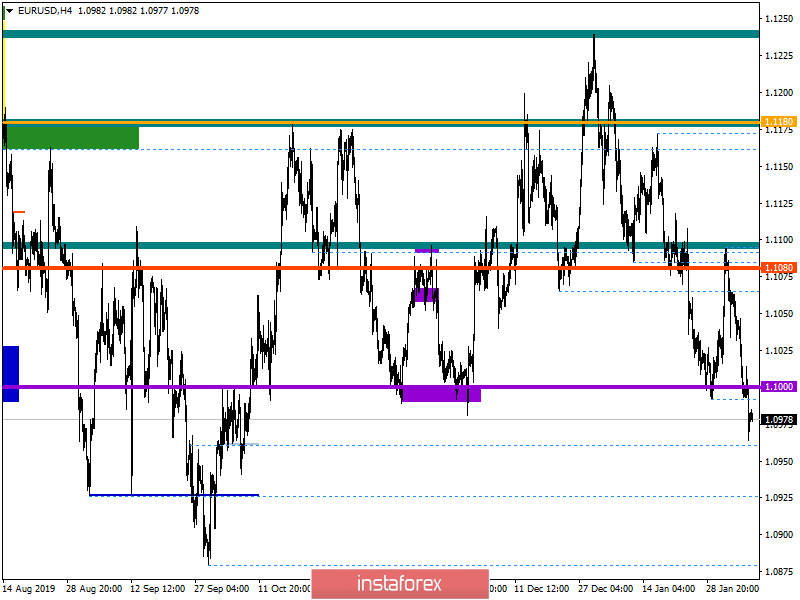

From the point of view of technical analysis, we see the first breakdown of the psychological level of 1.1000 for a long time, where the quote managed to go down locally down to the level of 1.0964. In fact, this is not just a local strike, but keeping the quote below all previously formed punctures by shadows, which may mean a change in interests.

In terms of a general review of the trading chart, we see the recovery process with respect to an elongated correction, where the quote has already managed to overcome the 70% recovery bar, which is a good sign in terms of improving the main trend.

It is likely to assume that we will see the retention process at this time, where chatter is not excluded within 1.0965 / 1.0990. Thus, you should not just analyze the fixation points, but look at the current news background, which may put pressure on the quote.

Concretizing all of the above into trading signals:

- Long positions are considered in case of price fixing higher than 1.0990 / 1.1000, coupled with negative data on the report.

- Short positions are considered in the case of fixing lower than 1.0965-60, paired with positive data on the report.

From the point of view of a comprehensive indicator analysis, we see a sell signal relative to all the main time intervals. It is worth considering that the indicators of technical tools at shorter time intervals can be multi-directional, in the event of a slowdown or a rollback.