It can be seen very clearly that the market froze while waiting for the publication of a report by the United States Department of Labor. Although there was very little data published yesterday, no reaction was still received. Looking ahead, it is very possible that the market has already put optimistic forecasts in the value of the dollar on the contents of this report itself, which will be discussed a little later.

To begin with, it is worth paying attention to yesterday's data on applications for unemployment benefits all in the same United States. The total number of which increased by 33 thousand. The fact is that in the best traditions of recent days the data came out completely different from what was predicted. However, they expected a reduction in the number of applications by 6 thousand. If you go into details, it's still interesting, since the number of initial applications for unemployment benefits declined by 15 thousand, while they were waiting for their growth by 2 thousand. At the same time, the number of repeated applications increased by 48 thousand instead in order to decrease by 8 thousand. Thus, everything is wrong, but no reaction followed. Investors just left this data without any attention.

Repeated Unemployment Insurance Claims (United States):

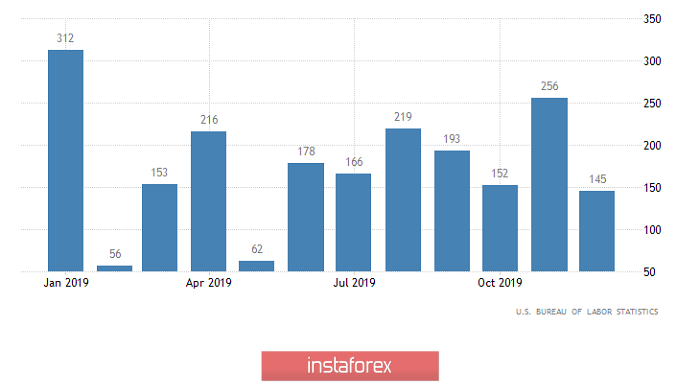

Now, we can talk about the report of the United States Department of labor, which, as I said earlier, should be extremely positive. However, the unemployment rate should increase from 3.5% to 3.6%. But the whole thing is that this should happen due to an increase from 63.2% to 63.3% of the share of labor in the total population. That is, it is not less work, but more free workers. And that's just great. Let's just say that's where the bad news ends. Indeed, the pace of creating new jobs outside agriculture should increase, and they may turn out to be 148 thousand against 145 thousand in the previous month. In addition, the growth rate of average hourly wages can accelerate from 2.9% to 3.0%, and the average working week should increase from 34.3 hours to 34.4 hours. I.e, as a result, there are more free workers. For them, more and more new jobs are being created. Salaries are growing, and people themselves are working more. Not a report, but a dream. However, given the way the market behaved yesterday, it is safe to say that investors have already put all this into the value of the dollar, and if the forecasts are confirmed, it will not grow much. But more importantly, in recent days, all macroeconomic data have come out completely different than expected. And the latest indirect data on the labor market clearly indicate that a similar fate awaits the content of the report of the United States Department of Labor. The only question is - for better or for worse. There is no definite answer, because some indicators speak for one, others for another. In any case, even if the content of the report is better than predicted, the growth potential of the dollar is limited, including its apparent overbought. But if worse, then we will witness here the long-awaited correction.

New non-farm jobs (United States):

So, if everything goes well with the content of the report, the single European currency may even decline to the level of 1.0950. Well, if it is disappointing, we can expect growth in the direction of 1.1025 which is only the first level.

If we talk about the pound, there are prospects for its decline to the level of 1.2900 if the contents of the report will please investors, Otherwise, it may well increase to the level of 1.3025.