The euro-dollar pair tried to adjust during the Asian session on Monday, after a sharp decline on Friday. The January NonFarm did not fail the dollar bulls, so the American currency quite reasonably strengthened throughout the market. However, the further fate of the EUR/USD pair remains in question, as the bears failed to break through the support level of 1.0950 (the lower line of the BB indicator on the daily chart). Now, the price movement vector depends on the key events of the current week. First of all, we are talking about the speech of Fed Chairman Jerome Powell in Congress and the release of data on rising US inflation. In addition, Christine Lagarde is expected to speak in the European Parliament this week - this fundamental factor will also affect the dynamics of EUR/USD.

So, on Tuesday, February 11, the head of the Federal Reserve will begin his two-day speech in the US Congress. First, Jerome Powell will present this report to the Committee on Financial Services of the House of Representatives of the Congress, then to the Committee on Banking, Housing and Urban Affairs.

The content of the report itself has already been published, so the main attention of traders will be focused on additional Powell comments. However, we can already conclude that the Fed was concerned about the spread of the Wuhan coronavirus - according to Fed members, the epidemic could be a threat to the prospects for the US economy. The regulator voiced a quite pessimistic scenario, which is caused by the "domino effect": further closure of Chinese cities will lead to a halt in tourism in the country, destabilizing the Chinese economy. This fact will have negative consequences for the global economy. The Federal Reserve also warned that a significant recession in China could spread to the US and global markets - by reducing risk appetite, revaluing greenbacks, as well as lowering trade volumes and commodity prices.

On the other hand, the remaining points of the report are positive. Fed members noted the growth of the US economy and the easing of tension in the trade sector. Key economic indicators "indicate the presence of stabilization signals", determining a wait-and-see attitude towards monetary policy. According to the general opinion of the members of the Federal Reserve, the interest rate will remain at the current level, and only "unforeseen events" will force them to soften the terms of the monetary policy. If Jerome Powell allows the realization of such a scenario during his speech (in connection with the Chinese coronavirus), the dollar will weaken throughout the market, despite the general positive report of the Fed.

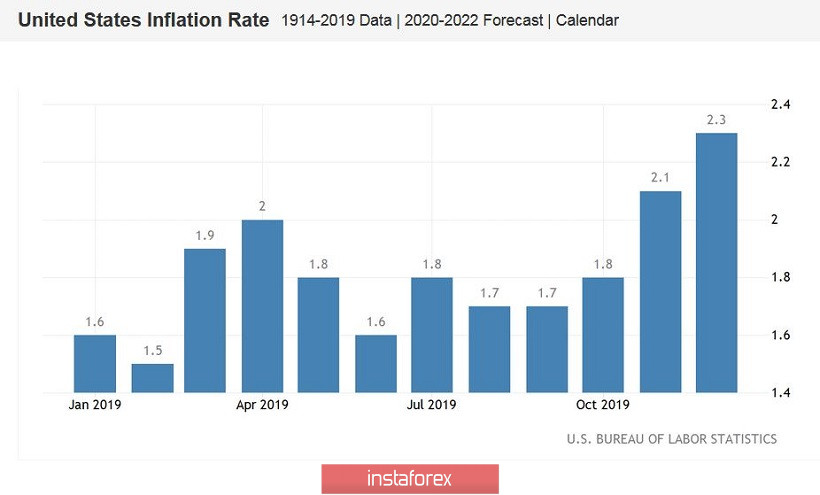

On Wednesday, the head of the Federal Reserve will continue his two-day speech in Congress, but on Thursday, February 13, the most important data for the dollar will be published. We are talking about the publication of data on the growth of American inflation. The general consumer price index should show positive dynamics, rising to 2.5% on an annualized basis and to 0.3% on a monthly basis. In turn, core inflation, excluding food and energy prices, can also show minimal growth in monthly terms (from 0.1% to 0.2%) and remain at the same level (2.3%) in annual terms. If real numbers decline below forecast values, the dollar could fall under a wave of sales. At the same time, weak inflation will affect Fed members who are forced to reckon not only with the dynamics of the labor market, but also with inflationary dynamics especially in the light of Powell's argument following the January meeting of the Federal Reserve. Therefore, the disappointing CPI report will in any case put downward pressure on the US currency.

On the last trading day of the week, the market will trade under the influence of previous events. However, Friday's economic calendar isn't completely empty: the United States will publish data on retail sales. In December, the overall indicator rose by 0.3%, and January figures should also show positive dynamics - both the total volume of retail trade, excluding car sales. All these indicators should go above zero (0.4 and 0.6%, respectively). In addition, we will find out on this day the second estimate of GDP growth in the Eurozone and Germany in the fourth quarter, as well as the German inflation rate.

Thus, the EUR/USD bears this week can either strengthen their success by pulling the pair into the region of the 8th figure, or give the initiative to the bulls, which will return it to the area of the 10th figure. Moreover, the coming days will be full of informational issues. Therefore, we can say that increased volatility is guaranteed. From a technical point of view, the EUR/USD bears need to overcome the support level of 1.0950 (the lower line of the BB indicator on the daily chart) - this fact will allow sellers to count on testing the 8th figure. Buyers, in turn, need to rise above the level of 1.1020 (Tenkan-sen line on D1) in order to end the pair's downward impulse.