Yes, Friday was a complete surprise specifically with how the market behaved. It all happened even before the publication of a report by the Department of Labor of the United States. At least with a single European currency. Although it left from side to side, just when the data on the labor market became known, however, the scale of the movement was not impressive. At the same time, the single European currency reacted most of all to macroeconomic data for individual countries of the euro area, which is not usually observed. Nevertheless, the pound behaved obediently and waited for the publication of the report.

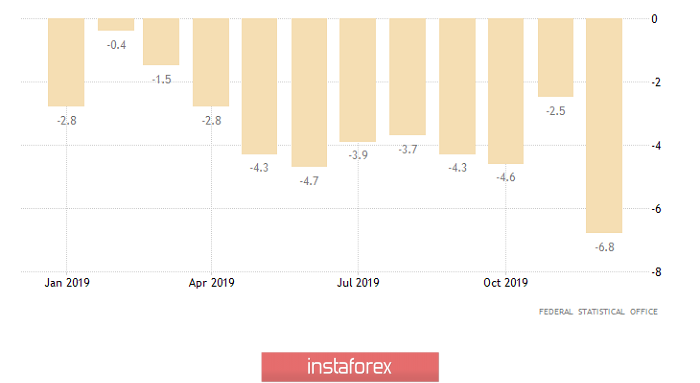

So, from the very opening of the European session, the single European currency almost flew down rapidly, and the reason was the data on industrial production in the largest countries of the euro area. In France for example, where until recently rejoiced in the industrial growth of 0.9%, are now forced to be sad about the 3.0% decline in annual terms. And given that this is data for December, it turns out that for 2019, industrial production in the Third Republic fell precisely by this very 3.0%. But what is happening in Germany is much worse, because in the largest economy in Europe, the rates of decline in industrial production only increased from -2.5% to -6.8%, which cannot be called anything but a catastrophe. Even in Spain, where industrial production is still growing, the pace of this growth slowed down from 1.6% to 0.8%. Well, I guess the cherry on the cake is the retail sales in Italy, with a growth rate that slowed down from 1.0% to 0.9%. The data on absolutely all countries is simply terrifying and it doesn't even make sense to talk about what data was expected, because all the forecasts did not materialize, and the data came out significantly worse.

Industrial production (Germany):

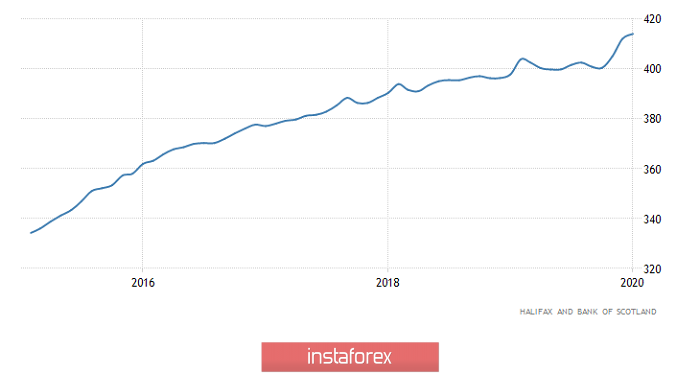

The pound, on the other hand, obediently awaited the publication of the report of the Department of Labor of the United States, although it has a diametrically opposite situation since Halifax housing price data turned out to be much better than forecasts. After all, the growth rate of housing prices accelerated from 4.0% to 4.1%, while they expected a slowdown to 2.3%.

Halifax Home Price Index (UK):

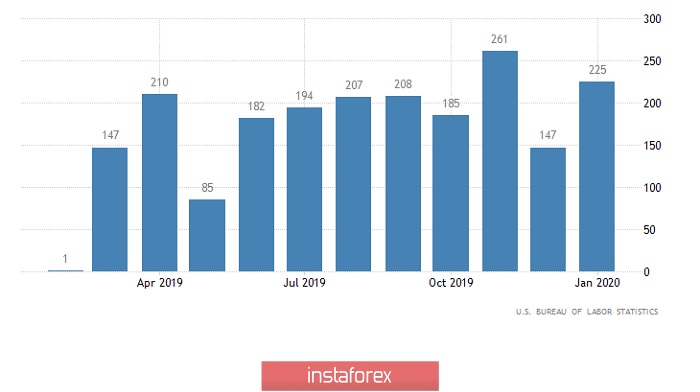

Only the pound reacted to the contents of the report while the single European currency weakened, but still far from how it was at the time of publication of European data. Moreover, the content of the report can be called simply magnificent. Yes, the unemployment rate, as expected, rose from 3.5% to 3.6%. And this fact caused a fleeting surge when both the pound and the single European currency tried to grow. But then investors, apparently, moved on to other sections of the report, and their moods changed in the opposite direction. The unemployment rate rose only due to an increase in the share of the able-bodied in the total population, which is from 63.2% to 63.4%. So, the unemployment rate was supposed to grow stronger. Not to mention the growth of unemployment itself is not associated with the worsening of the situation on the labor market, but with a banal sharp increase in free labor. This means that the unemployment rate did not grow stronger for the simple reason that 148 thousand new jobs were created outside agriculture, but 225 thousand. And not only were more jobs created than expected, but the average hourly growth rate wages also rose from 3.0% to 3.1%. The only indicator that let us down was the average working week, which did not grow and remained unchanged. But people can be understood, since why work more if they already pay more? The only indicator that let us down was the average working week, which did not grow and remained unchanged. But people can be understood, since why work more if they already pay more? The only indicator that let us down was the average working week, which did not grow and remained unchanged. But people can be understood, since why work more if they already pay more?

The number of new jobs created outside agriculture (United States):

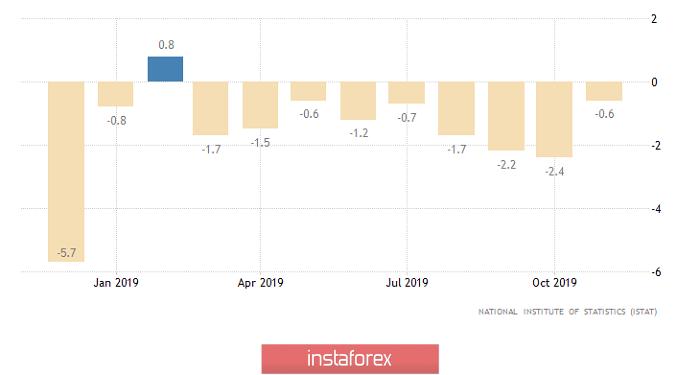

However, the extremely weak reaction of the market to the incredibly good content of the report of the Department of Labor of the United States clearly indicates that the dollar has already run out. It no longer has the strength to grow further and spent the latter on European macroeconomic data. This is not surprising since recently it has strengthened very seriously, and is clearly overbought. At the same time, part of the growth is not due to macroeconomic factors, but exclusively to emotions and informational noise. Therefore, it is necessary that it is essential that the dollar continues to grow. In addition, any factor that can somehow play against the dollar will lead to its noticeable weakening. However, today only the media or politicians can breathe life into the market since the macroeconomic calendar is completely empty and soon we will see a creeping and subtle weakening of the dollar. A sort of symbolic technical rebound. Market participants are unlikely to even notice data on industrial production in Italy, the decline of which should deepen from -0.6% to -1.2%. On Friday, everyone ate industrial production in Germany and France. Italian data will not change the overall picture.

Industrial production (Italy):

The single European currency will be in the region of 1.0950, although it will demonstrate a desire for growth towards 1.1000. But only demonstrate, not move.

The pound has a similar situation, so it will hang around 1.2875 - 1.2900. The medium-term benchmark is 1.2950.