GBP/USD

Analysis:

The British pound is dominated by the downward wave from December 13 and the first parts (A-B) are formed in its structure. Over the past month, the price formed a downward section of the final part (C) and the price has reached strong support on a large scale.

Forecast:

There is little chance that the pair will continue to decline without forming a pullback. Over the next day, we expect a flat mood of the price movement with a general upward vector. A return to the downward rate is possible at the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 1.2950/1.2980

Support:

- 1.2880/1.2850

Recommendations:

Purchases of the British currency in the main pair today is only possible in the next sessions, with a reduced lot. It is recommended to refrain from trading during the rollback period and monitor the sale signals.

USD/JPY

Analysis:

The main trend direction of the Japanese yen since August is set by an upward wave and its last section started on January 8. The price is approaching the lower limit of a strong resistance zone and the current price pullback in the last 2 days sets the stage for a further breakout of the price up.

Forecast:

In the upcoming trading sessions, a sideways flat is possible. In the first half of the day, repeated pressure on the support zone is expected. You can expect a change of course and an increase in the volatility of the currency by the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 110.20/110.50

Support:

- 109.60/109.30

Recommendations:

Selling the yen today is risky and transactions should be completed at the first sign of a reversal. We recommend that you focus on finding clear signals to buy a pair.

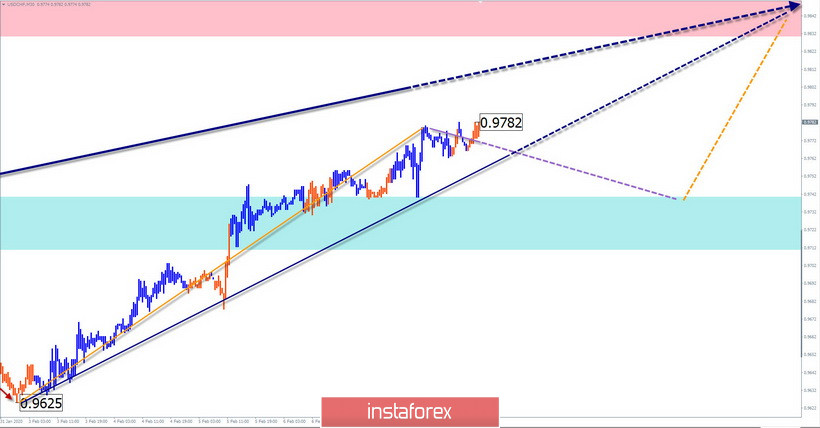

USD/CHF

Analysis:

The main trend of the Swiss franc since April last year is set by a bearish wave and the wave structure is not complete. From November, the final part (C) is formed. Since the beginning of this year, a complex correction structure has been formed in the form of an expanding triangle.

Forecast:

The current correction wave has entered the final phase and a general upward trend is expected during the next trading sessions. In the first half of the day, you can not exclude a short-term decline, no further than the calculated support. The beginning of the active lifting phase is possible by the end of the day.

Potential reversal zones

Resistance:

- 0.9830/0.9830

Support:

- 0.9740/0.9710

Recommendations:

Franc sales are possible today, but it is worth reducing the lot as much as possible. It is recommended to pay special attention to the emerging signals of buying a pair.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure and the dotted background shows the expected movements.

Note: The wave algorithm does not take into account the duration of the tool's movements in time!