To open long positions on GBPUSD, you need:

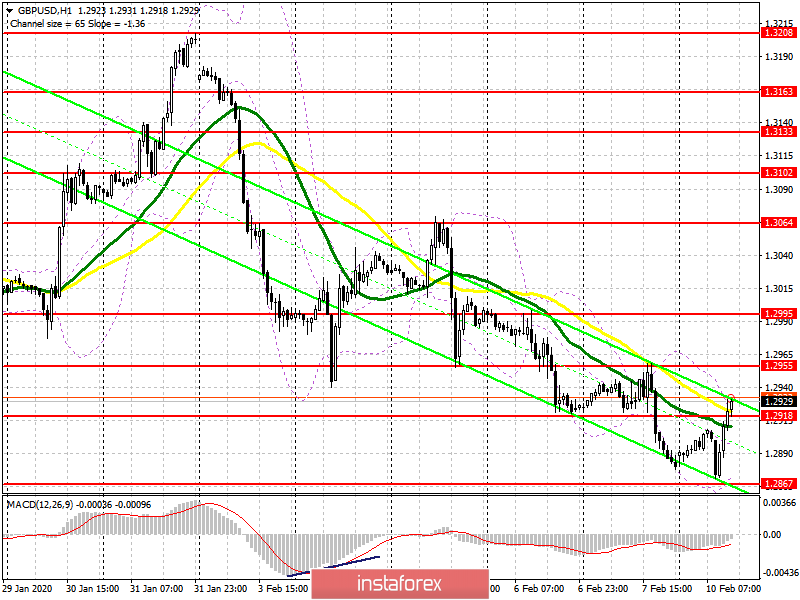

In the morning forecast, I paid attention to purchases in the support area of 1.2867 and to the divergence that could have formed on the MACD indicator, which pushed the sellers of the pound out of the market. At the moment, buyers have reached their target and are trying to pick up the resistance of 1.2918, however, it will be clear whether it will be possible to strengthen their positions above this range only after the close of the day. The nearest target of the bulls is a maximum of 1.2955, a break of which will provide a direct road to the area of the level of 1.2995, where I recommend fixing the profits. In the scenario of a downward correction of GBP/USD in the second half of the day and a return of the pair to the area of 1.2918, it is best to return to long positions only for a rebound from the minimum of 1.2867.

To open short positions on GBPUSD, you need:

Sellers, without thinking twice, left the market after reaching the support of 1.2867, which I paid attention to in my morning forecast. At the moment, much will depend on whether the area of 1.2918 can be regained or not. If the North American session will develop according to the scenario of bulls, then it is best to look at short positions only after updating the highs of 1.2955 and 1.2995. If the bears regain the level of 1.2918, then speculative buyers will also quickly exit the market, which may gradually push the pair into the area of today's opening, or even lead to a repeat update of the support of 1.2867, where I recommend fixing the profits. The speeches of the representatives of the Federal Reserve System are unlikely to have a serious impact on the pair's quotes and will have some short-term impact on the pound.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily averages, which indicates that the downward trend is gradually ending in the short term.

Bollinger Bands

The upper limit of the indicator at 1.2930 keeps the pair from further growth. In the case of a decline, you can open long positions on a rebound from the lower border of the indicator in the area of 1.2870.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence) Fast EMA Period 12. Slow EMA Period 26. SMA Period 9

- Bollinger Bands (Bollinger Bands). Period 20