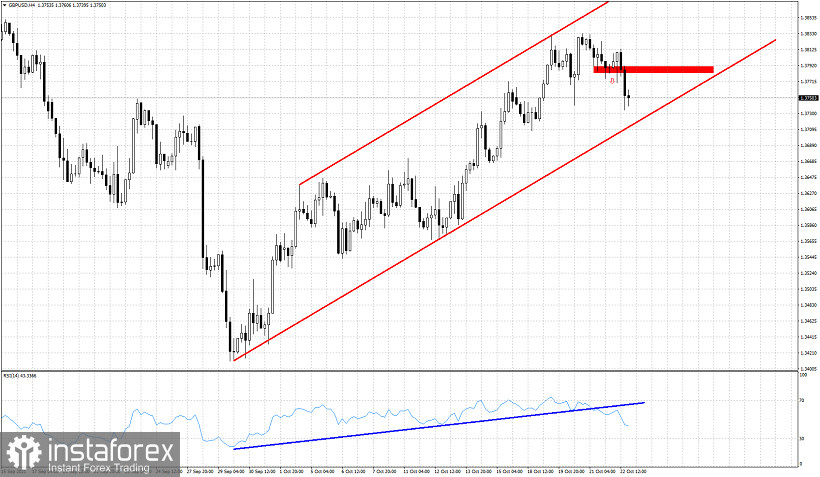

In our last analysis on GBPUSD we warned bulls that price was vulnerable in providing a sell signal. We outlined the reasons why we favoured a reversal from current levels and the level that will provide confirmation of the reversal. On Friday price broke below the short-term support at 1.3784 and ended the day around 1.3750.

Red rectangle -support

Blue line- RSI support

Our expectations are for price to reach at least the lower channel boundary around 1.37. Price has provided a bearish signal on Friday by breaking below the red rectangle which is now resistance. Short-term trend is changing from bullish to bearish as price has started making lower lows and lower highs. Price has stopped the decline at recent lows at 1.3740-1.3750. The RSI that provided us with a bearish divergence has now broken below the support trend line and is moving lower. Currently we do not rule out a bottom around 1.37, a new higher high above 1.3830 and the RSI to provide a new bearish divergence. As long as the bullish channel holds, bulls still have hopes for another move higher.