Hello, dear colleagues!

In yesterday's trading, the euro/dollar currency pair continued to decline. As you remember, yesterday's review of EUR/USD suggested a correction, after which it was recommended to open short positions on the main currency pair of the Forex market near 1.0990, 1.1010 and 1.1070. However, we did not see any rate adjustment. Now almost everyone is against the single European currency.

After a long new year's holiday on the lunar calendar, the Chinese returned to their jobs yesterday. However, it is difficult to call it a holiday in full. The coronavirus epidemic was the main reason for such a long new year's weekend.

Some experts believe that the epidemic has declined and the peak has already passed, while others suggest that "everything is just beginning". Whatever the case, it seems that the coronavirus is supporting the US dollar as the world's reserve currency and, in this case, a safe asset.

Probably, market participants continue to playback Friday's strong Nonfarm Payrolls and extremely weak data on industrial production in Germany. And then there's Annegret Kramp-Karrenbauer, a protege of Angela Merkel, who refused to run for the post of German Chancellor, thus causing political uncertainty in the country.

If you look at today's economic calendar, you should definitely pay attention to the speech of ECB President Christine Lagarde, which is scheduled for 15:00 (London time), as well as the first part of the semi-annual report on monetary policy of Fed Chairman Jerome Powell at 16:00 (London time). I believe that these events can have a real impact on the price dynamics of the main currency pair. In the meantime, let's move on to the euro/dollar charts.

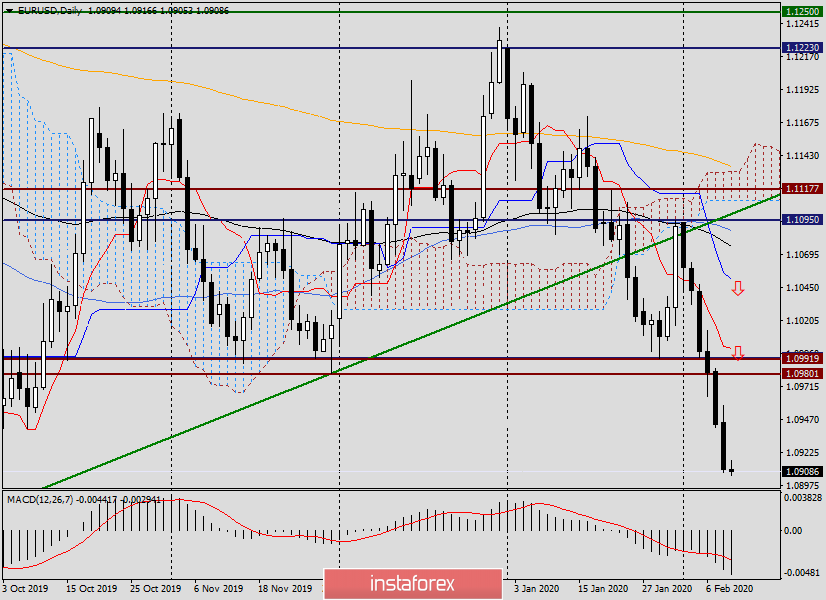

Daily

After yesterday's decline, the bearish view on the daily chart became even more distinct. Most likely, the pair is aimed at testing the support level of 1.0879 for a breakdown, where the minimum trading values were shown on 01/10/2019. To some extent, we can assume that in the current situation, this is one of the last strongholds of the euro bulls. If this level is broken and the pair is fixed below it, the decline will not only continue but also increase.

On the daily chart, options for opening positions are preserved but prices have become lower after yesterday's fall.

First, it is better to wait for a correction in the area of 1.0980-1.1000, where to consider selling the pair, especially in the presence of bearish candlestick patterns. In the selected zone, there are two broken brown support levels, and right at the significant technical and psychological level of 1.1000, the Tenkan line of the Ichimoku indicator is located. More distant benchmarks for sales near 1.1050, but it is hard to believe that the pair will be able to get to this price.

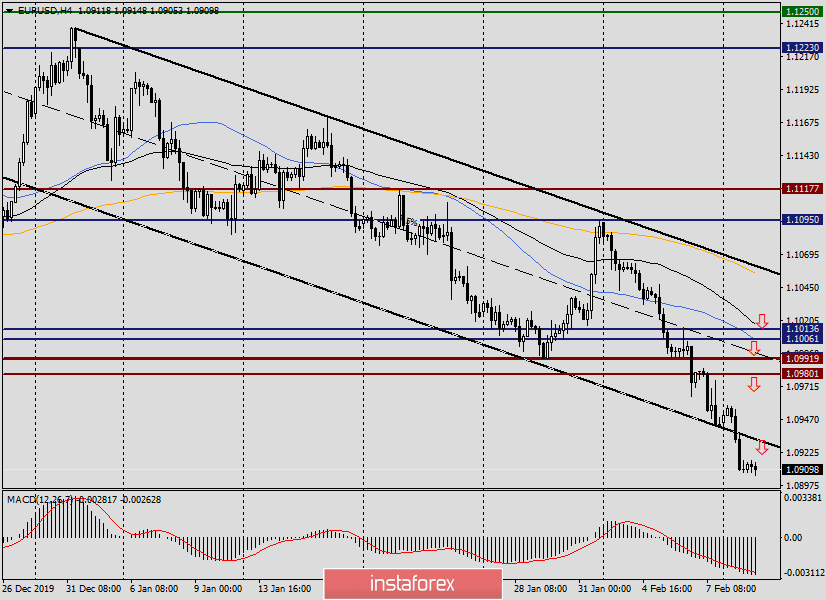

H4

On this chart, the picture is also clearly bearish. What can I say if the pair breaks the support line of the descending channel? This indicates the strength of bearish pressure.

In principle, the breakdown has already taken place and the quote is fixed under the lower border of the channel, which can now become a good resistance. Thus, the next sales are planned for the rise in the price zone of 1.0925-1.0930 and attempt to return to the limits of the abandoned channel.

However, it is not uncommon for the price to return to the channel. In this case, it is advisable to consider opening short positions on EUR/USD near 1.0980, 1.1000 and 1.1018, where the arrows are placed.

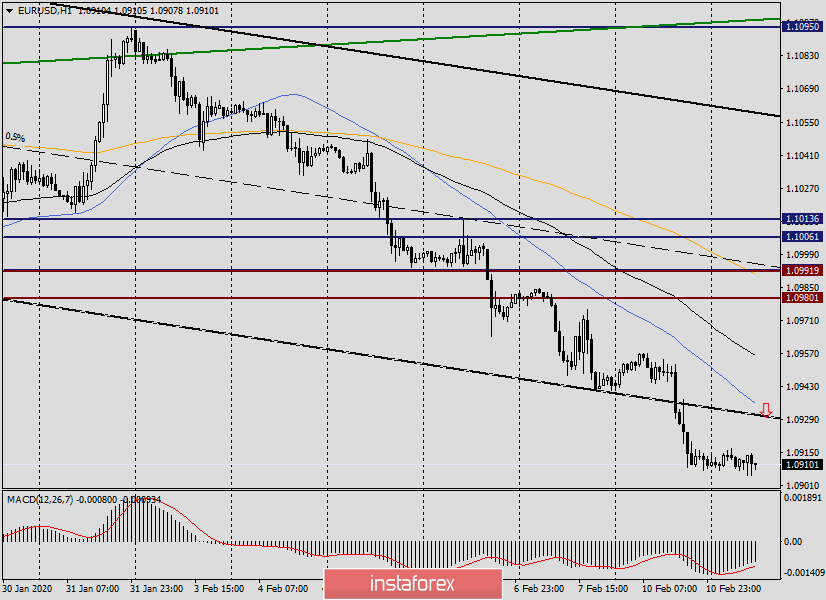

H1

On the hourly chart, the sales ideas suggested above are confirmed. The nearest sales are from 1.0930, and when trying to return to the channel, we consider opening short positions from the price zone of 1.0937-1.0957. These are currently trading recommendations that I can offer for the main currency pair.

Good luck!