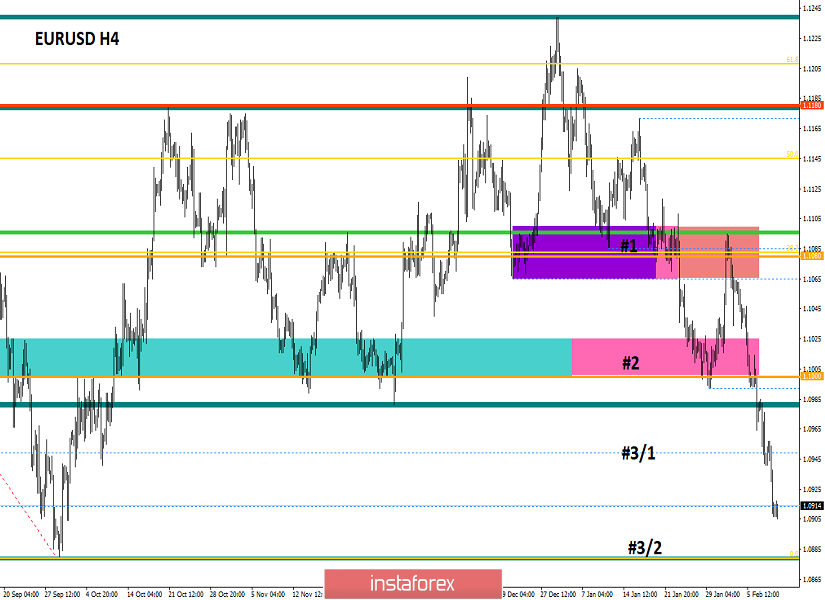

Using complex analysis, we can see that the quote managed to go down to 1.0907, which means that the end of the recovery is already close. Our deduced theories began to bear fruit at the end of last year so, the recovery theory has already passed the stages # 1 [1,1080], # 2 [1,1000], # 3/1 [1,0950], where the last stage was the average, which led to an increase in the course. In fact, at the moment, we have completed 91% of working out the oblong correction [Low-1.0879; High-1.1239], which means that we can consider it as a completed model. However, be reminded that the resumption of the original trend will begin after the price fixes below the original pivot point at 1.0879. Afterwards, the quote will automatically be at the values of 2017, which means that we will face one of the strongest range of interaction between the price and market participants. I advise everyone to carefully analyze the time interval from March 2015-April 2017, as we will fall into the trap of speculation, where the fear of historical lows will prevail over everything. Moreover, from the point of view of regularity, the range of 1.0000 / 1.0500 pursues an increased speculative interest, where short positions come to naught when critical levels are reached. The only working element that can help break through the boundaries of interaction is the information background, if there is one in the market. from the point of view of regularity, the range of 1.0000 / 1.0500 pursues an increased speculative interest, where short positions come to naught when critical levels are reached. The only working element that can help break through the boundaries of interaction is the information background, if there is one in the market. from the point of view of regularity, the range of 1.0000 / 1.0500 pursues an increased speculative interest, where short positions come to naught when critical levels are reached. The only working element that can help break through the boundaries of interaction is the information background, if there is one in the market.

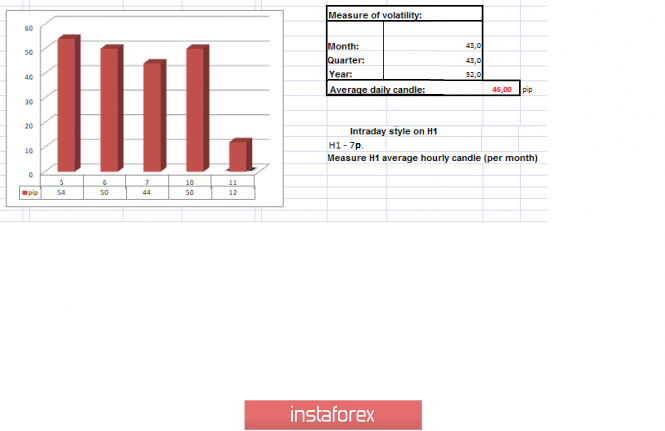

In terms of volatility, we see stable indicators that have already managed to overcome the daily average by 7%. In this case, we see not just the characteristic acceleration that occurred at the moment of the second stage breakdown [# 2 - 1,1000], but the stability that indicates a healthy tact.

Analyzing the past day by the minute, we see that at first, the quote was moving steadily at a horizontal direction, just along the step # 3/1 [1.0950], with an amplitude of about 15 points. The main surge in activity occurred at the start of the US trading session, where the main surge in short positions occurred between 14: 30-16: 30 London time [trading terminal time]. The movement after was in terms of point accumulation, garnering an amplitude of 7-8 points.

As discussed in the previous review , traders have been working downwards, ever since the second stage has been passed, and trading forces regrouped around 1.0950. As a result, speculators simultaneously worked on local spikes, which brought additional income with minimal return.

Looking at the trading chart in general terms [the daily period], we can almost see the end of the recovery.

The news background yesterday did not contain statistical data in both Europe and the United States, so we relied in the technical environment, as well as in the external noise.

In terms of general information background, we have a multi-faceted noise. The number of deaths from coronavirus has now exceeded the 1000 mark. This is negligible in terms of global risks, but in terms of fanning fear based on the media, it is enough, so the panic regarding it still remains. At the same time, the upcoming trade negotiations between Britain and Brussels are becoming more emotional, so the European Union intends to toughen its position during the negotiations, focusing on issues related to unfair competition, fishing and human rights. These factors put pressure on both the investors and the market dynamics.

In terms of the economic calendar, we have open vacancies for JOLTS, where growth is expected from 6.8 M to 7.0 M. Moreover, Jerome Powell, head of the Federal Reserve System, will also speak today during a two-day meeting in the US Congress, where on the first day before the House Committee of Financial Services, Powell will present a semi-annual report on monetary policy.

Further development

Analyzing the current trading schedule, we can see an extremely strong slowdown in the area of 1.0905 / 1.0917, where the quote is building up during consolidation. In fact, this is a kind of accumulation within the reference point of support [1.0879], where everything can be expected. I have two scenarios in this case: First, due to the historical regularity, the quote may again find a foothold, where against the background of the recent inertial descent, long positions may appear and form a correction; On the other hand, in the second scenario, the lows of 1.0879 will be broken, and the level of consolidation will be the point of regrouping the trading forces. Of course, these two judgments may happen, and everyone can make money on this.

Meanwhile, by detailing the available time period by the minute, we can see that the consolidation will end with a burst of activity.

In terms of the emotional mood of market participants, we see an extremely high coefficient of speculative positions. This is understandable, as we have a strong support, historical lows, and consolidation.

As a result, although traders are still holding short positions, they are already considering a consolidation. Speculators, on the other hand, are preparing for a surge in activity, regardless of the direction.

There is a possibility that the first thing we will see is a local surge against the background of consolidation, where drastic changes may not occur, but a jump will. Further actions will be based on the behavior of the quote, where the pivot point is already available, and reflects the lows of 1.0879. Because of this, the alignment is based on the rebound / breakout method, which should be used when making a trading decision.

Based on the above information, we will output the following trading recommendations:

- Buy positions will be considered if the price fixes above 1.0920, along with the prospect of movement to 1.0950. Make local transactions.

- Positions for sale are left for fixing. Further short positions will be considered after the price is fixed below 1.0879. Local positions [speculative] are considered from 1.0900 to 1.0880.

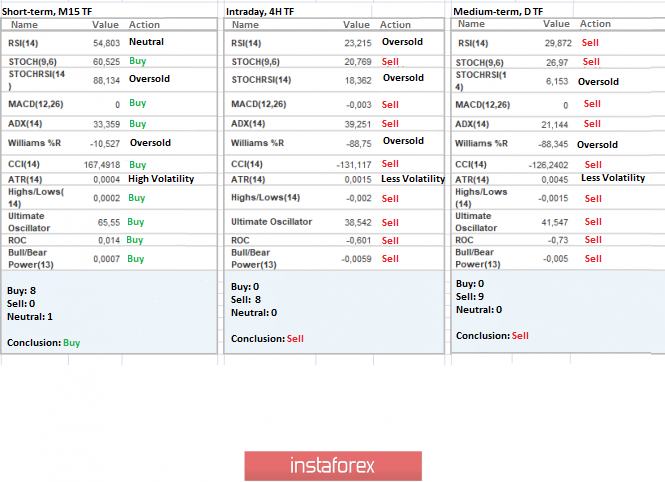

Indicator analysis

Analyzing the different sectors of timeframes (TF), we can see that the indicators of technical instruments mostly occupy a downward position. However, due to consolidation, we have an alternating signal on smaller periods.

Volatility for the week / Volatility Measurement: Month; Quarter Year

The volatility measurement reflects the average daily fluctuation, based on the calculation for the Month / Quarter / Year.

(February 11 was based on the time of publication of the article)

At the moment, volatility is at 12 points, which is an extremely low value in terms of the pair's dynamics. It is likely to assume that acceleration will occur when there is a local jump in activity, and the level of consolidation is broken down.

Key level

Resistance zones: 1,0900/1,0950**;1,1000***; 1,1080**; 1,1180; 1,1300**; 1,1450; 1,1550; 1,1650*; 1,1720**; 1,1850**; 1,2100

Support areas: 1,0850**; 1,0500***; 1,0350**; 1,0000***.

* Periodic level

** Range level

***Psychological level

***** The article is based on the principle of conducting a transaction, with daily adjustments