The EUR/USD pair is moving sideways trying to accumulate more bullish energy before jumping higher. The bias remains bullish as the DXY maintains a bearish outlook. The US dollar Index is trapped within a down channel, so it remains vulnerable.

Today, the German ifo Business Climate could have an important impact on the EUR/USD pair. The economic indicator is expected to drop from 98.8 points to 98.2 points. On Tuesday, the US CB Consumer Confidence will be released and is expected to drop from 109.3 to 108.4 points.

The upside pressure remains intact on the EUR/USD pair as the US and the EU manufacturing and services data have come in mixed on Friday.

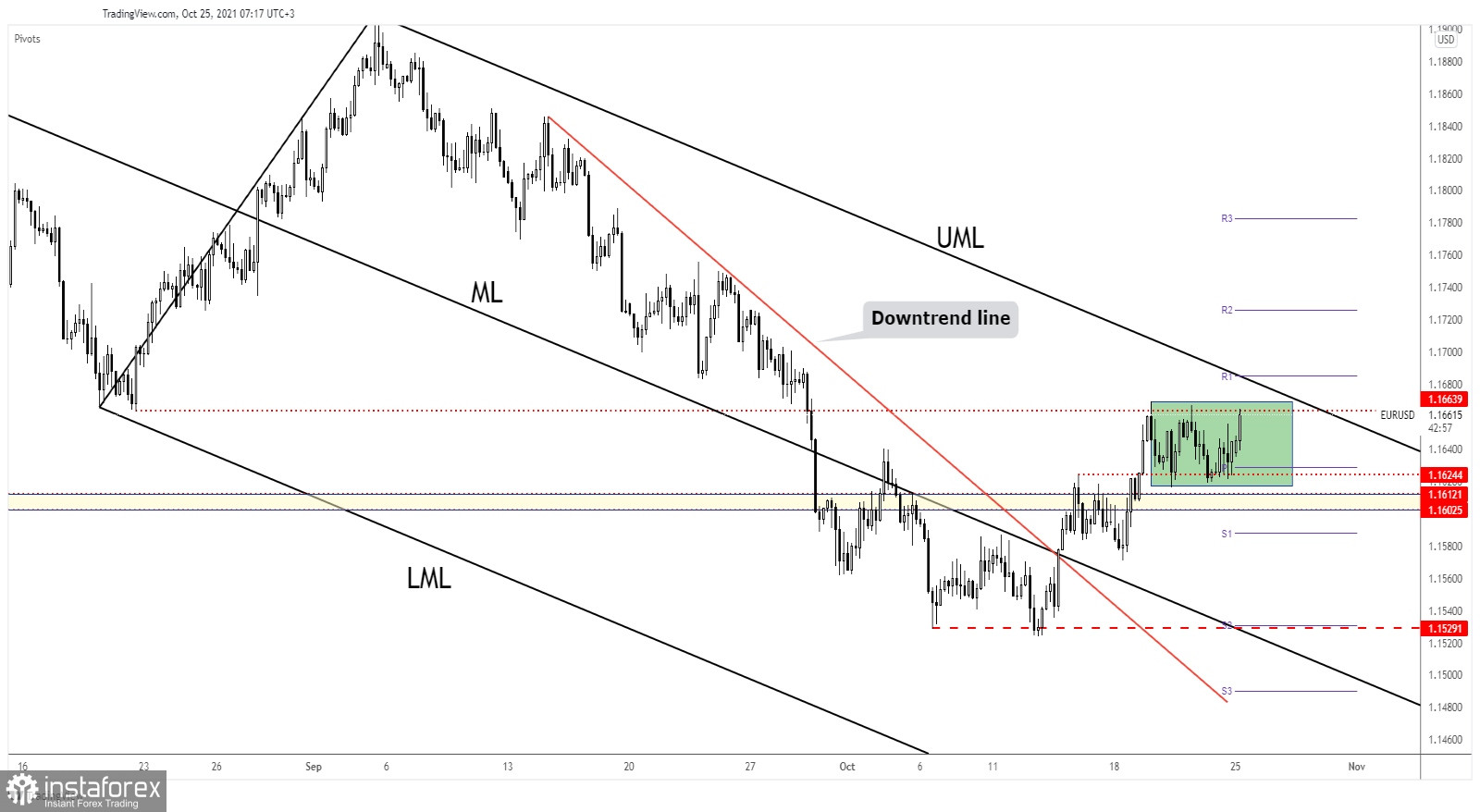

EUR/USD Range Pattern!

The EUR/USD pair is trading at the 1.1661 level at the time of writing. It is likely to try to break through 1.1663 static resistance. As you can see, the pair stands within a narrow range between the 1.1624 and 1.1663 levels.

After its breakout above 1.1602 - 1.1612, the EUR/USD pair was expected to resume its upside reversal. Making an upside breakout from this pattern confirms it as a continuation formation.

Technically, the upper median line (UML) is seen as dynamic resistance, as an upside obstacle. A valid breakout through this line announces a larger upwards movement ahead.

EUR/USD Prediction!

The bias is bullish. So, an upside breakout above 1.1663 and above the upper median line (UML) is seen as buying opportunity with potential upside targets at the R2 (1.1726) and at the R3 (1.1782) levels.