Yesterday's "duet" by Jerome Powell and Christine Lagarde was actually ignored by market participants. The speeches of the head of the Fed in the US Congress and the chairman of the ECB in the European Parliament were quite dry and predictable. They were not able to support the EUR/USD bulls or the bears. In general, Powell repeated the theories of the report published the day before (which, in turn, includes the main arguments of the January meeting), while Lagarde voiced the already familiar concerns of traders about the slowdown in economic growth in the Eurozone.

However, there were still certain "plot twists" yesterday. For example, the head of the Fed focused on the spread of coronavirus, which, he said, could slow down the Chinese economy in the first quarter of this year. Powell said the Fed is closely monitoring this topic, especially in the context of a slowdown in the global economy. He also acknowledged that coronavirus can affect the US economy, but at the same time, it is too early to talk about the degree of this influence.

Jerome Powell also voiced other risks. For example, he was worried about productivity gains. Key indicators in this area are at a low level (despite the recent increase in the ISM manufacturing index), and this fact reduces corporate profit in the United States. According to the head of the Federal Reserve, the current situation could negatively affect the labor market, taking into account the reduction in capital costs. By the way, Powell praised the recent Nonfarm, but he found cause for concern here. According to him, there has recently been an inequality between racial and ethnic groups when hiring.

But in general, Jerome Powell made it clear from his speech that the Fed is ready to maintain a wait-and-see attitude, unless events of an "unforeseen nature" lead to a significant reassessment of current prospects. This conclusion was also mentioned in the report published the day before. Therefore, it did not make a special impression on traders. The risks voiced by Powell did not also unfold a pair of EUR/USD: buyers allowed themselves only a slight correction, but in general, the dollar retained its position throughout the market.

On the other hand, the head of the ECB, Christine Lagarde, was similarly unable to surprise the market with anything. As she spoke within the walls of the European Parliament yesterday, she only voiced one "hawkish" theory. In her opinion, the current too soft monetary policy of the European Central Bank negatively affects the income from savings, increasing the value of assets. In this context, Lagarde stated that "monetary policy should not be the only player." She called on governments of the European Union to take measures to stimulate economic growth. And although she did not voice specific states, it is obvious that her appeal concerned primarily the Germans.

The remaining paragraphs of her speech were "dovish" in nature. She recalled again that the impulse for the growth of the European economy has been fading since 2018 against the backdrop of trade conflicts and in the face of increased external uncertainty. Slowing economic growth in the eurozone, in turn, eases price pressures - inflation still falls short of the ECB's medium-term target level.

However, all these theories did not become a revelation for the market: she voiced similar rhetoric both at the ECB meeting in January and earlier. Lagarde also mentioned earlier the side effects of low rates. But this does not mean at all that the European regulator is ready to tighten monetary policy. In this case, we can rather talk about maintaining a wait-and-see attitude on the part of the ECB, which is consistent with the general expectations of the market.

Thus, yesterday's events did not allow the EUR/USD bears to gain a foothold in the 8th figure, and the pair's bulls - to rise to the borders of the 10th. Moreover, the downward trend remained in force, but somewhat halted due to the "coronavirus factor", which Jerome Powell focused on.

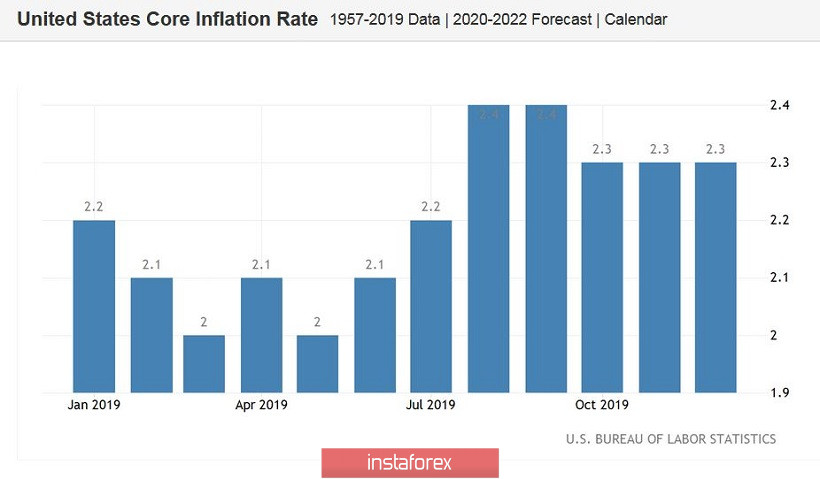

The further direction of the price movement will depend on the dynamics of American inflation. Let me remind you that key indicators in this area will be published tomorrow. The general consumer price index should show positive dynamics, rising to 2.5% on an annualized basis and to 0.3% on a monthly basis. At the same time, core inflation, excluding food and energy prices, can also show minimal growth in monthly terms (from 0.1% to 0.2%) and remain at the same level (2.3%) in annual terms. If real numbers fall below forecast values, the dollar may fall under a wave of sales. Otherwise, the EUR/USD bears will finally settle down within the 8th figure, opening up new price ranges for themselves at the downside.