Economic calendar (Universal time)

You can pay attention to the following data in the economic calendar today:

- Report on the autumn forecast (UK, tentatively in the afternoon);

- Speech by the head of the Fed (expected at 15:00);

- Crude oil reserves (USA, 15:30).

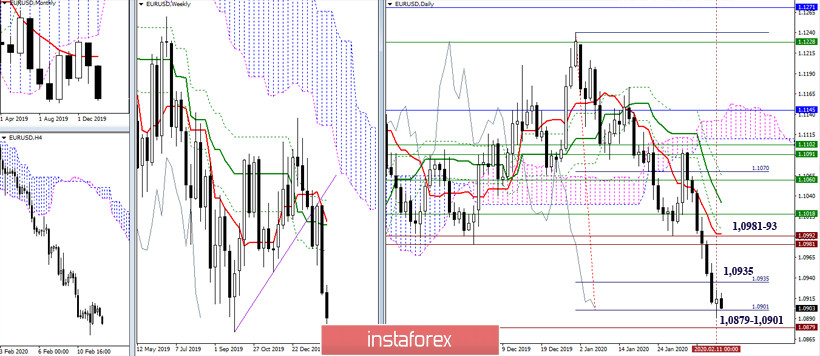

EUR / USD

Yesterday, the pair fulfilled a 100% downward target for the breakdown of the daily Ichimoku cloud (1.0901), and also went down into the zone of influence of the monthly minimum extremum (1.0879). As a result, there was a slowdown - a small candle with a white body appeared on the background of black daytime bear candles. Now, it is unlikely that players on the downside will be able to continue to further decline just as actively and efficiently. Most likely, the pause will be delayed. So, what form will it take? Correction or consolidation? Only time will tell. Support today is 1.0879 - 1.0901, while resistance can be identified at 1.0935 (the first target of the daily target) and 1.0981-93 (daily Tenkan + historical levels).

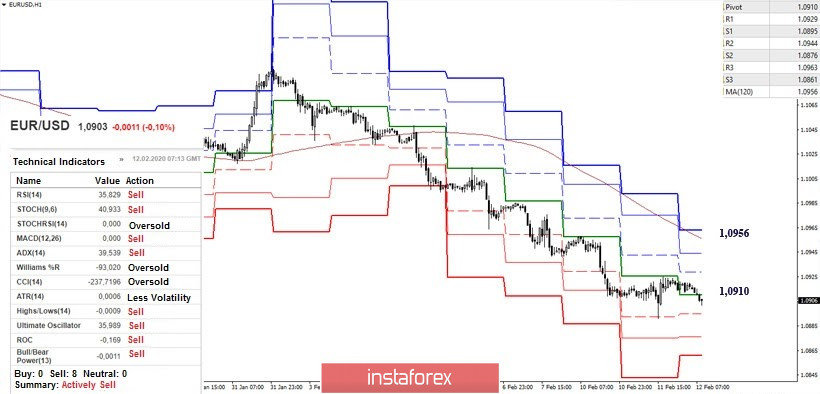

All the advantages at the moment on the side of the players on the decline, weakening their position only being in the correctional zone. Moreover, if you exit the correction zone (1.0891) and continue the downward trend, the Pivot levels S2 (1.0876) and S3 (1.0861) will act as support and bearish signs within the day. Consolidation above the central Pivot level of 1.0910 will allow us to take a closer look at the growing correction again. The next significant reference is the resistance of the weekly long-term trend (1.0956) and the nearest resistance along this path can be noted at 1.0929 (R1) and 1.0944 (R2).

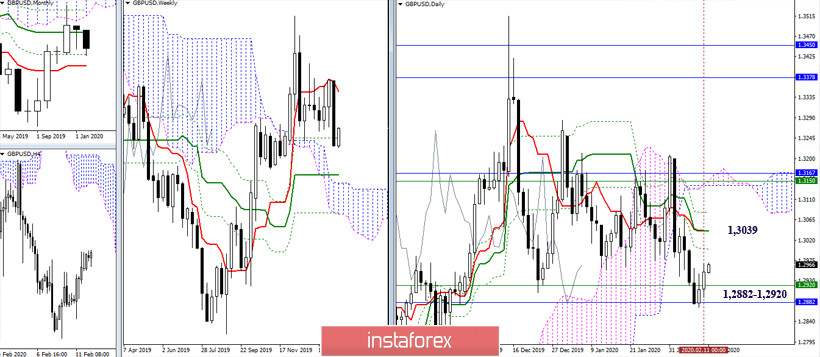

GBP / USD

The slowdown indicated before remained. The met support (1.2882 - 1.2920 Fibo Kijuns of the week and month) continue to stand guard, blocking the bears from leaving the current consolidation zone. As a result, the main conclusions and expectations have not changed. On the other hand, downgrade is important for the breakdown of the lower boundaries of consolidation. The development of inhibition, and especially the formation of rebound from the met supports, will return them to the center of gravity of the zone, which is now the daytime cross of Ichimoku, which has combined its efforts at 1.3039.

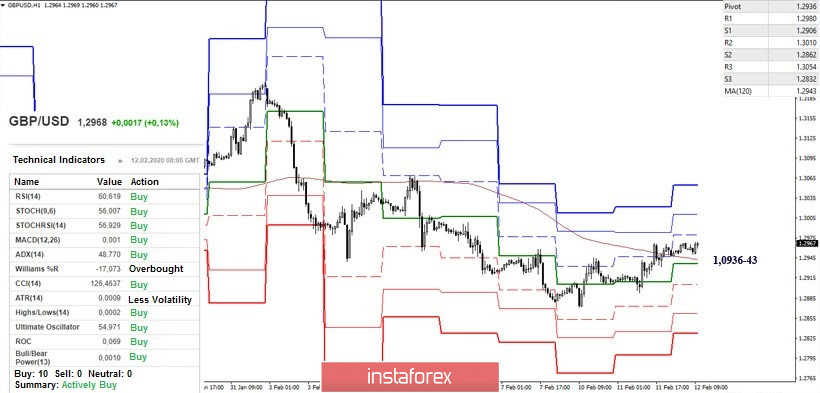

Yesterday, the players on the increase were able to defend the right to the development of the correction. Today, they are busy changing the balance of power in the lower halves. Consolidating above the weekly long-term trend and reversal of the moving will allow us to consider the levels of higher halves as reference points. Now, such a significant reference is the daytime cross (1.3039). The resistance within the day today can also be the classic Pivot levels (1.2880 - 1.3001 - 1.3054). The key lower support in the current situation joined forces in the area of 1.0936-43 (central Pivot level + weekly long-term trend). Thus, returning to the most important levels can cancel the players further plans to increase and return the bearish mood.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)