The euro continued to stagnate in one place after a weak report on industrial production, which declined at the end of last year, which was quite expected against the background of a sharp drop in many European countries. And if a partial solution to the trade conflict between the US and China could bring growth to the sector, the slowdown in the global economy and problems with Brexit continued to make a negative contribution to the indicator.

According to the report, industrial production in the eurozone in December 2019 decreased by 2.1% compared to November and fell by 4.1% compared to December 2018. Economists had expected a less active decline of 1.6% and 2.5%, respectively. Data for November was revised downward to -1.7% per annum. A decrease in orders and a slowdown in the manufacturing activity index also made a negative contribution to the overall indicator.

Given that no other important fundamental data is expected today, the market may continue to show very low volatility. At the North American session, Federal Reserve Chairman Jerome Powell is expected to deliver a speech on the economy and monetary policy before the Senate Banking Committee. However, we will not hear anything new since Powell will read out the same report that he made on the eve of the Committee on Financial Services of the House of Representatives. Let me remind you that at the end of last year, the Fed stopped lowering rates amid signals that global growth is stabilizing. At present, the US economy looks quite resilient to global problems. During yesterday's speech, the Fed Chairman said that the current monetary policy is appropriate and the central bank will only change it if the situation forces a more significant revision of forecasts. Among the positive changes, the head of the Federal Reserve noted the labor market, which continued to support the economy, strengthening last year, but consumer spending at the same time became more moderate by the end of 2019. Problems remain in companies' investments and exports.

As for the technical picture of the EURUSD pair, there are no changes here. Just keeping buyers of risky assets at 1.0900 is not enough to turn the market in their direction. Building the lower border of the new ascending channel from yesterday's lows and breaking the resistance at 1.0930 are the bulls' priorities for today. Only a break in the range of 1.0930 will open a direct path to the highs of 1.0975 and 1.1030. If the pressure on the euro returns, the breakdown of the support of 1.0890 will quickly push the trading instrument to the lows of 1.0860 and 1.0830.

NZDUSD

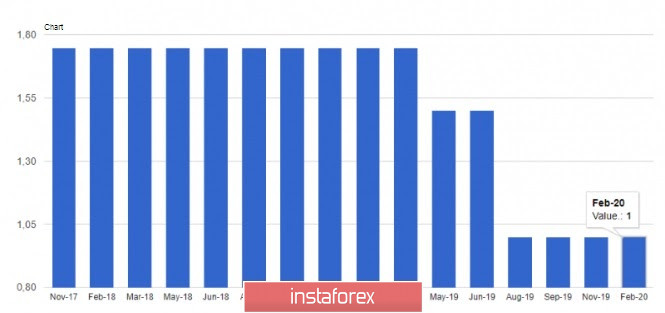

The New Zealand dollar "flew into space" after the Central Bank said it would keep the interest rate unchanged. According to the data, the Reserve Bank of New Zealand left the official interest rate unchanged at 1.0%, saying that keeping interest rates low is necessary for inflation to remain near the target level. The regulator also believes that the coronavirus outbreak is a downside risk for the economy, but the impact of the epidemic on New Zealand will be short-term. Despite this, the RBNZ has enough time to make the necessary decisions as new information becomes available.

The average official interest rate is expected to be 1.0% in the fiscal year 2021, and the average official interest rate is expected to be 1.3% in 2022.

The growth of the New Zealand dollar was against the expectations of traders, who predicted that the regulator would lower interest rates or make direct hints about lowering rates in the future.