The US dollar will continue to strengthen against risky assets, especially against the euro. Given that the EUR/USD pair has been declining daily ever since the beginning of this month, it is quite difficult for the bulls to focus on anything. Moreover, the recent pullback from the level of 1.0890 was not supported by large buyers of euro, so it led to another sell-off.

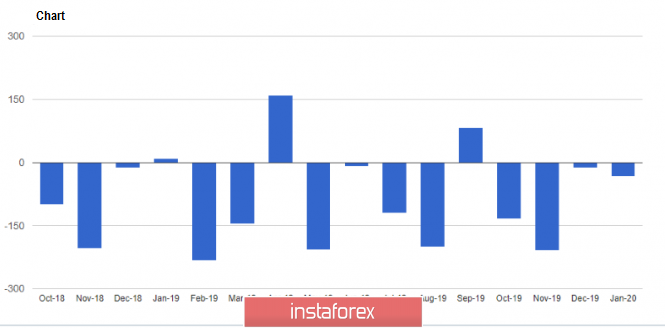

The growth of the US budget deficit is not surprising. Thus, yesterday's report, which indicated another jump between revenues and expenditures, did not lead to any major changes in the market. According to the data, from October 2019 to January 2020, the budget deficit increased by 25% at once and amounted to 389 billion dollars, against 310 billion dollars in the same period of 2019. This gap was caused by a sharp increase in government spending, which, according to the US Treasury Department, had increased by 10%, and amounted to $ 1.6 trillion. Meanwhile, tax revenues increased by only 6%, and amounted to $ 1.2 trillion. The Ministry notes that the increase in the deficit was caused by news factors, since the payment terms of benefits was shifted. If we take into account a more accurate estimate of the deficit, taking into account the benefits, the increase would only be by 6%, and expenditures and budget revenues would increase by 7%. The main items of expenditure fall on weapons and healthcare, garnering +9% and +15% to the indicators.

Yesterday, Fed Chairman Jerome Powell gave a speech to the Senate Banking Committee. He said that the Fed is focused on new plans to restructure banks and to maintain high liquidity requirements. He also pointed out that in order to deal with future downturns, it will be necessary for the Fed to resort to leading indicators and purchase long-term assets, especially since low inflation creates new challenges.

At the same time, for the labor market, the head of the Federal Reserve drew attention to low mobility and stagnation of income, which constraints the labor force in the global economy. Nevertheless, the report on the growth of the economically active population, who increased to 63%, was a very positive news for the Fed.

Today, an important report on US inflation will be published. The further movement of the EUR/USD pair may depend on it. A good data will once again help the major players to record profits on short positions without significant losses, while a weak report may keep the pressure on the euro, leading to the renewal of the next annual lows in the area of 1.0840 and 1.0800. Without the formation of a good day, as we are told by yesterday's situation of an unsuccessful growth above 1.0920 and a breakdown of the 1.0890 level, it is wrong to expect a major upward correction in the short term.

AUD

Pressure on the Australian dollar has returned, following the statements made by the Reserve Bank of Australia today during the Asian session. The RBA Governor expressed his opinion on the coronavirus, which is worsening the prospects for the Australian economy, even though the implementation of stimulus measures in China should have a positive impact on the economy. Philip Lowe believes that lowering interest rates is working, and government and business should use low rates to increase capital investment. Household debt remains the main problem for Australia.

Hints of keeping interest rates low and possibly lowering them in the future put pressure on the Australian dollar, which has just slightly recovered from its annual lows recently.

As for the technical picture of AUD/USD, while the bulls took good support in the area of 0.6710, a breakthrough of it will push the aussie to return from the lows of 0.6680 to the lows of the year. The upward potential is limited by the highs in the area of 0.6765, where a breakout of which will open a direct road to the area of 0.6860.