USD/CAD climbed as much as 1.2400 psychological level in yesterday's session where it has found temporary resistance. Now, it has decreased a little, but the bullish pressure remains high in the short term as the DXY could resume its growth.

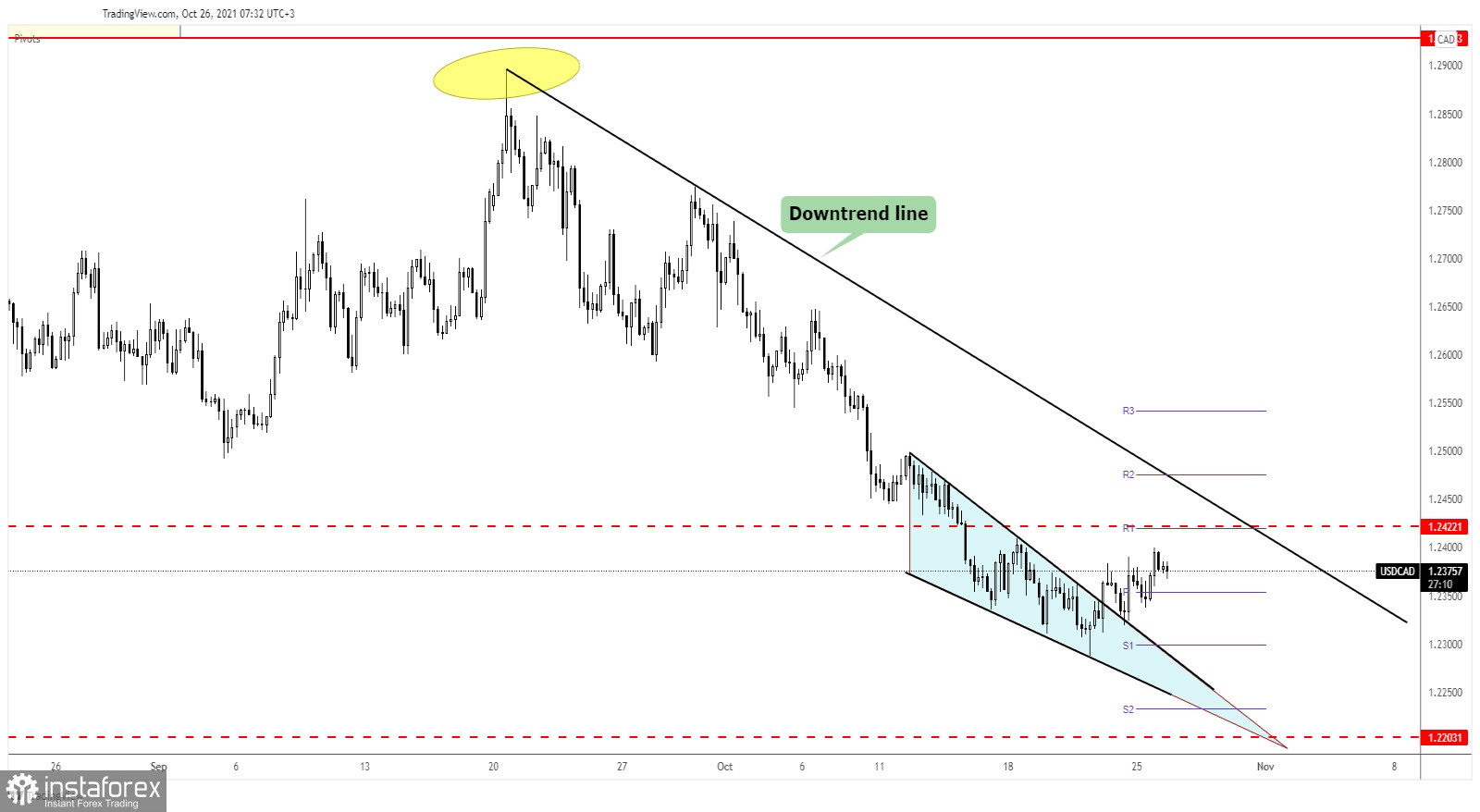

The pair has started to grow after validating its breakout from the Falling Wedge reversal pattern.

Fundamentally, the greenback needs support from the US economic data to be able to resume its growth. The CB Consumer Confidence index could drop from 109.3 to 108.4, the New Home Sales indicator is expected at 755K below 740K in the previous reporting period, while the Richmond Manufacturing Index could be reported at 4 points in October far above -3 points in September. Moreover, the HPI will be released as well and it's expected to register a 1.5% growth.

Positive United States economic data could help the Dollar Index to resume its growth. This scenario could boost the USD.

USD/CAD Turned To The Upside!

USD/CAD has managed to print a new higher high of 1.2400. In the short term, the bias remains bullish as long as the pair stays above the weekly pivot point (1.2353). Its failure to stay below this level signaled potential growth.

Still, we cannot exclude a minor drop as USD/CAD could come back to test and retest the pivot point before jumping towards new highs. 1.2422 historical low and the downtrend line are seen as upside targets.

USD/CAD Prediction!

A sideways movement above the weekly pivot point (1.2353) could announce a breakout above the downtrend line. Taking out the downtrend line may announce an upside reversal.

Still, you should be careful as the pressure remains high. Failing to reach the 1.2422 or the downtrend line may signal strong selling pressure. Dropping and stabilizing under the weekly pivot point (1.2353) may signal a deeper drop towards the 1.23 psychological level.