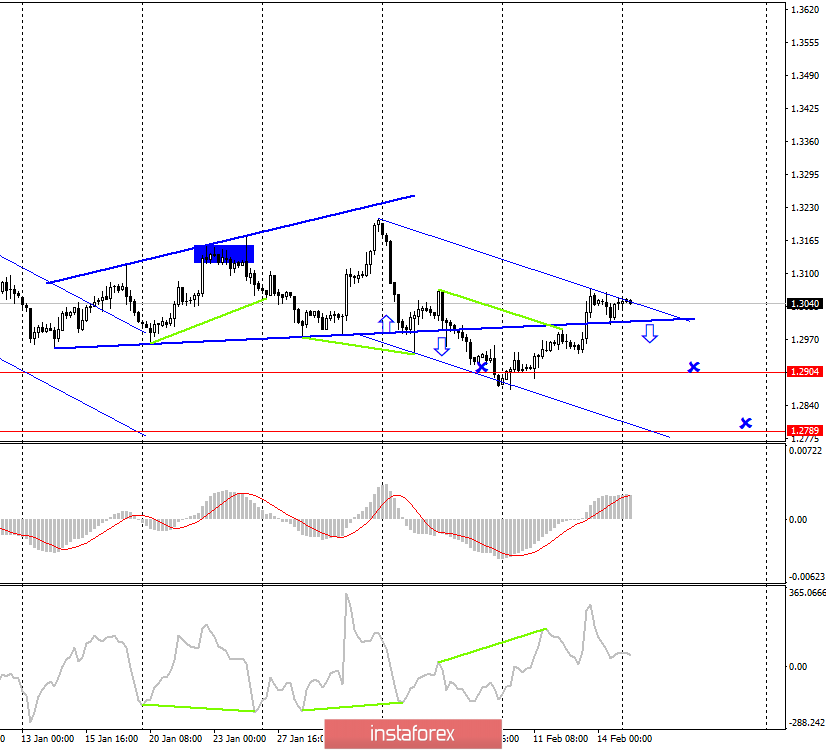

GBP/USD – 4H.

Good day, dear traders!

As seen on the 4-hour chart, on Friday, the "Briton" first fixed above the global correction line, after which it made a return, rebound and attempt to resume the growth process. However, it hit the upper line of the downward trend corridor and stopped this process. I still expect the pound/dollar pair to consolidate below the correction line, which will again work in favor of the US currency and resume falling towards the target levels - the low of 1.2904 and 1.2789. The second target level is located near the lower line of the corridor. At the same time, continuing to find the pair's rate above the correction line will most likely lead to the exit of quotes from the descending corridor and, accordingly, to the cancellation of the trading idea with sales. Today, the divergence is not observed in any indicator.

GBP/USD – 1H.

As seen on the hourly chart, we have an upward trend corridor. That is, the mood of traders in the short term is "bullish". If it persists, there will be no closure under the ascending corridor in the near future. Then on the 4-hour chart, the pound/dollar pair will probably go beyond the limits of the descending corridor. Thus, on the hourly chart, I am waiting for a sales signal in the form of a close under the trend range, and the goals will be the same as on the 4-hour chart.

News overview:

On Monday, February 17, there is no news on the calendar of the UK and the US.

Forecast for GBP/USD and recommendations for traders:

The trading idea is to sell the pound with the targets of 1.2904 and 1.2789 when fixing quotes under the correction line, as well as under the ascending corridor on the hourly chart. If these conditions are met, I recommend selling the pound/dollar pair again.