From a comprehensive analysis point of view, we see a prosaic curtain, where, after the quotes returned above the psychological mark, stagnation occurred that clearly reflected the desire of market participants and now about the details. After the quotes found a foothold in the area of the average level of 1.2885, the adjustment process began, which returned us above the level of 1.3000 and locally hit the value of 1.3068. Can this be considered a failure, in the downward building stage? Not at all, since any cycle should have adjustments that will give strength to the main course. This is the whole point of trends with a lot of measures in their structure that are both positive and negative. In our case, it is too early to talk about the trend, since it is still very far from being fully restored, but even with the current fluctuations, we see our own patterns that should have happened, as with the current fluctuation.

Regarding our theory, the downward movement is still valid, it makes no sense to panic since the tipping points in terms of price-fixing in the values of 1.3000 / 1.2900 / 1.2885 have already taken place, which means we are off the ground hovering, which hypothetically can lead to the resumption of the main course. The best confirmation of our theory will be the return of the price to the area of 1.2885 / 1.3000, and in case of retention and fixation, we will be able to open the range to the main border of 1.2770, [1.2770 // 1.2885 // 1.3000].

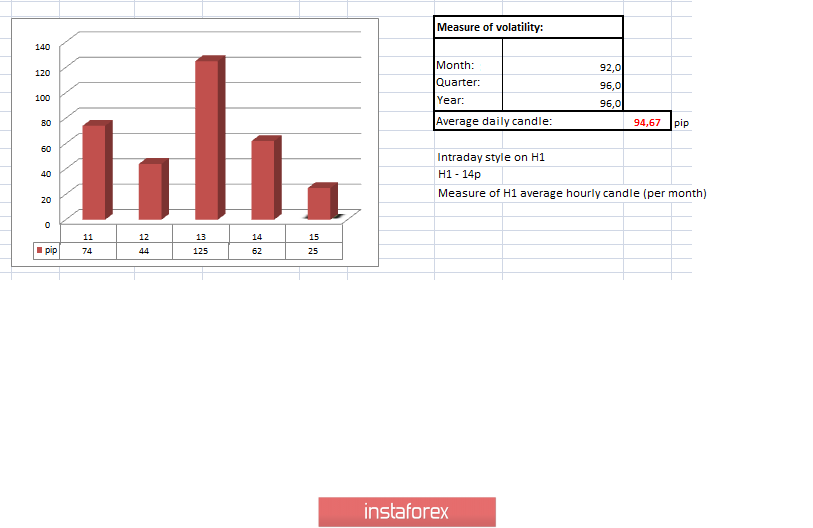

In terms of volatility, we see a characteristic slowdown of 34% relative to the average daily value and by 50% in comparison with the day before. In fact, we returned to the same slowdown framework that attracted special attention for five days before the acceleration.

Details of volatility: Thursday - 79 points; Friday - 79 points; Monday - 74 points; Tuesday - 74 points; Wednesday - 44 points; Thursday - 125 points; Friday - 62 points. The average daily indicator, relative to the dynamics of volatility is 94 points [see table of volatility at the end of the article].

Detailing the days that have passed by the minute, we see that from the moment of touching the 1.3068 mark, the process of another deceleration has begun within the range of 1.000 / 1.3068, which has already stretched for 40 hours.

As discussed in a previous review, traders continue to follow the theory of downward development, where deals are already available, but with an optimal volume, which is designed for a fairly significant price adjustment. As you know, this strategic position is designed for at least the medium term. At the same time, speculators do not sit still and work on local races, which appear on the market almost on a daily basis.

Considering the trading chart in general terms [the daily period], we see a fluctuation in the structure of the medium-term upward trend, where the quotes are still at a conditional peak, but the measures have already been changed.

Friday's news background contained data on retail sales in the United States, where it recorded a slowdown from 5.5% to 4.4%, with a forecast of a slowdown in growth to 4.9%. The data is not the best, and if we make an adjustment to the fact that retail is considered one of the locomotives of the US economy, then we have sad statistical data. The same with the published data on US industrial production, which came out slightly better than expected. So they expected a decline from -0.9% to -1.4% but got a slowdown to -0.8%.

Market reaction to statistics was in terms of local weakening of the US dollar, but not significantly. In anticipation of the publication, the possible non-coincidence of forecasts was the strengthening of the dollar towards the level of 1.3000.

In terms of a general informational background, we again have an escalating round of emotions related to the upcoming talks between England and Brussels. So comments regarding this process were given by the French Ministry of the Interior, Jean-Yves Le Drian, who seems to see common ground, at the same time very skeptical of them and expects difficult negotiations.

"I think that the negotiations that we are going to start on trade issues and on the mechanism of future relations, we tear us all apart," said the French Foreign Minister during the Munich security conference.

Also, Le Drian added that in the negotiations everyone will defend their own interests, which in principle is not surprising, but reinforces the earlier statements of other leading figures from the EU.

At the same time, the ex-head of the Bank of England, Mark Carney, who was against Brexit from the very beginning, changed his rhetoric and said that this process still has positive aspects that will help to rethink the internal process of the economy.

"This is a large-scale re-registration of our relations not only with the European Union but also our trade relations with the rest of the world, it has prompted a reassessment of the economic policy, the structural economic policy of the country," said Mark Carney.

Today, in terms of the economic calendar, we do not have statistics, in addition to everything, the United States is not working, due to the celebration of Presidents Day, which may affect trading volumes.

Further development

Analyzing the current trading chart, we see all the same fluctuation in the structure of the borders of 1.000 / 1.3068, where the quotes develop near the middle of this range. In fact, we are faced with a kind of accumulation, where market participants are trying to rethink everything that is happening and make a decision in favor of sellers. The theory of downward development is more relevant than ever, but we need time to fully develop.

From the point of view of the emotional mood of market participants, we see extremely high caution in terms of actions, since the tact is already broken, and the quotes are still at high values. At the same time, speculative interest on a daily basis manifests itself in the market.

By detailing the per minute portion of time, we see that the activity has decreased many times, and the quotes are strongly fixated on the existing accumulation.

In turn, traders continue to work the same way, alone in the medium term, having short positions. Others are waiting for the price to return below the level of 1.3000 to take short positions, while others are also speculators who work at local jumps in the market.

Having a general picture of actions, it is possible to assume that the current range of 1.3000 / 1.3068 will not last long, where the main scheme will be to work in a downward movement but at the same time, due to safety net, we consider a local upward surge in case of breakdown of border 1, 3068.

Based on the above information, we derive trading recommendations as follows:

- Local purchase positions were already considered in case of price-fixing higher than 1.3070.

- Positions for sale are already being conducted by traders in the direction of the level of 1.2770, a conservative volume per transaction. Speculative positions are lower than 1.3025 with a prospect of 1.3000. At the same time, traders will consider selling deals in case prices are fixed lower than 1.3000, with a move to 1.2900 and 1.2885.

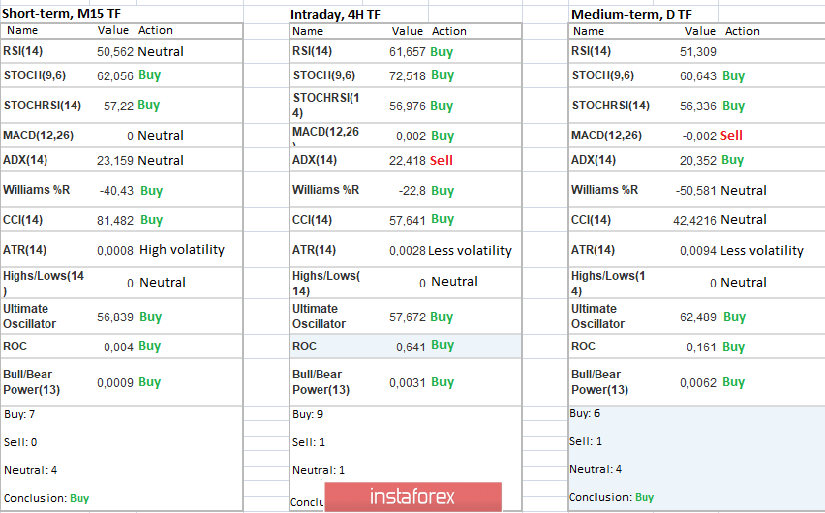

Indicator analysis

Analyzing a different sector of timeframes (TF), we see that due to the reverse move, the indicators' indicators took on a variable upward interest. It is worth considering that the indicators are not stable and there are suggestions of an early change in the signal.

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(February 17 was built taking into account the time of publication of the article)

The current time volatility is 25 points, which is a low value in terms of currency dynamics. It is likely to suggest that due to the absence of the United States market, the activity of participants may be.

Key levels

Resistance zones: 1.3170 **; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support Areas: 1,3000; 1.2900 *; 1.2885 *; 1.2770 **; 1.2700 *; 1.2620; 1.2580 *; 1.2500 **; 1.2350 **; 1.2205 (+/- 10p.) *; 1.2150 **; 1,2000 ***; 1.1700; 1.1475 **.

* Periodic level

** Range Level

*** Psychological level

**** The article is built on the principle of conducting a transaction, with daily adjustment