To open long positions on GBPUSD, you need:

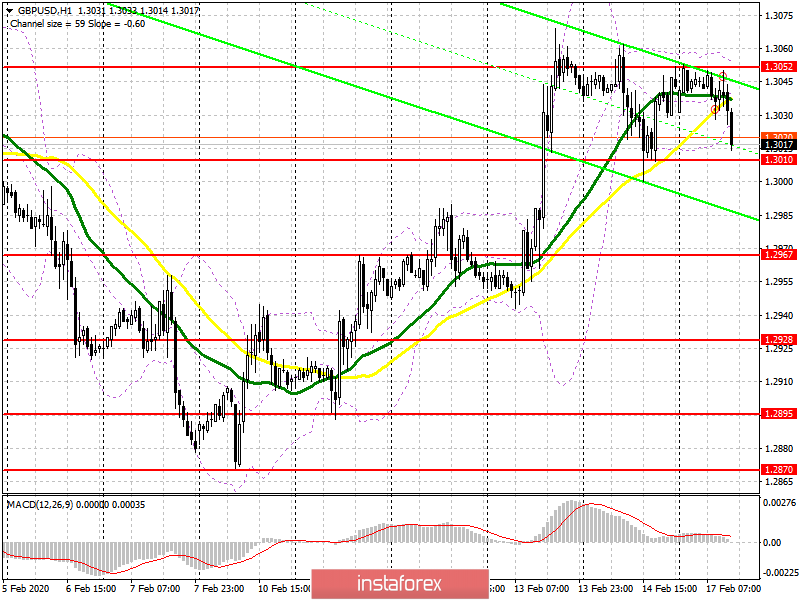

In the morning forecast, I paid attention to the resistance of 1.3052, on which the further upward trend of the British pound depended. The main task of the bulls for the second half of the day remains to break through and consolidate above this level, which will open a direct road to the area of the highs of 1.3093 and 1.3133, where I recommend fixing the profits. Support for 1.3010 remains a more optimal scenario for opening long positions, however, as at the end of last week, an important condition will be the formation of a false breakdown. Rebound purchases can only be considered after the support test of 1.2967. The absence of important fundamental statistics can keep the pair on the current side channel.

To open short positions on GBPUSD, you need:

Sellers did not let the pair above the resistance of 1.3052, and its next test without a breakdown in the first half of the day led to a return of pressure on the British pound. The GBP/USD is approaching the support of 1.3010, but only a break will increase the pressure on the pair, which will lead to a decrease in the area of the minimum of 1.2967, where I recommend taking the profits. If sellers fail to implement this scenario, it is best to postpone short positions until the level of 1.3093 is updated or sell GBP/USD immediately to rebound from the resistance of 1.3133.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily averages, which indicates market uncertainty.

Bollinger Bands

A break in the lower border of the indicator around 1.3026 may return the pressure on the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20