The Australian dollar viewed the minutes of the last RBA meeting negatively - the AUD / USD pair fell once again to the base of the 64th figure. The overall tone of the document is really "dovish", although, in my opinion, it contains encouraging notes. In any case, the movement of the aussie now largely depends on the dynamics of key macroeconomic indicators. Because of this, it is risky to open any positions on the pair right now: if the data on the Australian labor market that will be published on Thursday comes out in the "green zone", the currency may again show character, especially if the panic about the spread of the coronavirus will decrease.

Regarding the RBA Protocol, looking ahead, we can assume that the negative reaction of the aussie will be temporary. The AUD / USD pair will either get stuck in a flat until Thursday, or will move in the wake of the US currency (today, US trading platforms will resume their work, after the Presidents' Day celebration). In any case, the minutes of the February meeting are not capable of provoking a prolonged downward impulse, as first, many theses have already been announced by Philip Lowe following the meeting of the regulator's members. Second, the Central Bank has made it clear that it will resort to rate cuts only in extraordinary situations.

Let me remind you that at the end of this year's first meeting, the RBA left the main rate at a record low of 0.75%. Moreover, in the accompanying statement, the regulator gave a signal that it does not exclude further easing of the monetary policy. The Protocol published today made it possible to get acquainted with the Central Bank's position in more detail. The key message, in my opinion, is to recognize the risks of lower rates. The Australian regulator admitted that the risks concerning the further easing of the monetary policy "outweigh its benefits."

The Central Bank assured market participants that rates will remain low (at the current level) "for a long time." It is worth noting here that traders focused their attention only on the second thesis, while the one about recognizing the side effects of ultra-soft monetary policy was ignored. The market is still confident that the Reserve Bank intends to take decisive action in response to the slowdown in China's economy. The regulator does not rule out this possibility, stating in the Protocol: "the Central Bank is ready for further policy easing if necessary." However, the Central Bank members remarked that they need to "balance the risks that are inevitably associated with even lower rates."

In addition, RBA members linked the issue of monetary policy easing with the dynamics of key macroeconomic indicators in Australia. According to them, the need for a rate cut depends on the progress or regression in achieving the Central Bank's inflation and employment goals. This suggests that the growth of the Australian labor market, as well as the main indicators of inflation growth, will continue to be considered by the market as the future prospects of the RBA's monetary policy. This is the reason why the bears of the AUD / USD pair are not confident in their abilities right now: after a reflex decline of 30 points, the downward impulse stalled, and the sellers were not even able to test the 63rd figure.

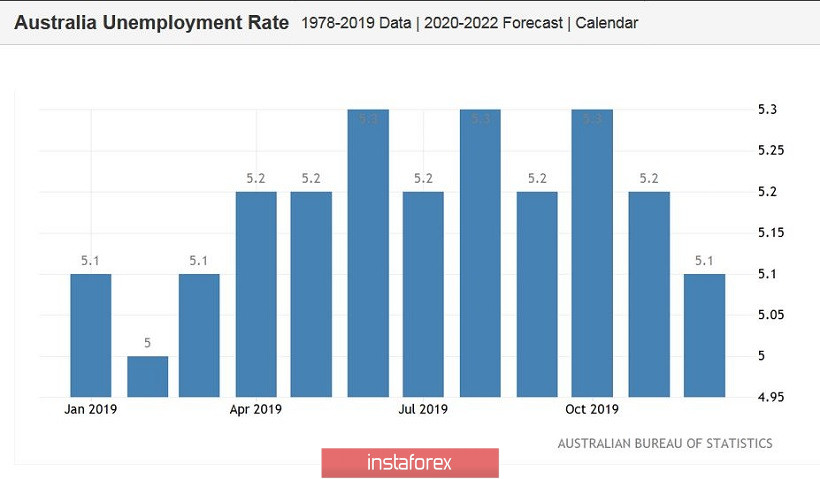

Australia's unemployment rate is forecasted to rise slightly to 5.3% in January. However, it is worth noting that this indicator has been fluctuating in the range of 5.1% -5.2% since March last year, so such a minimal increase will not cause a stir in the market. Meanwhile, the increase in the number of employees can affect the pair. According to the consensus forecast, this indicator will grow by 10 thousand. However, here, it will be necessary to study its structure. For example, the month before last, the total increase in employment jumped by 24 thousand at once. However, the increase was due to an increase in part-time employment, while the full-time employment indicator showed a negative trend. If the January figures show a mirror situation (growth in full employment while reducing partial employment),

In its February meeting, the Reserve Bank of Australia also discussed the coronavirus. According to the members, this factor is "a new source of uncertainty for the global economy". Regardless, the Central Bank is in no hurry to make any conclusions: the RBA repeated the phrase of Jerome Powell, who said that "it is too early to assess the extent of the virus's impact on the economy."

As a result, the published RBA Protocol put a little pressure on the AUD / USD pair. In my opinion, it is not advisable to open short positions on the pair right now. Data on the Australian labor market, which will be released the day after tomorrow, can radically change the mood of traders. If they exceed expectations (and even if they come out at the forecast level), the AUD / USD bulls will seize the initiative for the pair, sending it towards the resistance level of 0.6540 (the lower limit of the Kumo cloud on the daily chart )