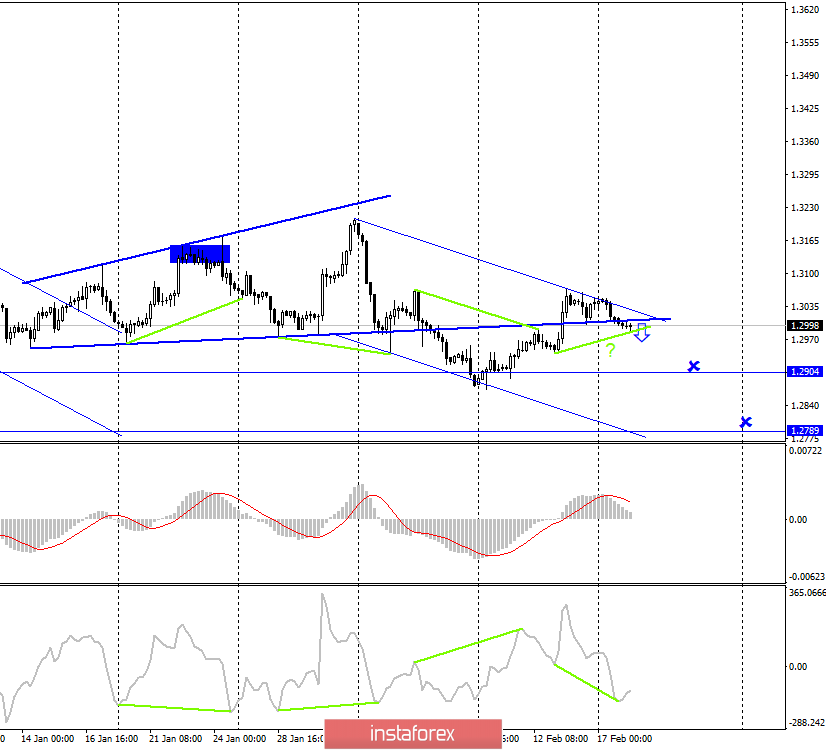

GBP/USD – 4H.

Good day, dear traders!

As seen on the 4-hour chart, on Monday, the "Briton" still performed a consolidation under the global correction line, near which it has been trading in the last few months. Thus, a sales signal was formed with the goals that I called a week ago - 1.2904 and 1.2789. However, the pound has not been able to boast of a trend movement recently. So at the moment, a bullish divergence has been formed in the CCI indicator, which predicts the pound/dollar pair to resume growth. At the same time, the downward trend corridor indicates a "bearish" mood among traders and a resumption of the fall, as the pair's quotes performed a rebound from its upper line. Thus, there is a certain conflict of indicators and graphical factors. In this situation, you can do the same as in the case of the euro: use the available signal, but work with very short stops. Closing the pair's rate above the descending corridor will significantly increase the probability of further growth of the "Briton".

GBP/USD – 1H.

As seen on the hourly chart, the quotes of the GBP/USD pair performed a reversal in favor of the US currency and closed under the upward trend corridor. Thus, on the hourly chart, the mood of traders also changed to "bearish" and a signal for sales was formed. In total, we already have two signals for sales at once, in opposition – bullish divergence.

News overview:

On Monday, February 18, several economic reports will be released in the UK.

Change in the number of applications for unemployment benefits (09:30 UTC +00).

Unemployment rate (09:30 UTC +00)

The change in the average level of earnings (09:30 UTC +00).

Traders will be most interested in the report on wages with forecasts of +3.1% 3 m/y and +3.3% 3 m/y. I believe that failure to exceed the forecasts will allow us to count on the continuation of the fall of the pound on February 18.

Forecast for GBP/USD and recommendations for traders:

The trading idea is to sell the pound with targets of 1.2904 and 1.2789 since there are already two signals available. Stop Loss should be short, that is, above the upper line of the descending corridor on the 4-hour chart. A strong report on UK payrolls could boost the pair's chances of some growth on February 18, so it should be closely monitored.