News of a slowdown in the spread of coronavirus provoked an increase in demand for risky assets. At the same time, the yen is sharply cheaper, there is an increase in demand for raw materials, oil is adding more than 1%, while palladium is 7% at all, updating the record once again.

Today, a lot of news is expected from the US, and the markets are likely to maintain a slightly positive direction until the end of the day. There will be reports on the number of building permits and producer prices at 14.30 Universal time. Moreover, several FOMC members will speak at once before the publication of the Fed protocol. If the protocols do not contain negative surprises, then the dollar will likely strengthen further across the entire spectrum of the market at the end of the day.

NZD/USD

The New Zealand dollar declined again to the February low of 0.6376, and technically, the situation can go according to two scenarios: either a second bottom will be formed or Kiwi's recovery will begin. In this case, we can expect an increase to resistance 0.6486 and a higher exit, or support will be broken and the direction will open to a 4-month low of 0.6316.

At first glance, the decrease in NZD is associated with an overall increase in tension due to the COVID-19 virus, since internal indicators give a very positive picture. The business activity index from Business NZ rose in January from 52.1p to 57.1p, ANZ reported stable inflation of 3.2% y / y, and the decline in dairy prices declined within the usual range of fluctuations.

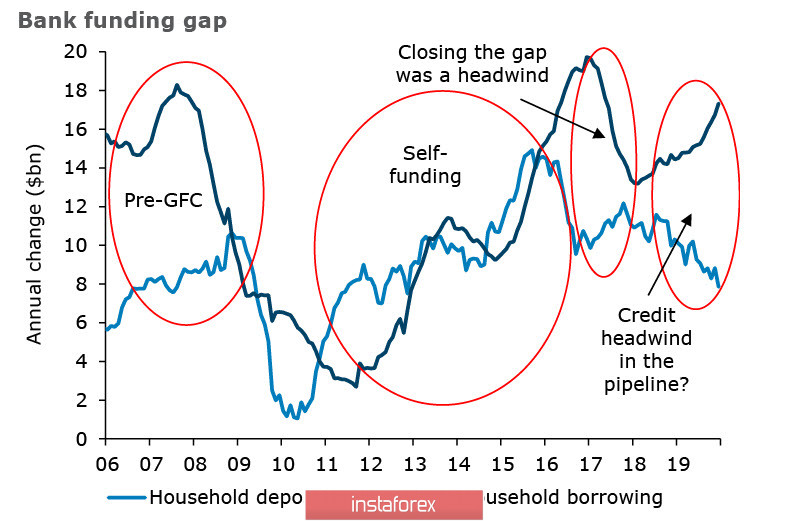

However, there are other, less noticeable, factors that can completely change the whole assessment of the prospects of Kiwi. ANZ Bank draws attention to the fact that the spread between the growth in lending and the volume of deposits with banks since 2018 has been increasing rapidly.

At present, there is an obligatory connection between the growth of deposits and the growth of lending, which did not exist before the crisis of 2008. However, the reason for this violent discrepancy remains unclear.

In any case, banks are faced with the need to limit lending. This goal can be achieved in several ways that have a common denominator, and it is called - tightening financial conditions. If banks go this way, and ANZ does not see any other way out, then the result will be a slowdown in economic growth which is just like it was in 2017.

What can the RBNZ do in this case? It is to develop incentive measures in conjunction with the government, just as the Bank of England is preparing for this. The RBNZ commentary on the February 12 meeting was calm and consistent with the Fed's attitude, but in light of recent changes, the chances of a Kiwi's growth are decreasing rather than increasing, since the New Zealand economy is too much influenced by China. Moreover, the latest CAEC report has confirmed a trend towards an increase in the volume of short contracts on Kiwi. Thus, a drop in support of 0.6376 looks very likely by a combination of factors.

AUD/USD

The Australian currency came under increasing pressure after the publication of the RBA minutes. The minutes noted that the bank sees reasons for further rate reductions, although the explanations are vague: "lower rates can accelerate progress in achieving the Bank's goals and make it more confident in the face of current uncertainty." In addition, the RBA notes the risk of household debt growth due to the exceeding growth of the housing market, and, of course, the prospects for the spread of COVID-19 are of great concern.

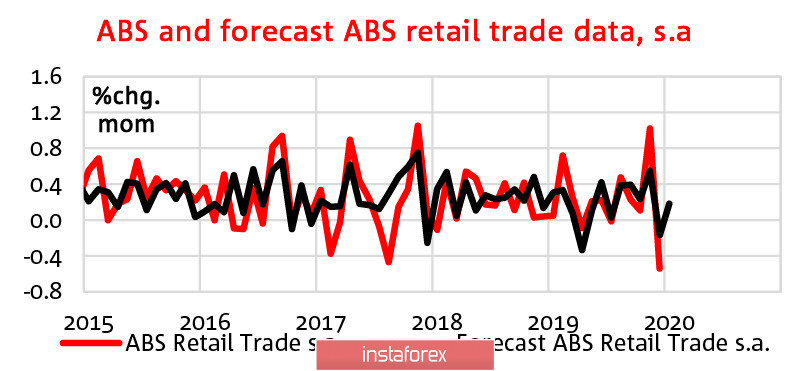

As for the internal indicators, they are quite stable and fit into forecasts. Damage from forest fires will lead to losses of 0.15% of GDP according to the NAB, while the ABS retail indicator improved after the December decline.

Salary Index on the 4th quarter also met expectations and does not raise concerns about the impact on demand and inflation. Tomorrow, the labor market report in January will be published. Now, if it does not show deviations down from the forecasts, the factors exerting bearish pressure on the Australian currency will be entirely concentrated around COVID-19 and the expected sharp decline in trade with China. Nevertheless, they will not be enough to suggest a decrease in the RBA rate at the next meeting.

AUD/USD has good chances to stay above the level of 0.6660 and develop corrective growth to the upper boundary of the range of 0.6773. However, it is still early to expect the break of this range up.