Hello!

For the dollar/franc currency pair, we can say that it "woke up" and began to actively move in the north. Growth has been going on for the third week in a row.

The EUR/USD pair is actively declining and USD/CHF is a mirror image of the euro/dollar. At least it used to look more distinct and recently it's become a bit blurry. I believe that the reason for this is in some cross-rates and the unambiguous status of the Swiss franc - it is either a safe-haven currency or not. However, the correlation trend of the two pairs persists.

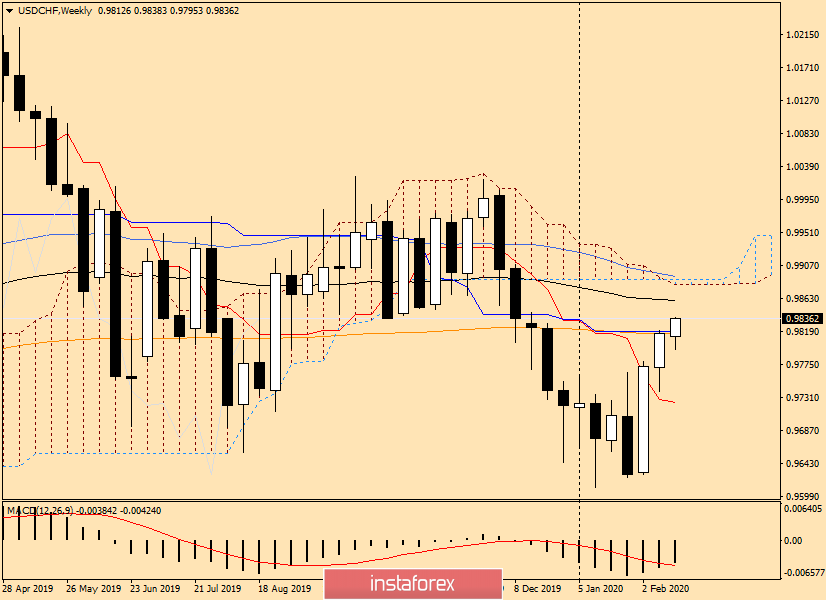

Weekly

The pair overcomes very serious and important resistances. First, the Tenkan line of the Ichimoku indicator was passed. Last week's trading ended right at the 200 exponential moving average and just a little below the Kijun line.

As a result of the growth that the pair is currently showing, trading is already above 200 EMA and Kijun. However, there is still a long way to go before the closing of the week and a lot can change. It is necessary to take into account a very large flow of macroeconomic data that will be coming from the United States during this week. And today at 20:00 (London time), the minutes of the last meeting of the Open Market Committee (FOMC) will be published. Perhaps this is the main event of the week that will determine the fate of the US dollar.

At the moment, the US currency is experiencing quite strong bullish sentiment.

If the growth continues, the dollar/franc will rise to the area of 0.9860-0.9890. I would like to note that 0.9860 is a fairly strong technical level that has repeatedly influenced the price. Now there are 89 exhibitors at this level, which will further strengthen this mark. Both borders of the Ichimoku indicator cloud and the 50 simple moving average are located near 0.9890.

Thus, the area of 0.9860-0.9890 seems to be quite difficult to pass. It is worth taking into account the fact that a significant level of 0.9900 passes a little higher. In general, if the pair gets to these prices, there will be a serious struggle between the opposing sides.

A bearish candlestick analysis model with a closing price below Kijun and 200 EMA signal a weakening of bullish sentiment or even a reversal at all. In this case, it is possible to correct or cancel the ascending scenario, however, it is still being implemented.

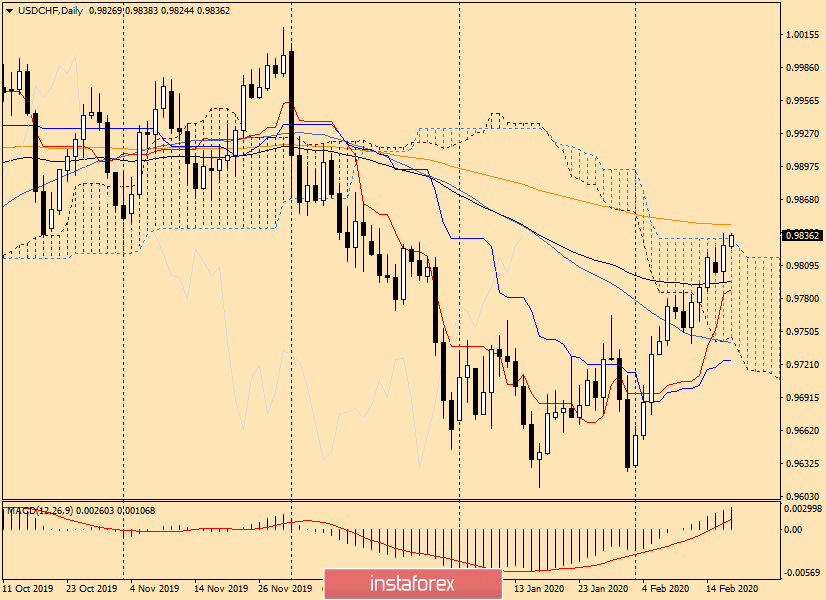

Daily

Interesting and important events also occur on the daily chart. The pair is trying to get out of the Ichimoku indicator cloud. This was not possible yesterday, however, the USD/CHF bulls are persistent. And at the moment of writing, the pair is trading above the upper border of the cloud. If the growth continues, it will test the 200 exponential moving average for strength. Thus, the nearest resistance in the form of 200 EMA can be expected at 0.9846.

Its closing price will be extremely important for further understanding of the price dynamics of the dollar/franc. The closing of today's trading above 0.9846 will further indicate bullish sentiment for the pair. If the closing price of today's session is within the Ichimoku cloud and a bearish reversal candle appears, you should think about the pair's sales.

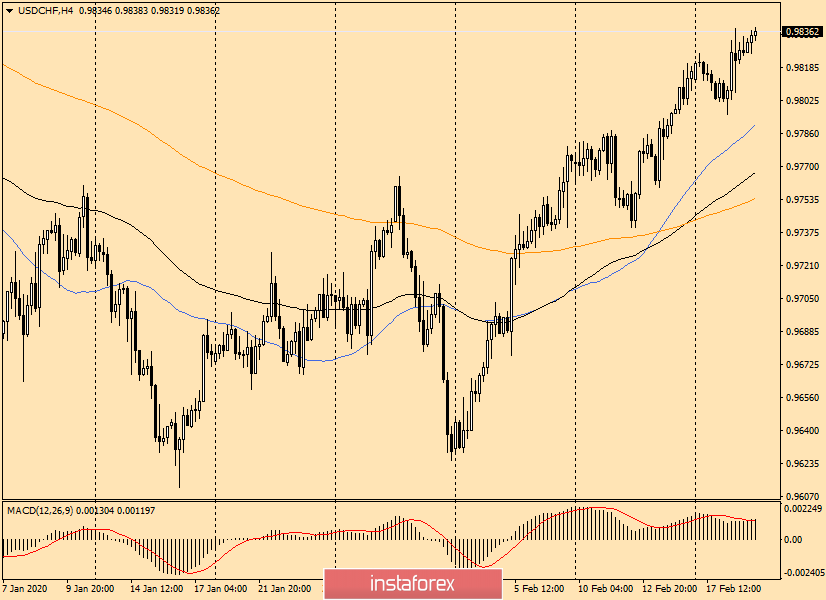

H4

On this chart, the strong bullish trend slowed down near 0.9835. As we remember, on the daily chart, there are attempts to exit up from the Ichimoku cloud, which is why the pair met resistance on the 4-hour timeframe.

If a candle indicating a decline is formed, we wait for a correction in the area of 0.9800 and try to buy. Lower prices for opening long positions are in the price zone of 0.9770-0.9750.

In general, today is not the most favorable day for forecasts. When market participants will get acquainted with the Fed's minutes at 20:00 (London time), volatility will increase significantly and we will see sharp and strong movements, perhaps in each of the parties.

Good luck!