To open long positions on EURUSD, you need:

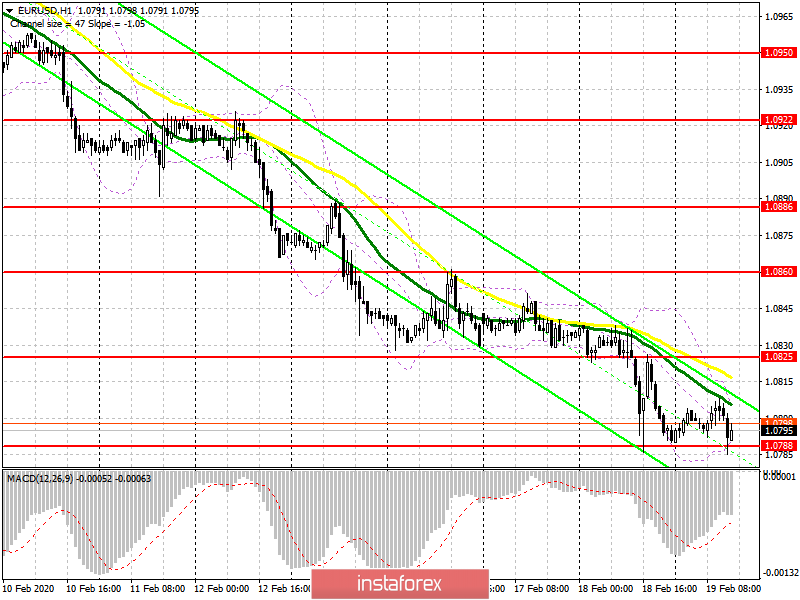

Given the latest weak data on the eurozone, namely the current account balance of the balance of payments, which showed growth less than expected by economists, the euro moved up a little. At the moment, the bulls are focused on yesterday's low around 1.0788 and the update of which led to the formation of a divergence on the MACD indicator, which is a bullish signal. However, there are no strong buyers in the market yet. In the scenario of a breakdown of this range, it is best to consider new long positions after updating the lows of 1.0765 and 1.0740. However, in the current bear market, one should be careful in finding the bottom. A better solution for buyers of the euro will be a return to the resistance of 1.0825, from which a good upward correction will be formed in the area of the highs of 1.0860 and 1.0886, where I recommend fixing the profits.

To open short positions on EURUSD, you need:

Bears continue to bend their line and weak fundamental data on the state of the European economy helps them in this. Already in the first half of the day, sellers updated the minimum of a year but it was not possible to gain a foothold on it. Most likely, the bears will rely on good reports on the US real estate market, as well as on the minutes of the Federal Reserve, which can put even more pressure on the euro. A break in the support of 1.0788 will bring EUR/USD in the area of the lows of 1.0765 and 1.0740, where I recommend taking the profits. In the scenario of the pair's growth in the second half of the day, only the formation of a false breakdown in the area of 1.0825 will signal the opening of short positions in the euro. I recommend selling immediately for a rebound only after testing the maximum of 1.0860.

Signals of indicators:

Moving averages

Trading is conducted below the 30 and 50 moving averages, which indicates a further bearish trend in the euro.

Bollinger Bands

A break of the lower border of the indicator at 1.0768 will lead to a further fall in the euro. A break of the upper border of the indicator in the area of 1.0810 will help the bulls to build an upward correction.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20