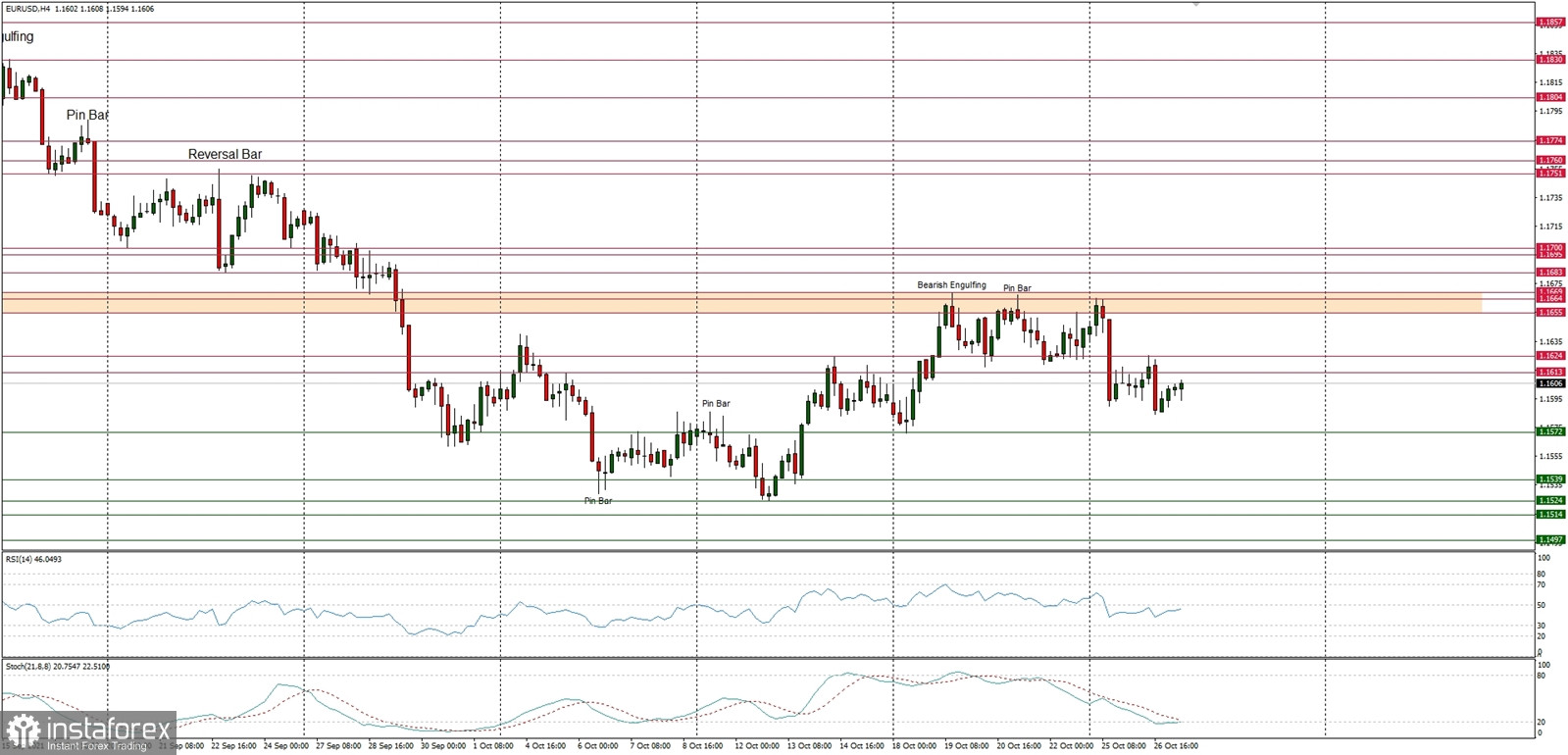

Technical Market Outlook

The EUR/USD pair has made a new local low at the level of 1.1584 and continues the down move. Despite the oversold market conditions, the momentum is seen under the level of fifty already, so the bearish pressure intensify and the bears might test the technical support at the level of 1.1572 soon. Only a sustained breakout above the supply zone located between the levels of 1.1665 - 1.1655 would change the outlook to more bullish, but so far no avail.

Weekly Pivot Points:

WR3 - 1.1784

WR2 - 1.1726

WR1 - 1.1691

Weekly Pivot - 1.1630

WS1 - 1.1593

WS2 - 1.1532

WS3 - 1.1494

Trading Outlook:

The market is in control by bears that pushed the prices towards the level of 1.1562, which is the lowest level since November 2020. The next target for bears is seen at the level of 1.1497. The up trend can be continued towards the next long-term target located at the level of 1.2350 (high from 06.01.2021) only if bullish cycle scenario is confirmed by breakout above the level of 1.1909 and 1.2000.