Hello, dear colleagues!

In the market, it often happens that when you wait for an important event and subsequent strong movements, nothing special happens. So yesterday's minutes of the US Federal Open Market Committee (FOMC) gave almost no new food for thought to market participants.

A lot of attention in the published protocols was paid to the coronavirus as the main threat to the world economy. Also, the possibility of resuming repo operations was discussed. Inflation is expected to be near 2% or even slightly above this target level.

In connection with the achievement of the first phase of trade negotiations with China, the Fed experts raised their forecasts for GDP growth for next year. According to Federal Reserve economists, unemployment will continue to decline this year.

Nothing specific was found in the minutes about further steps in monetary policy. According to most Fed officials, current interest rate levels support economic growth in the United States and have a positive impact on the labor market.

Frankly, nothing was interesting in the minutes of the last FOMC meeting and they turned out to be quite boring and uninformative.

But yesterday's statistics from the US on the housing market and producer prices were better than expected and all came out in green. However, this did not help the US dollar to continue strengthening against the single European currency.

Today is a much more modest day for events. The ECB's report on the monetary policy meeting will be received from the eurozone.

From the American statistics, it is worth paying attention to the initial applications for unemployment benefits, as well as to the production index of the Philadelphia Federal Reserve. I do not think that today's events can significantly affect the price dynamics of the main currency pair.

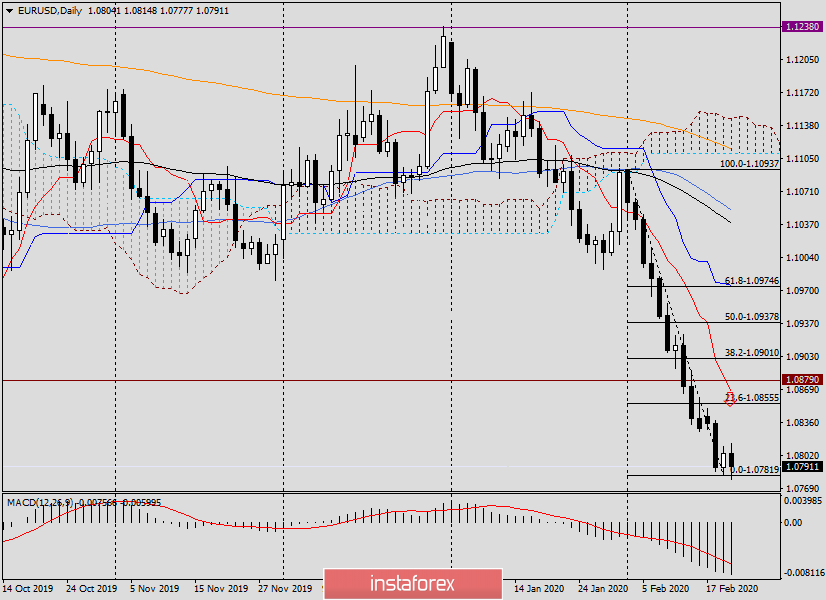

Daily

After five consecutive black (bearish) candles, a white one appeared yesterday. After very good statistics from the US and generally neutral protocols, the dollar suffered losses.

However, at the moment of writing, the pair is declining and updates yesterday's lows at 1.0782. At the moment, the minimum values were shown at 1.0777. Now there is a small rebound up.

The situation for making trade decisions is complicated. On the one hand, a course correction is long overdue. On the other, the bears are so strong that they may not allow the bulls to develop their yesterday's success.

Whatever happens, it is not advisable to sell at the very bottom of the market, especially since the pair is trading in a strong price zone of 1.0800-1.0750, from which a corrective recovery may well begin.

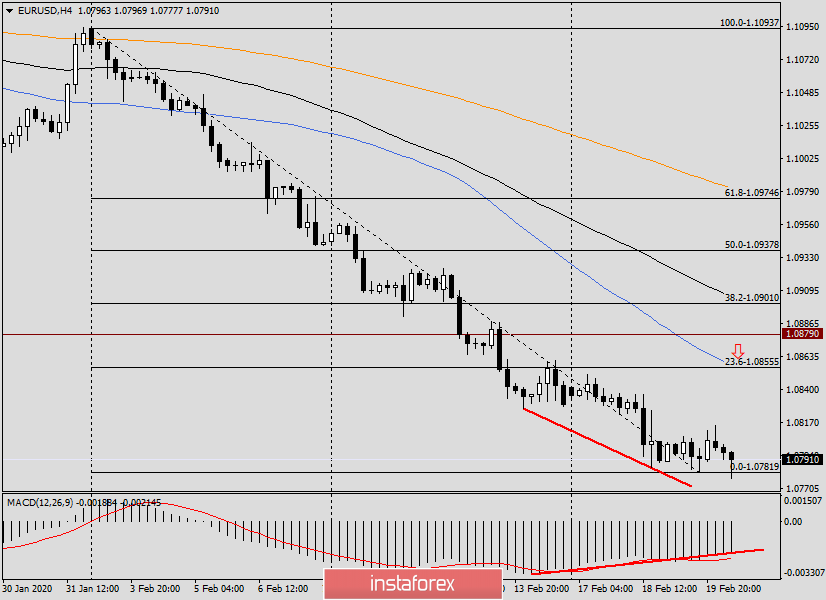

H4

This chart retains the bullish divergence of the MACD indicator, however, this is not enough to open purchases. If the current candle is formed in the form of a bullish reversal pattern, then you can try to buy with a small stop and goals in the area of 1.0855-1.0880, from where you can already consider sales.

As you can see, in the selected zone, there are 50 simple moving average, 23.6 Fibo from the fall of 1.094-1.0780 and the same broken support level of 1.0879. We are looking for sales at higher prices near the significant level of 1.0900.

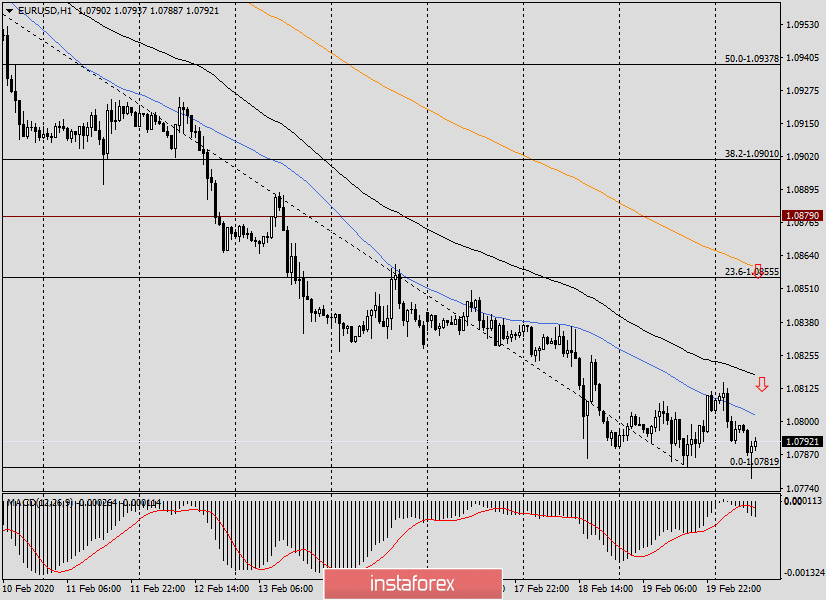

H1

The current candle on the hourly chart clearly shows that the market does not intend to decline further.

Risky and aggressive. You can try to buy euros from current prices but with small goals. The position is against a strong downward trend, which may resume at any moment. It is less risky to skip the corrective rebound and plan sales on the trend near 1.0818 and 1.0860. I like the second option better but will they give such a price?

Successful and profitable deals!