EUR/USD – 1H.

Hello, traders. According to the hourly chart, the EUR/USD pair left the downward trend corridor. However, the pair showed no signs of the expected upturn. Shortly, the euro reversed against the dollar and fell again. Thus, we have one more downward trend corridor which differs from the first corridor by a smaller angle. Anyway, despite positive signals, traders are still not willing to buy the euro. Bears should stay in the corridors until there are buying signals. Bulls should wait for these buying signals as well.

EUR/USD – 4H.

The 4-hour chart indicates that the quotes continue to fall. There are two bullish divergences near the MACD and CCI indicators which allow the pair to reverse so that the euro could go upward. However, in 24 hours the pair managed to break through its low. Thus, both divergences remain strong as the pair is likely not to go below them. No potential divergences are seen near the indicators.

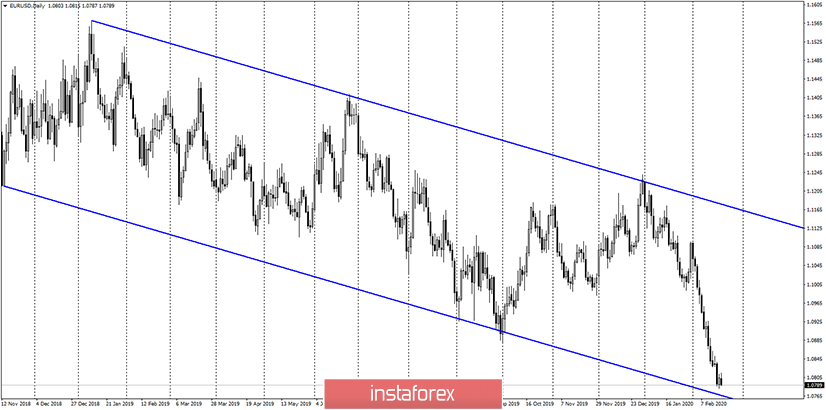

EUR/USD – Daily.

The most clear downward trend corridor is observed on the daily chart. A strong bearish signal was formed right after the last rebound from its upper line. This signal provided selling opportunities with the target at. This target has long been left behind and the quotes are reaching to the bottom line of the corridor from which a rebound can follow. This rebound can indicate either bearish or correction signal.

EUR/USD – Weekly.

If the pair approaches the lower line of the tapering triangle on the weekly chart, it will be a clear signal of the trend reversal to the upside. The probability of a rebound from the line is very high and is up to about 20 points. Approximately, the price may touch the line at 1.0767 level. The rebound from this level will work in favour of the euro currency and mark the beginning of growth in the direction of the upper line of the triangle.

Overview of fundamentals:

Publication of the Fed meeting minutes was the only event on February 19. However, the content of the minutes has been known for a while. The Fed reported a strong labour market, declining unemployment, and coronavirus concerns. There were no signs for another cut or an increase of the interest rate.

There are no events on the news calendar for the US and the EU as of February 20.

COT survey (Commitments of traders)

For the week of February 11, short positions of large speculators increased by only 2,146 contracts. Long positions gained 20,622. It means that the major market players gradually start preparing for a reversal increasing the number of buy deals. The total number of Commercial Long positions outweighs the number of Short positions. Anyway, the total number (Total) is still dominated by sales. According to the last COT survey, the major market players, who do not use the currency market to speculative profit, increase their buy deals. Speculators, hedge funds, and traders continue to short the pair. The drop of the euro currency will slow down which coincides with the 1-hour chart where the second trend corridor was formed.

Forecast for EUR/USD pair and recommendations for traders:

The trading idea is still to buy the euro. However, it requires signals from the two charts. Each of the four charts there seem to provide signals to buy the euro. The COT survey also warns that trader sentiment can change.