The single European currency completely refuses to grow, and continues to stagnate, and even weak statistics did not encourage investors to take any active actions. And even the text of the minutes of the meeting of the Board of the European Central Bank did not impress market participants yesterday. Although it couldn't be otherwise, since there is nothing new in the text of the minutes. And most importantly, there is no specifics regarding the change in the monetary policy of the ECB announced by Christine Lagarde.

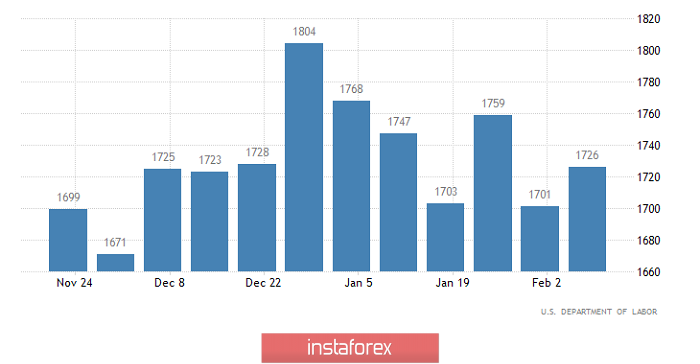

Although the content of the text of the minutes of the ECB meeting did not provide any reason for changes in the dynamics of the euro, the data on applications for unemployment benefits should have made at least some impression on market participants. After all, their total number increased by 25 thousand. In particular, the number of initial applications increased by 4 thousand, and repeated ones by 21 thousand. At the same time, it was predicted that the number of initial applications would grow by 9 thousand, but repeated, by only 4 thousand. Thus, the growth turned out to be somewhat large, and just for repeated applications that reflect long-term unemployment, which means that it is not worth waiting for a decrease in unemployment. Rather, it is better to wait for its growth. At least the likelihood of just such a development of events is much greater. But the market did not react to this data. And it is not strange, but it shows the mood of the market to further weaken the euro.

Repeated Unemployment Insurance Claims (United States):

There is a possibility that today, at least during the European session, market wishes will be fulfilled, thanks to European statistics. Inflation should rise from 1.3% to 1.4%, which is an extremely positive factor. However, this is the final data, and the market laid this fact in the euro's value when the preliminary data was published. But preliminary data on business activity indices may be an excellent occasion for the euro to decline further. Thus, the index of business activity in the manufacturing sector should fall from 47.9 to 47.4. In the service sector, a decrease is expected from 52.5 to 52.0. So it's easy to calculate that the composite business activity index may decline from 51.3 to 50.7. In other words, investors will have quite a serious reason to sell the euro.

Composite Business Activity Index (Europe):

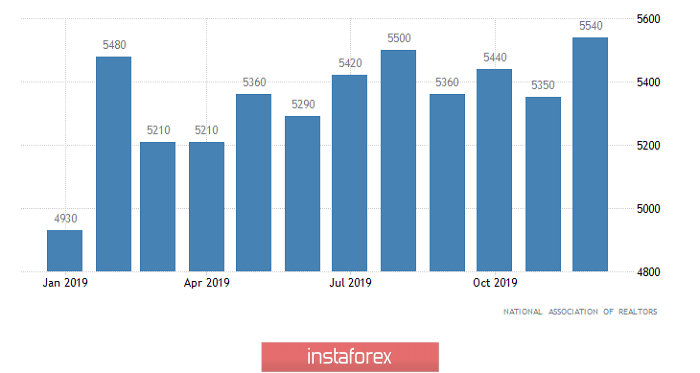

However, the decline will not be so strong and long, because they do not expect good news in the United States. All the same preliminary data on business activity indexes are likely to disappoint investors. The manufacturing sector could show a decline from 51.9 to 51.1. The index of business activity in the services sector should fall from 53.4 to 53.2. As a result, the composite index is expected to decline from 53.3 to 52.8. But this does not end the bad news, as home sales in the secondary market should drop by 2.2%. So there are not so many reasons for optimism. More precisely, they do not exist at all. But if you recall the previous days, the weak US data will only become an excuse to stop the euro's fall. But do not change the general direction of movement.

Secondary Home Sales (United States):

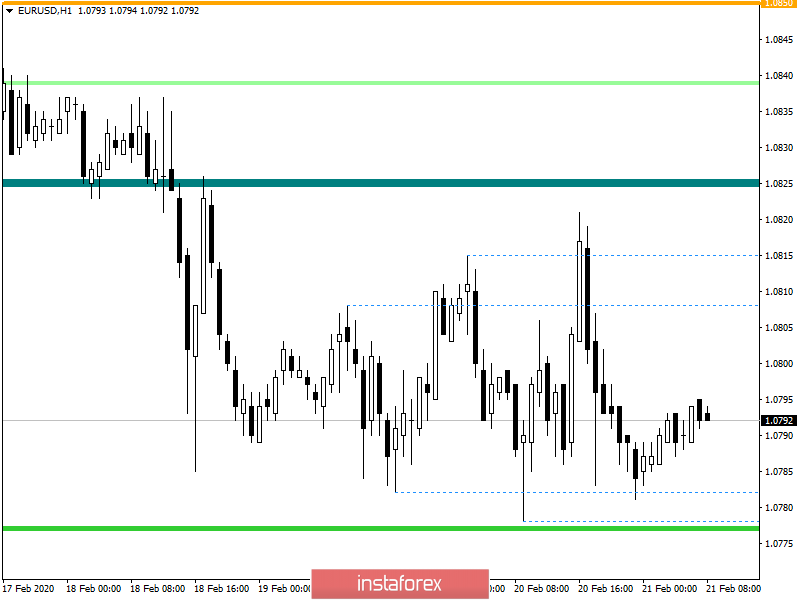

From the point of view of technical analysis, we see a stable downward move, which led the quote to the 1.0780 area, where a variable flat of 1.0780/1.0815 was formed. In fact, we have an inertial move set back in early February, where there was no correction and pullback, which led to overheating of short positions and, as a fact, to a flat.

In terms of a general review of the trading chart, we see a global downward trend, which is at the level of 2017, and ranges of psychological significance are under the quote.

It is likely to assume that the movement in the specified frames of 1.0780/1.0815 will not last long, where the best tactic is the method of working on the breakout of interaction points that reflect the boundaries of the oscillation. It is worth considering that the breakout signal will not be piercing shadows, but pulse candles with a fixed quote.

Concretizing all of the above into trading signals:

- Long positions, we consider in case of movement higher than 1.0825, towards 1.0850-1.0875.

- Short positions, we consider in the absence of correction and consolidating the price lower than 1.0775.

From the point of view of a comprehensive indicator analysis, we see that due to a two-day flat, we have an alternating signal with relatively shorter time periods. In terms of daily charts, the downward signal remains unchanged.