Crypto Industry News:

The European Central Bank (ECB) has announced the creation of a market advisory group to examine the infrastructural and circular potential of the digital Euro from the perspective of industry leaders.

The group also aims to discover the optimal function of the digital Euro in the vast pan-European currency payment ecosystem.

The group includes many renowned experts from the banking and financial sector, incl. Aleksander Kurtewski, Managing Director of Bankart, Antonio Macias Vecino, Head of Payment Discipline at BBVA, and Axel Schaefer, Payment Regulation and Innovation Officer, Ingka Group (Ikea), among others.

Initial consultation meetings are expected to start in November 2021 and take place monthly. 30 members will work in advisory roles and will submit their findings for consideration in discussions on retail payments under the Euro Retail Payments Board.

In mid-July, the ECB's Governing Council unveiled plans to launch a two-year initial research initiative on the viability of the digital Euro project, assessing parameters such as infrastructure creation, distribution and design, with the intention of "topping up cash, not replacing it".

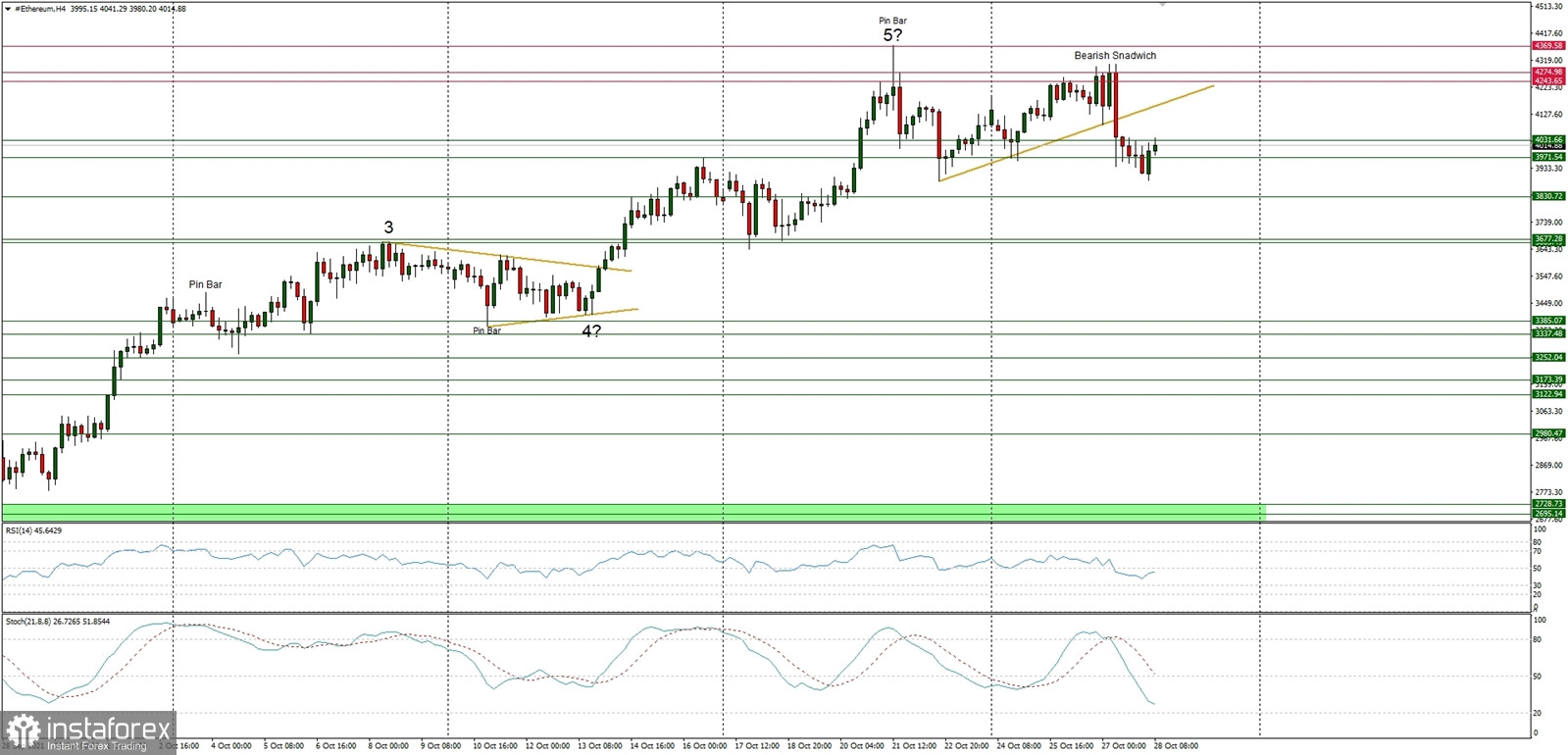

Technical Market Outlook

The ETH/USD pair continue to move lower after the bears had broken below the short-term trend line support around the level of $4,100 and is trading around $4,000 already. The last local low was made at the level of $3,890 and the corrective cycle might extend towards the next technical support seen at $3,830 soon. The momentum is weak and negative already, so the bears are in control of the market and continue the corrective cycle. Only a sustained breakout back above the level of $4,273 would change the outlook to more bullish.

Weekly Pivot Points:

WR3 - $5,099

WR2 - $4,706

WR1 - $4,412

Weekly Pivot - $4,017

WS1 - $3,701

WS2 - $3,313

WS3 - $2,969

Trading Outlook:

The next long-term target for ETH is seen at the level of $5,000. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,906. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls. The level of $3,677 is the key mid-term technical support for bulls.