To open long positions on GBPUSD, you need:

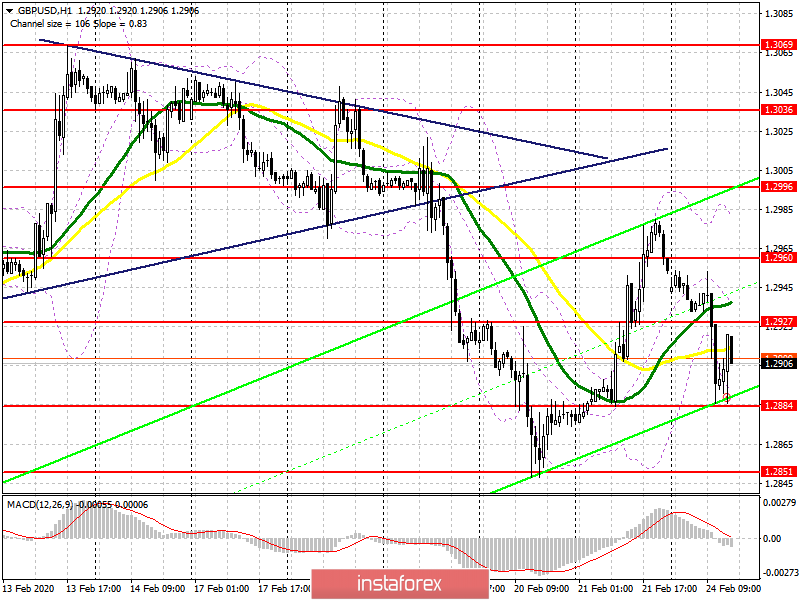

In the first half of the day, the bulls failed to catch on to the support of 1.2927, the breakdown of which led to a rapid fall of the pound in the area of 1.2884, from which I recommended opening long positions. A good rebound from this level with the building of the lower border of the new ascending channel keeps the bulls' hope for the continued growth of the pound in the short term. An important task for the second half of the day will be a breakdown and consolidation above the resistance of 1.2927, which will lead to an update of the highs in the area of 1.2960 and 1.2996, where I recommend taking the profits. If the bears again return the pair to the minimum of 1.2884, it is better to abandon long positions and wait for the update of the minimum of 1.2851, where I recommend buying immediately for a rebound.

To open short positions on GBPUSD, you need:

Bears continue to control the market. The return to the support of 1.2927 led to complete overlap of Friday's growth. Now an important task for sellers is to break through and consolidate below the support of 1.2884, which will quickly push the pound to the lows of 1.2851 and 1.2830, where I recommend fixing the profits. But no less important task will be to protect the level of 1.2927 already in the role of resistance. The formation of a false breakdown in this range will be a signal to open short positions. In a different scenario, it is best to sell GBP/USD on a rebound from the maximum of 1.2960.

Signals of indicators:

Moving averages

Trading is conducted around the 30 and 50 daily averages, which indicates market uncertainty after the bears quickly regained control of the market today.

Bollinger Bands

The pound bounced off the lower border of the indicator but the task of the bulls will be to break the middle of the channel in the area of 1.2935.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20