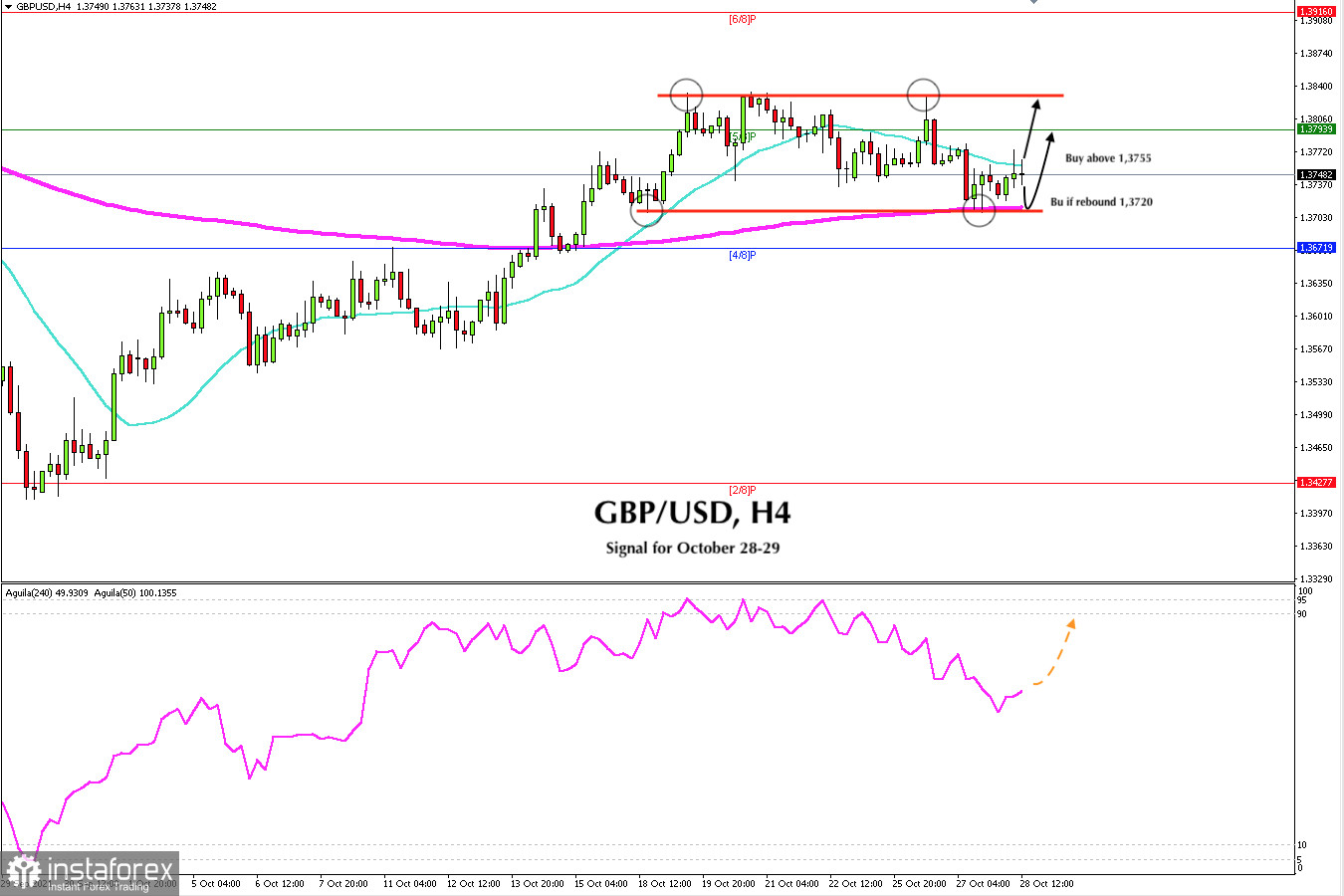

Since October 18, the British pound has been consolidating within a price range between 1.3710 and 1.3830. Yesterday, it came to test the strength of the support of this range. The pair made a technical bounce around the 200 EMA. At this time of writing, if the continued bounce could break above the 21 SMA, it will be a sign of a bullish move to the top of the range around 1.3830.

Since September 29, the British pound is moving within an uptrend channel. As long as it remains above this channel and above the 200 EMA located at 1.3703, there is a probability that it will continue its upward movement. This sideways period could be considered a correction for a move towards the 1.3916 level, but first the price should break the top of the range at 1.3830.

On the contrary, if the British pound remains under bearish pressure and breaks the 200 EMA around 1.3703 and on daily charts it closes below 1.3690, then it could be a sign of a trend reversal and we could wait for a fall to 1.3671. This will be the last key support and breaking it could accelerate the fall to 1.3427 which is the low of September 29.

We believe that the British pound will continue trading within this price range until next week, as the market is watching policy decisions from the Fed regarding its change in monetary policy. Therefore, you can buy and sell within of this range around 1.3720 and 1.3830.

After having logged strongly overbought levels and having reached 95 on 3 occasions, the eagle indicator is now around 56 points, hence giving a bullish signal. We could consider this signal to buy the British pound only if it is trading above 1.3755 (SMA 21).

Support and Resistance Levels for October 28 - 29, 2021

Resistance (3) 1.3822

Resistance (2) 1.3793

Resistance (1) 1.3765

----------------------------

Support (1) 1.3706

Support (2) 1.3671

Support (3) 1.3639

***********************************************************

A trading tip for GBP/USD for October 28 - 29, 2021

Buy if breaks above 1.3755 (SMA 21) with take profit at 1.3793 (5/8) and 1.3830, stop loss below 1.3715.