Economic calendar (Universal time)

In today's economic calendar, you can pay increased attention to the following events:

13:30 President of the ECB will deliver a speech;

15:00 sales of new housing (USA);

15:30 crude oil reserves (USA).

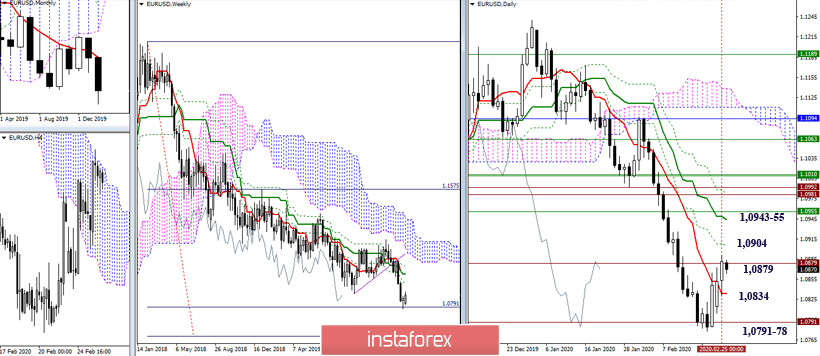

EUR / USD

The situation over the past 24 hours has not changed in its conclusions and expectations. It is important for the players on the downside to organize a bearish close of the week and month this week. To do this, they need to stay in the downward trend zone, with a minimum extremum of 1.0879. The opponent's task, in turn, comes down to the maximum possible development of an upward correction and the formation of a long lower shadow at the February candle. In addition, the nearest benchmarks for the development of the daily upward correction today can be identified at 1.0904 (daily Fibo Kijun) - 1.0943-55 (daily Kijun + weekly Fibo Kijun). In this situation, support can be noted at 1.0834 (daily Tenkan) and 1.0791-78 (the first target of the weekly target + current minimum).

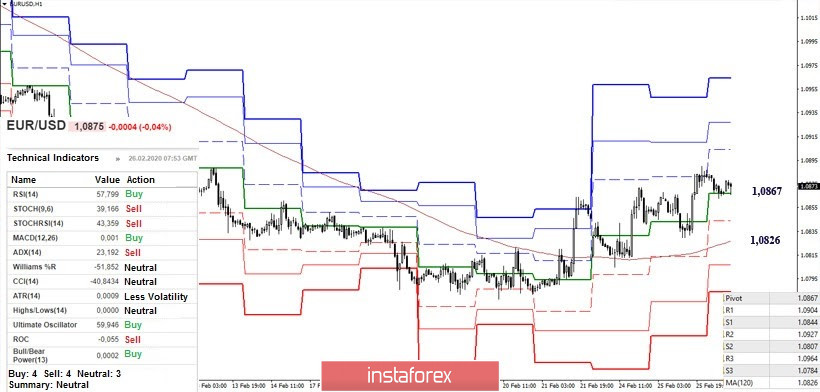

The pair continues the increase, using support and resistance, including significant levels of lower time intervals. Currently, the key levels on H1 are located at 1.0867 (central Pivot-level of the day) and 1.0826 (weekly long-term trend). Consolidating below can change the current balance of strength of the lower halves. On the other hand, the continued rise in resistance within the day can be noted at 1.0904 (R1) - 1.0927 (R2) - 1.0964 (R3).

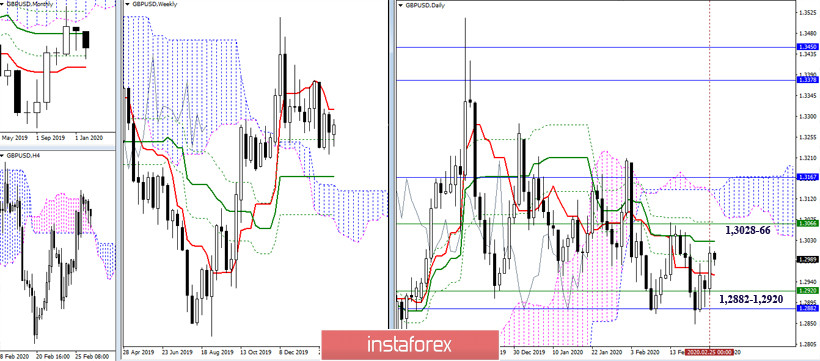

GBP / USD

The pair continues to rise to the central part of the zone of the current confrontation using key support in the area of 1.2882 - 1.2920 (the lower boundaries of the consolidation zone), which can now be designated within 1.3028 (daily Kijun) - 1.3066 ( weekly Tenkan). The main options for the development of the situation have not changed. In this situation, the pound is busy forming the result of closing the week and month.

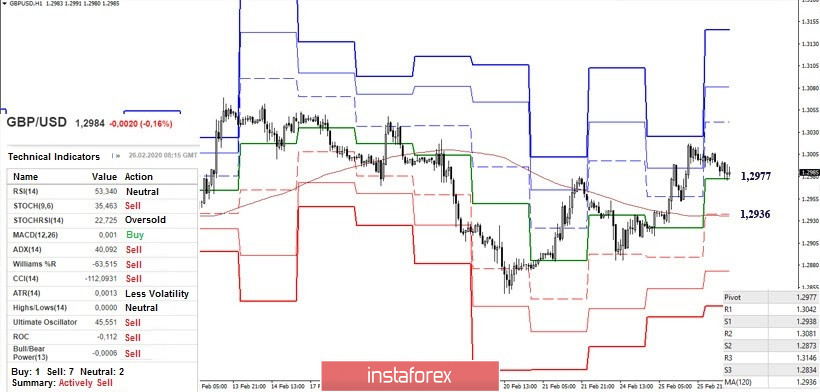

At the moment, on H1, the pair is in the downward correction zone again, which has already led the pound to support the central Pivot level of the day (1.2977) and has influenced the preferences of the analyzed technical indicators. The next important bearish target is 1.2936 (weekly long-term trend). Leaving the correction zone (1.307) may return the resistance to the classic Pivot levels; they are located at 1.3042 - 1.3081 - 1.3146 today.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)