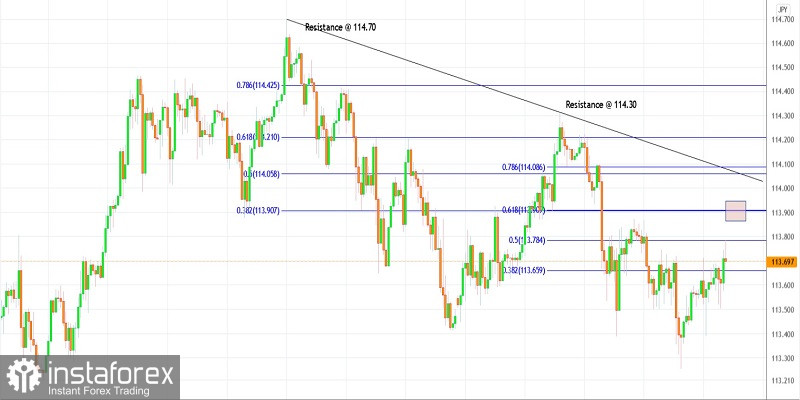

Technical outlook:

USDJPY carved a meaningful resistance around 114.70 levels on October 20. The currency pair has been drifting lower since then and dropped to 113.27 lows before pulling back to 113.80 in the last hour. Intraday resistance comes around 113.90 mark, which is the Fibonacci 0.618 retracement of the recent downswing between 114.30 and 113.27 levels respectively.

USDJPY bears might be targeting 113.00 mark in the near term (1-2 trading sessions) before producing a pullback rally. At the time of writing, the currency is working upon the recent downswing and might push through 113.90 levels before resuming lower again. On the flip side, bulls might extend higher up to 114.50 zone before giving in to bears.

Either way, USDJPY remains an ideal case for selling on rallies toward 113.90 and up to 114.40-50 mark. Only a consistent break below 113.30 would confirm a meaningful top is in place around 114.30 and bears are back in control. The currency is targeting 112.50 and 111.30 levels in the next few weeks.

Trading plan:

Potential drop through 111.30 against 115.00

Good luck!