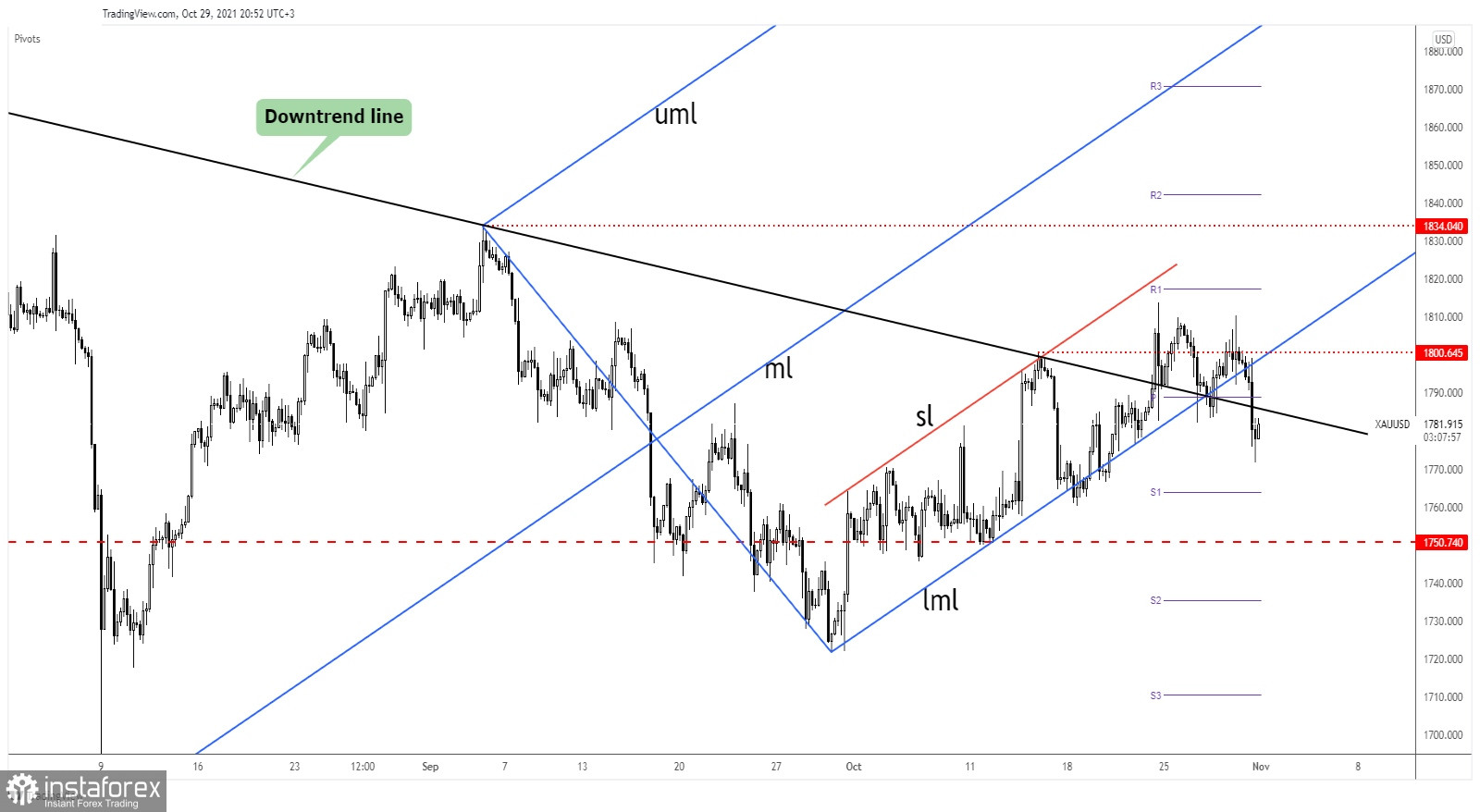

Gold was trading at 1,781.67 at the moment of writing after dropping to as low as 1,771.98. Unfortunately, the precious metal failed to stabilize above the downtrend line, so the bias is bearish at the moment as the Dollar Index has registered an amazing rally.

Surprisingly or not, higher inflation reported by the eurozone failed to boost Gold. The CPI Flash Estimate reported a 4.1% growth versus 3.7% expected, while the Core CPI Flash Estimate increased by 2.1% compared to 1.9% estimates. This was bad for the euro so it has dropped versus its rivals.

On the other hand, the Dollar Index rallied after the Eurozone data publication. DXY's rally pushed Gold down.

GOLD turned to the downside

The price of Gold failed to stabilize above 1,800.64 static resistance and above 1,800 psychological level. Also, it has failed to approach and reach 1,813.84 former high signaling strong selling pressure.

As you can see on the H4 chart, XAU/USD dropped far below the downtrend line and most important, far below the Ascending Pitchfork's lower median line (lml) which represented strong dynamic support.

Gold prediction

Making a new lower low, its bearish closure below 1,782.88 signaled a potential deeper drop. Still, we cannot rule out a temporary rebound in the short term. XAU/USD could come back to test and retest the broken levels before dropping deeper.

Staying below 1,782.88 and under the downtrend line could bring us new short opportunities.