4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - up.

CCI: 135.8504

A new trading week begins on the Forex market and traders will have to answer the question: what is happening with the euro currency now? Is this the beginning of a new long upward trend or just a strong upward trend correction? Friday's trading showed that the market is almost in a panic: high volatility, multidirectional movements, lack of correlation with the pound, and ignoring macroeconomic statistics. However, this week, the passions should subside, and the auction should return to its usual course. Thus, on Monday, we expect the volatility to decrease to the usual 50-60 points per day. In this article, we wrote about all the macroeconomic statistics planned for this week and its possible impact or lack thereof on the EUR/USD currency pair.

In the same article, we want to review Jerome Powell's emergency statement on Friday late at night, in which the Fed's head announced his readiness to intervene in monetary policy at the next meeting. Last week, the US stock market crashed to a record high due to market participants' fears of a slowdown in the global economy "due" to the spreading "coronavirus". The capitalization of the US stock market has fallen by almost $8 trillion. According to the Fed Chairman, the "foundation" of the US remains strong, however, "coronavirus" is a great threat to business activity. Powell noted that the Federal Reserve keeps "a finger on the pulse of the market" and closely monitors any changes in market conditions, as well as events in the world, in order to be able to intervene in time and stimulate the American economy. Most of the world's experts, after reading Powell's official statement on the Fed's website, made an almost unambiguous conclusion: the regulator is ready for a new course of monetary policy easing. It is the "coronavirus" that is the main source of concern for Fed members. If a few months ago there were no talks or plans to reduce the rate during 2020, now we are talking about a reduction of 0.50% at once and at the next meeting - in March. Many experts note that the 2008 crisis taught the world's central banks a lot. You need to react very quickly to uncontrolled stock market crashes, while you can still prevent a collapse. Some experts believe that the Fed will not immediately cut the rate by 0.50%, however, they will lower the rate several times this year. However, all analysts agree that it is not only the Fed that will lower the rate. It is not only the Federal Reserve that needs to take this step. It's not just the American economy that will be in trouble because of the outbreak of the Chinese virus. We are also talking about the Bank of England, which has long been going to lower the rate, and the ECB, whose rates are already "ultra-low" (or to be more precise - negative). Thus, we still want to draw the attention of traders that the balance of power between the euro and the dollar is still not changing. If both the ECB and the Fed simultaneously lower rates, nothing will change.

In addition to the problem of "coronavirus", traders are now interested in what measures the authorities will take to avoid the spread of the epidemic. First of all, everyone is interested in the policy of Donald Trump, who recently spoke very lightly about the virus, saying that Americans have nothing to fear. Earlier, the US leader promised that the virus would not survive the spring because of its instability before heat. However, experts believe that Trump should either impose a quarantine, which will lead to an almost complete drop in business activity and a strong slowdown in the economy. Or the US President may not impose a quarantine, however, the virus will still spread, which will lead to the same recession. We can also mention Italy, which has already introduced quarantine in several of its regions. Tourists refuse to travel to this country, so Rome is suffering huge losses due to falling tourism revenues. In any case, you need to stop the spread of the virus and find a cure for it as quickly as possible. Otherwise, no monetary incentives will help. Recall that, according to the latest information, the number of infected people in the world is 85,000 and about 3,000 have already died. Cases have been reported in 55 countries, on all continents except Antarctica.

Thus, if the problem of the spread of the virus can not be solved in the near future, new collapses in the stock markets are not excluded. The currency market may remain in a state of panic, although we still believe that traders will be less prone to panic next week. From a technical point of view, we expect a downward correction.

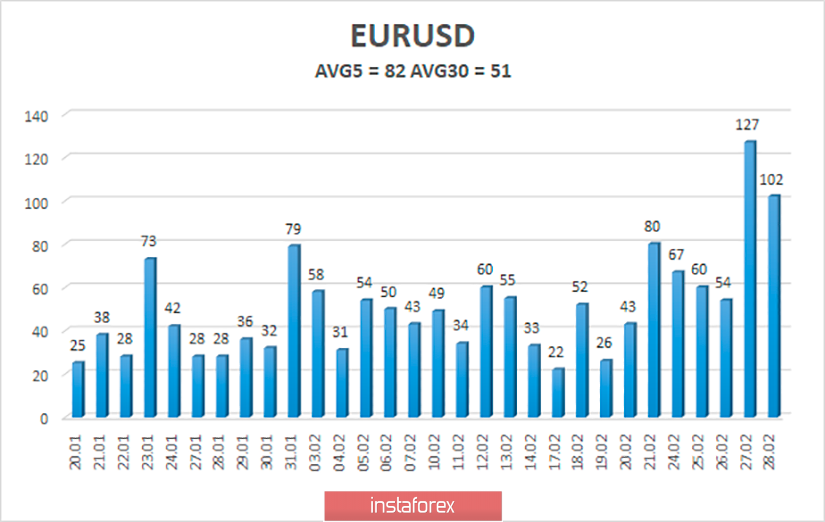

The average volatility of the euro/dollar currency pair rose to 82 points per day, which is a very high value for the euro. Thus, on the first trading day of this week, we expect a decrease in volatility and movement within the channel, limited by the levels of 1.0944 and 1.1108. A downward turn of the Heiken Ashi indicator will indicate a round of corrective movement.

Nearest support levels:

S1 - 1.0986

S2 - 1.0925

S3 - 1.0864

Nearest resistance levels:

R1 - 1.1047

R2 - 1.1108

R3 - 1.1169

Trading recommendations:

The euro/dollar pair is still continuing its increased upward movement. Thus, purchases of the European currency with the targets of 1.1047 and 1.1108 remain relevant. However, we are waiting for a downward correction against the pair's growth in the last week. You can return to sell positions after the price is fixed below the moving average line with the first targets of 1.0864 and 1.0803.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.