EUR/USD

Good data on the US came out on Friday, which put pressure on most currencies, but the euro ended the day higher after a bit of confusion. Personal incomes of consumers increased by 0.6% in January, expenses increased by 0.2%, business activity in the manufacturing sector of the Chicago region in February amounted to 49.0 points against 42.9 a month earlier. Also, the commodity trade balance improved from -68.7 billion to -65.5 billion in January.

Today the final PMI estimates for February will come out in the eurozone (expectations unchanged), while the US ISM Manufacturing PMI is projected to decrease from 50.9 to 50.5, which may extend the euro's growth amid expectations of a Fed rate cut on the 18th. Markets lay a 94.9% probability of a rate cut immediately by 0.50% to 1.25% and another decrease by 0.25% at a meeting on April 29th. Looking ahead, we note that lowering rates will have a short-term effect on the dollar, the development of the crisis will nevertheless return market sentiment to the purchase of safe haven currency, as it was during the 2008 crisis.

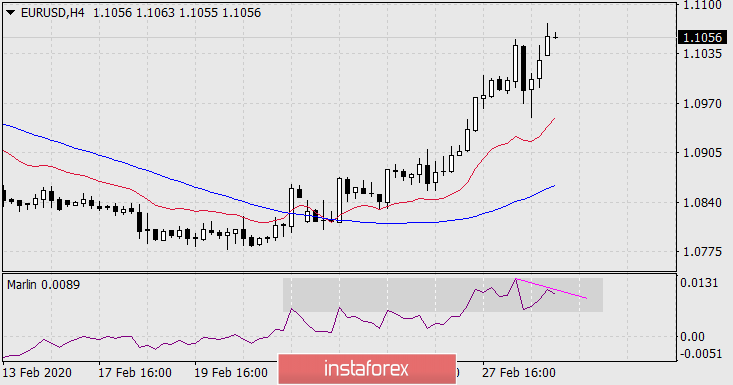

On the daily chart, the price went above both indicator lines - above the red balance line, which shifts the price balance towards growth, and above the MACD line, which indicates a medium-term direction to growth. The immediate goal is the correction level of 76.4% at the price of 1.1130, overcoming the level opens the second goal of 1.1175 - a strong record level (a high on January 16, December 17, etc.).

The daily Marlin oscillator is close to the overbought zone, it has significantly pulled down the growth rate. We are waiting for the euro's next reaction. Labor indicators on Friday will become very important for understanding the Fed's intentions on the rate - good data are unlikely to push the central bank to double the rate cut, and one decrease by 0.25% is already actively included in the price.

The situation is completely upward on the four-hour chart, only the Marlin oscillator forms a kind of consolidation in front of the overbought zone, and a small divergence, which indicates an imminent slowdown in price growth with the likelihood of converting into a short-lived horizontal trend (1-2 days).