Following a string of a continuous decline over the past few days, the ruble opened today's session with a gap heading for the upward trend. The upward correction was expected since the ruble eased mainly on coronavirus fears and the panic among market players. Oil prices plunged amid concerns about a possible sharp decline in oil demand. And we shouldn't forget that for many investors oil remains a major marker of the ruble's value. Thus, significant changes in oil prices, that could be observed over the past week, heavily affected the ruble. Notably, the ruble's decline started right after the tax period in Russia had ended. The end of the tax payment period means that the number of foreign companies that need the ruble for their settlements has sharply decreased.

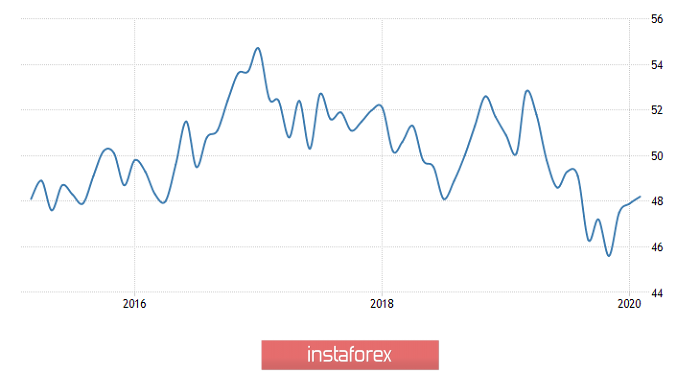

However, a rapid rebound was widely expected at least because oil prices are still holding steadily high. Even a slight uptick in oil prices would push the ruble higher. Besides, the budget dependence on oil has become less obvious, and major investors have already noticed this. If you count exports revenue excluding the profit gained from oil, the trade balance will still remain in surplus. This is why the rapid fluctuation of the ruble amid changing oil prices happens only due to investors' negative sentiment which is unlikely to have a long-term impact. Traders may have some influence on the overall ruble's trajectory but are unlikely to change the direction of the movement. Meanwhile, oil is expected to rebound and rise to the level of 48.4 from the previous mark of 47.9. In addition, the manufacturing PMI has recently increased, although the reading was slightly less than expected, compared to the forecasts of 48.8. Anyway, the indicator and the way it is calculated in Russia is rather unreliable as it stays below 50.0 points. The reading below 50.0 indicates contraction but industrial production is expanding in Russia. In the US, however, this index is above 50.0 points, but industry in the country has been declining for several months in a row.

Manufacturing PMI in Russia:

Nevertheless, the market is still driven by emotions and we should keep this in mind. Besides, the weakening ruble might become more attractive for investors, especially given the higher yield of Russian federal loan bonds. There is a high possibility of the dollar/ruble pair to gradually slide to the level of 65.75.