Buyers of the euro continue to ignore the problems that the eurozone economy is facing amid the spread of coronavirus, as well as the fact that the European Central Bank will need a lot of effort, including expanding the bond redemption program to keep the eurozone from slipping into recession. However, at the time of writing, EURUSD is trading around 1.1150, updating the next daily high.

It is also not necessary to say that the euro is supported by fundamental reports, and despite a slight increase in the index of production activity, the sector continues to decline in all countries of the eurozone. It is important to note that the February growth of the purchasing managers index for the manufacturing sector does not yet affect the problem of the spread of coronavirus in the eurozone. Data were provided for the period from February 12 to 21, before a sharp increase in the number of cases in Italy. Most likely, the March indicators will again begin to decline.

Let's go through the key countries. A report from the Markit statistics agency indicated that the PMI supply manager index for Italy's manufacturing sector slightly fell to 48.7 points this February, while it was forecasted to be 49.1 points. The index is at 48.9 points in January. A similar index in France fell to 49.8 points in February, while experts expected a larger drop to around 49.7 points. In January, the indicator was above the mark, at 51.1 points.

The data turned out to be much better than forecasts in Germany, however, they did not work beyond the mark of 50 points. According to the report, the PMI for Germany's manufacturing sector rose to 48.0 points in February, compared to 45.3 points in January.

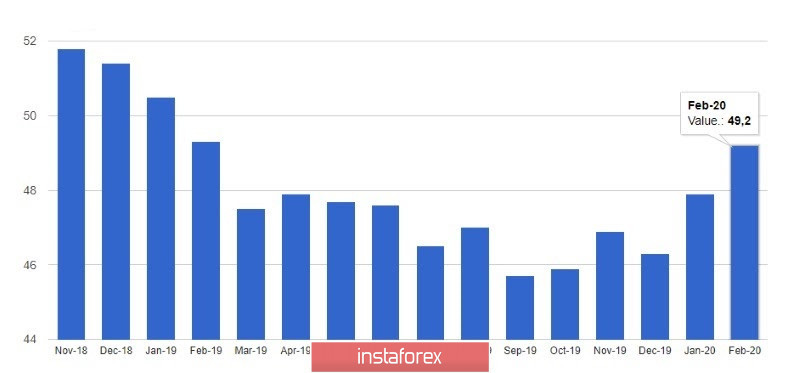

On the whole, the index has already come close to the level of 50 points in the eurozone, the achievement of which will indicate an increase in activity in the sector. According to the data, the index of purchasing managers for the manufacturing sector of the eurozone rose to 49.2 points in February against 47.9 points in January and the economists forecast 49.1 points.

From a technical point of view, the next update of sufficiently large resistance levels in the region of 1.1160 maintains a bullish trend in the market, although, as was the case with the US dollar a couple of weeks ago, there are no objective reasons for such a large increase except for conversations and discussions on the issue of lowering the Federal Reserve interest rates.

As for activity in the UK manufacturing sector, it grew more slowly than expected. The main production problems were associated with Brexit and coronavirus, which negatively affected demand. Thus, the index of purchasing managers for the UK manufacturing sector was at 51.7 points in February versus 51.9 points (preliminary estimate).

Today, following the Bank of America, the Organization for Economic Commonwealth and Development published its forecast for global GDP growth. In it, economists lowered their forecast for world economic growth in 2020 to 2.4% from 2.9% amid the spread of coronavirus. The OECD expects economic recovery in 2021, which led to an increase in the growth forecast to 3.3% from 3.0%. As for China, the organization expects growth to slow down to 4.9% in 2020 from the past 5.7%. The US economy will slow down to 1.9%, but the impact of coronavirus on the United States will be limited.

Following the collapse of stock markets, US President Donald Trump once again announced that he was counting on the support of the Federal Reserve. Trump's favorite pastime is putting pressure on the committee to lower interest rates, especially during times of economic uncertainty. One can safely say that last year it was the position of the White House that led to the beginning of a cycle of easing monetary policy.