The US President repeatedly called for a lower interest rate. As a result, the euro continued to strengthen against the US dollar. Another factor that contributed to the situation was the statements made by the heads of the World Bank, as well as the International Monetary Fund, who said that they are ready to provide assistance to all those in need, to fight the coronavirus.

Yesterday, US President Donald Trump has once again said that the Fed is acting very slow, and called for more aggressive actions aimed at preventing a slowdown in the growth of the economy. He said that Americans should lead rather than follow other countries, most likely referring to monetary policy and interest rates, which, in his opinion, are still quite high, unlike in other countries.

At the same time, the World Bank and the International Monetary Fund said that they are ready to help member countries overcome the effects of the coronavirus, and promised to use all available tools, including emergency funding. The IMF noted that they have fast enough financial instruments to help the countries. These statements provided some support to stock indexes, which recovered from major declines seen last week due to the fears of the spread of the coronavirus.

In his speech, the Vice President of the European Central Bank, Luis de Guindos, also hinted that the ECB may resort to lowering interest rates, as well as buying bonds in the future. Regardless, it did not affect the market in any way, since apparently, traders consider the euro as undervalued. Nevertheless, de Guindos said that the ECB is ready to lower rates, buy assets to support the Eurozone economy, and adjust its instruments in order to ensure that the inflation target is reached. According to him, the coronavirus is the current main risk for EU countries, as it has increased the uncertainty of the prospects of the world economy and the Eurozone economy.

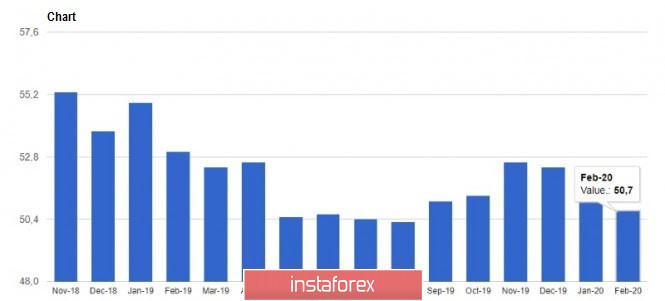

For fundamental statistics, reports on the growth rate of the US manufacturing activity put pressure on the US dollar. The slowdown in the sector due to the decline in production and orders is a bad signal for the country's economy. The IHS Markit report indicated that the final purchasing managers' index (PMI) for the US manufacturing sector fell to 50.7 points in February 2020, as compared to its 51.9 points in January. Index values above 50 indicate an increase in activity. Most likely, given the spread of the coronavirus, production and order indicators will deteriorate more significantly in March, as many companies will continue to face falling exports and supply chain disruptions.

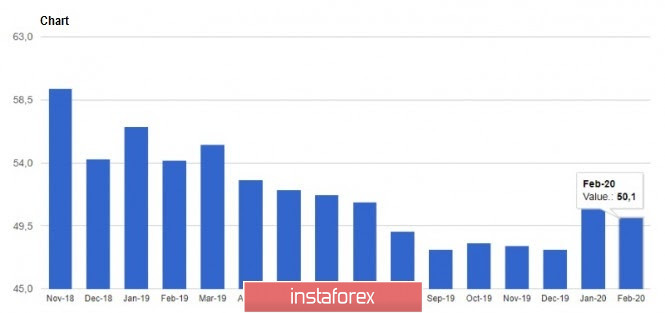

Meanwhile, according to the Institute for Supply Management (ISM), activity in the US manufacturing sector was still growing in February. The report shows that the manufacturing index fell from 50.9 points in January, to 50.1 points in February. Economists had expected the index to reach 50.8 points. The new orders index fell to 49.8 points in February, while the production index fell to 50.3 points.

Construction spending in the United States, which is directly related to the activity in the real estate market and the lack of offers, continues to grow. According to a report from the country's Ministry of Commerce, construction spending in January of this year increased by 1.8% compared to the previous month, and amounted to 1.369 trillion dollars per year. Economists had expected a growth of 1.0%. If compared to the same period of the previous year, construction costs increased by 6.8%.

As for the current technical picture of the EUR/USD, the test of the 12th figure confirms the fact that investors and traders base their actions on speculative considerations, without laying a longer-term foundation in the calculation. Right now, they only talk about the Fed lowering the interest rates, completely forgetting the fact that there is no place to lower rates in the Eurozone. The market's reaction to negative rates remains a mystery, but it will be a surprise to the buyers of risky assets. Meanwhile, the growth of the euro will continue if the resistance breaks 1.1165, and the high is updated at 1.1205. This will either break the upward trend, or lead to the levels of 1.1240 and 1.1290. A more rational solution would be to buy EUR/USD on a correction from the supports of 1.1080 and 1.1040.