Today, the meeting of the Big Seven (G-7) will take place, which will be chaired by J. Powell, head of the Federal Reserve and S. Mnuchin, US Treasury Secretary. The meeting will discuss the topic of assistance to countries belonging to this club, aimed at the consequences of the influence of coronavirus on these countries.

For the part of investors, they expect the representatives of the Big Seven to make a decision on expanding financial measures to support the economies of the member countries of this privileged club, which, in fact, is the main reason for the resumption of demand for risky assets and a sharp rise in prices for commodity assets and crude oil.

In the currency exchange market, this news was met by continued strengthening of the single currency against the US dollar, stabilization of gold prices and the dollar / yen pair, as well as a sharp rise in the yield of US Treasury bonds. Thus, the benchmark yield of 10-year-old traders is adding 3.3% to 1.124% from the local minimum of 1.043% at the time of writing, which was reached this Monday.

Today, there will be a meeting of the Reserve Bank of Australia. The regulator expectedly lowered its key interest rate by 0.25% to 0.50% from 0.75%. He explained his decision as a response to the global outbreak of coronavirus, which overshadowed the short-term prospects of the global economy in general and the Australian economy in particular.

Markets believe that the largest world Central Bank, the Fed, will decide at the March meeting to cut off the current level of interest rates, which is a factor in a noticeable weakening of the dollar, which is most noticeable in relation to the euro. This dynamics is due to the fact that the ECB is not expected to take any new measures to stimulate the economy of the region, yes, in fact, it has practically no such measures, but the American regulator, as they say, still has such opportunities.

Assessing the likely development of events, we believe that the euro is the only one that can receive short-term support out of the main currencies, against the background of some calmness of the markets. All the rest will remain under pressure from expectations of either lowering interest rates or expanding incentive measures by pumping significant volumes of liquidity into financial systems.

Forecast of the day:

EUR/USD is trading below the level of 1.1180. The decision of the G7 countries to begin broad stimulus measures for the economies of their countries, and this primarily applies to America, which may lead to the resumption of growth of the pair. We believe that it is possible to buy it after breaking through the level of 1.1180 with a local target of 1.1240.

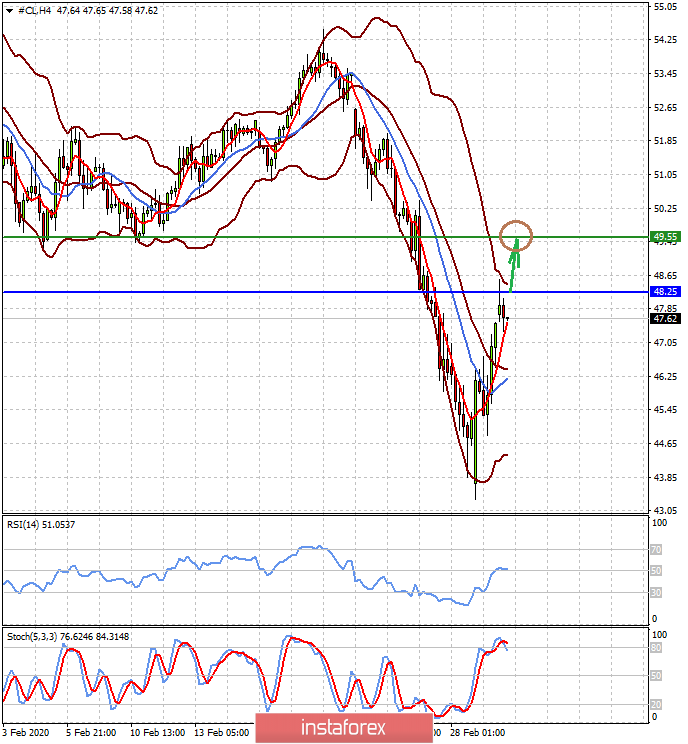

Crude oil prices are supported by the expectation of broad stimulus measures from the world's largest central banks, and primarily from the Federal Reserve. We believe that these measures will stimulate an increase in oil prices. In this case, the WTI crude oil brand will resume growth to 49.55 after breaking through the level of 48.25 dollars per barrel.