After losing more than 30% of its value from January highs and sagging to the bottom since December 2018, black gold managed to mark the best daily rally since the attack on oil companies in Saudi Arabia last September. The most rapid collapse of US stock indices from record peaks in history and pessimistic forecasts of the OECD forced central banks, finance ministries and OPEC to get down to business. The coordinated efforts of the powerful suggest that the worst for Brent and WTI is behind us.

According to the Organization for Economic Cooperation and Development, the global GDP in 2020 will expand by 2.4% instead of 2.9%, as previously expected. And that's assuming that the coronavirus is forgotten within the next few months. In the opposite case, the growth rate of the world economy risks being reduced by almost two times. Up to +1.5%. The lower the index, the worse the situation with global oil demand. The situation with China looks especially sad, as the gross domestic product will slow down from 6% to 4.9%. China is the largest consumer of black gold, so bad news from Asia is a "bearish" factor for Brent and WTI.

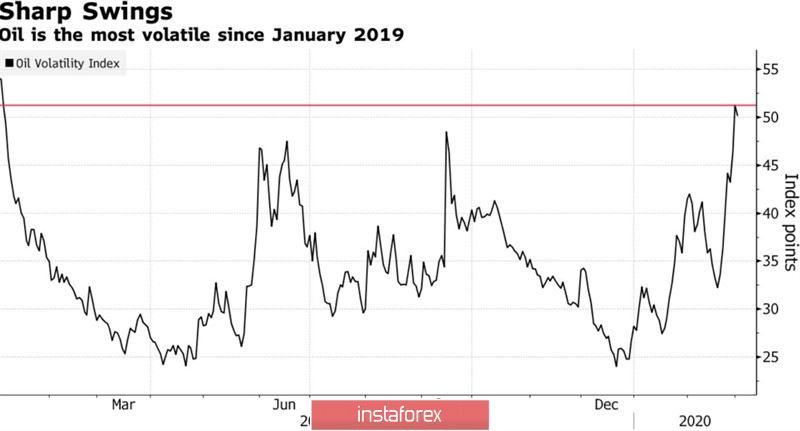

Everyone is well aware that joint efforts are needed. The Fed and ECB are ready to act on the circumstances, hinting at easing monetary policy. The Bank of Japan and the Bank of England intend to do everything possible to stabilize financial markets, and the Reserve Bank of Australia even cut the rate by 25 bps to 0.5%. G20 Finance Ministers will discuss the possibility of fiscal stimulus, and OPEC+ will discuss the possibility of another reduction in production volumes. Inaction by the cartel and Russia is fraught with another sell-off in the oil market, which increases uncertainty and increases volatility.

The dynamics of the volatility of oil

Despite the fact that Saudi Arabia intends to assume the main burden of responsibility, the market is concerned about the participation of the Russian Federation in the new volume of obligations. Moscow says it is ready to continue cooperation with OPEC but it is satisfied with the current oil prices of about $50 per barrel. Russia understands that further production cuts create additional preferences for competitors, in particular for American black gold producers. Taking into account the fact that since the beginning of February, short positions on WTI in the futures market have increased by the equivalent of 460 million barrels. Their scheme of working with price risk hedging by selling oil is working. It allows you to increase production and increase your market share regardless of the current value of black gold.

According to 27 of the 29 Bloomberg experts, OPEC+ will report a reduction in production by another 750 thousand b/d.

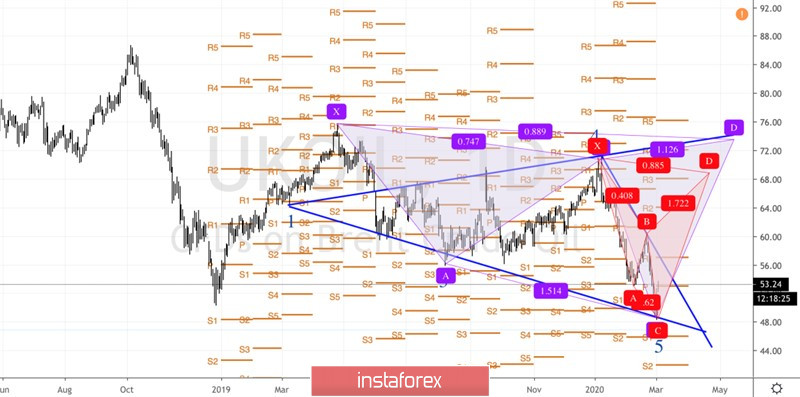

Technically, the "Wolf Wave" pattern is forming on the daily Brent chart. A rebound of quotes to the resistance at $57 per barrel with its subsequent successful assault will increase the risks of activating the "Shark" subsidiary model with a target of 88.6%, which corresponds to the level of $67.

Brent, the daily chart