Good day!

This week, the Australian dollar was destined to experience several important events, which should be discussed in more detail.

Yesterday, March 3, at its regular meeting, the Reserve Bank of Australia (RBA) decided to reduce the main interest rate from 0.75% to 0.5%. For many market participants, this decision was unexpected, since most forecasts assumed that the RBA would keep the rate at 0.75% and would not make any changes to its monetary policy for the time being.

However, everything turned out differently, and it seems that the distribution of the ill-fated coronavirus around the world played an important role in this decision of the Australian regulator. The number of cases and deaths is increasing every day. The tourist business suffers huge losses, people are simply afraid to travel to other countries, especially to those where cases of the epidemic have already been registered.

In China, which is Australia's largest trading partner, some factories have been closed. All this creates additional risks and increases the likelihood of another global financial and economic crisis.

The Australian Central Bank was not inclined to tighten monetary policy and decided to act ahead of the curve, as well as the Fed, which urgently lowered the main interest rate by 50 basis points last night.

Today, at 01:30 (London time), data on Australia's GDP for the 4th quarter was published. Both in annual and quarterly terms, the indicators were stronger than the forecasts and amounted to 2.2% and 0.5%, respectively.

Australia will publish its trade balance tomorrow, and retail sales data will be released on the last day of the trading week. However, it seems that the most important and significant for investors will be labor reports from the United States, the publication time of which will take place at 14:30 (London time). I believe that this event will determine the results of the closing of the current trading five-day period. Now let's see what pattern is observed on the daily AUD/USD chart.

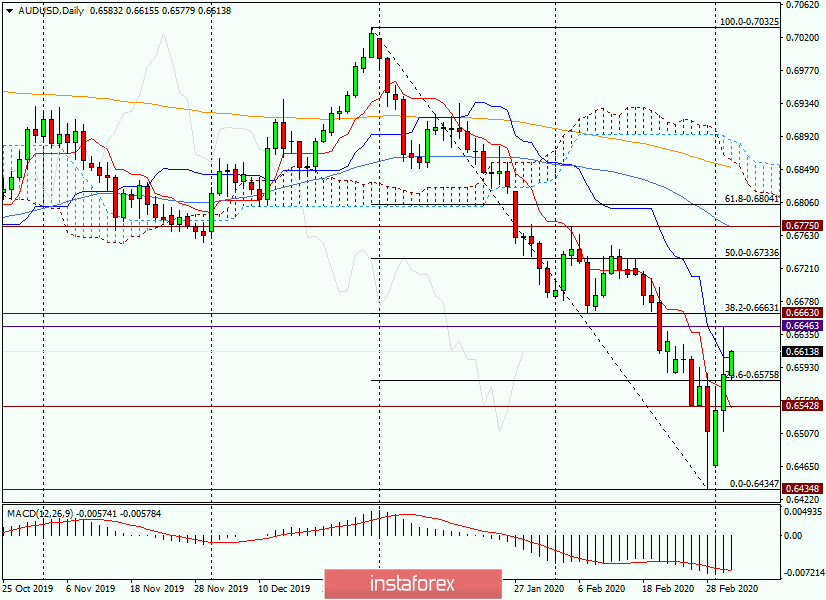

Daily

This may seem improbable, however, after the RBA cut its main interest rate, the Australian dollar rose. Different scenarios are possible on the market, so you should not be surprised at anything. In addition, the Fed also lowered the rate at the end of yesterday's trading.

After the pair soared to 0.6646, the upward momentum faded and the quote fell back to 0.6583, where it ended Tuesday's trading. The Kijun line of the Ichimoku indicator has definitely resisted growth, and it is this line that the "Australian" is trying to overcome again at the moment of writing this article.

If it is possible to break through the Kijun and close trading higher, the next benchmark for the bulls on the "Ozzy" will be the price zone of 0.6646-0.6663, where yesterday's highs and the broken support level are located. Also, there is a level of 38.2 Fibo from a decrease of 0.7032-0.6434.

At the moment, the current growth is corrective, so if a bearish candle or candles appear in the area of 0.6646-0.6663, this will be a signal to sell the pair. However, it is not yet clear how market participants will treat the US dollar after such an unexpected and sharp reduction in the main interest rate. Perhaps you should take your time and watch, besides on Friday's nonfarm. In general, a fun week.

However, at the moment, there is a high probability that the AUD/USD will continue to rise. However, much will depend on whether the pair will be able to return above the broken support level of 0.6663 and gain a foothold over it. In this regard, I will refrain from specific forecasts and trading ideas for AUD/USD at this time.

Have a nice day!