GBP/USD

Analysis:

The British pound chart is dominated by a downward wave from December 13. At the beginning of this year, the final part (C) started. At the end of last week, the price pushed through strong support and began to move sideways. The support that was broken earlier became resistance.

Forecast:

Until the structure of the current correction is completed, movements in the lateral plane will continue. A general flat mood is expected today. In the first half of the day, a downward vector is likely. You can wait for the pair's rate to rise by the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 1.2830/1.2860

Support:

- 1.2760/1.2730

Recommendations:

It is optimal for traders to stay out of the market for the period of correction of the pound. According to the expected sequence, intraday supporters can use short-term trade deals.

USD/JPY

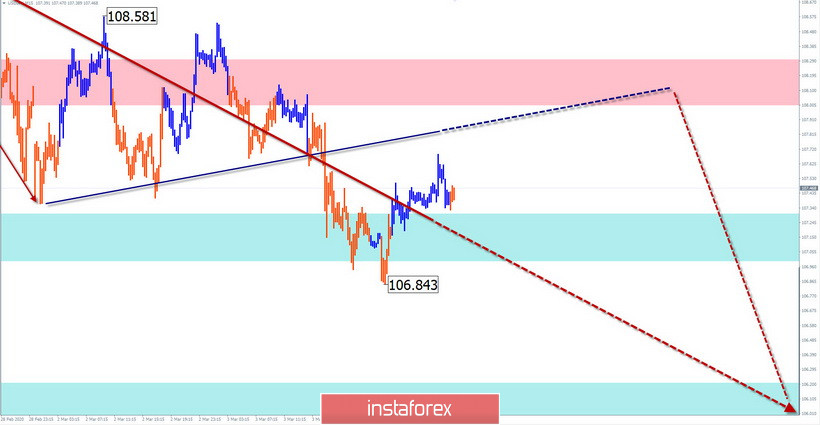

Analysis:

The potential for the yen's price decline, which began on February 20, indicates a change in the course of at least the medium-term trend direction. The price movement has a pronounced impulse form. The preliminary calculation gives approximately one and a half-price figures to the upper limit of the nearest potential reversal zone.

Forecast:

The intermediate correction that started two days ago is expected to be completed in the next trading sessions. Today, we expect a flat mood of exchange rate fluctuations, with a general upward vector. It is unlikely that the price will rise above the calculated resistance zone. A return to the main course of movement is possible at the end of the current day.

Potential reversal zones

Resistance:

- 108.00/108.30

Support:

- 107.30/107.00

- 106.20/105.90

Recommendations:

Purchases of the Japanese yen are very risky today. It is wiser to refrain from trading and wait for the upcoming pullback to complete. If there are signs of a change in the exchange rate, it is recommended to look for sell signals.

EUR/JPY

Analysis:

The current wave structure of the pair has been counting since the beginning of August last year. In the last two months, the price is adjusted. There are no signals of completion of the correction yet. The price rise that began at the end of last week has a reversal potential. This is a signal that the rise will continue further.

Forecast:

Without a fully formed corrective structure, there will be no price rise. Today, the flat rate decline that started yesterday is expected to continue. The preliminary completion section is located in the settlement support area. The resumption of price growth is not expected until tomorrow

Potential reversal zones

Resistance:

- 120.20/120.50

Support:

- 119.40/119.10

Recommendations:

Sales of the pair are possible today, however, you should reduce the lot as much as possible. In the area of the support zone, it is recommended to track the instrument purchase signals.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure and the dotted background shows the expected movements.

Note: The wave algorithm does not take into account the duration of the tool's movements in time!