In recent years, the market often talks about paradoxes. But the 5% peak of gold at the auction on February 28 does not climb any gates at all. The fastest correction of US stock indices from the levels of record highs, the fall of 10-year bonds in the direction of 1%, the lowest in history, and the collapse of the US dollar created an extremely favorable environment for the precious metal in which it almost always strengthens its positions. This time it was the opposite. Gold lost about $100 per ounce. They didn't really understand what was going on.

The market was bursting with rumors. Someone said that in the conditions of finding speculative positions on the asset in the area of record highs, the risks of a sharp pullback should not be surprising. Someone claimed that the holders of gold do not want to get rid of it, however, they are forced to sell it to cover losses in other asset classes. Asset Manager Canaccord Genuity noted that since 1989, there have been only 16 cases when a sharp drop in XAU/USD was accompanied by a rapid peak in the S&P 500. All of them ended with a serious weakening of the Fed's monetary policy and the restoration of the "bullish" trend for the precious metal. A typical example is 2008, when during the height of the global financial crisis, gold suddenly lost almost a quarter of its value before heading for historical highs of more than $1,900 per ounce.

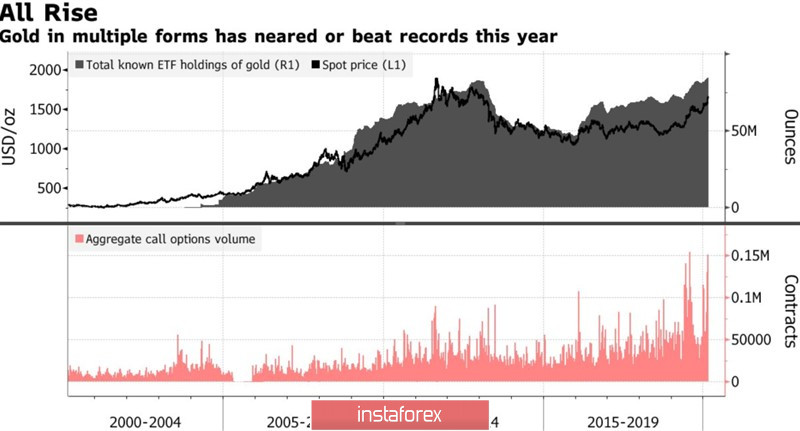

As a confirmation that the sale of the XAU/USD at the end of February was speculative, we can cite an increase in stocks of specialized exchange-traded funds by 8.6 tons on the 28th, resulting in a record high of 2634.4 tons.

Dynamics of gold prices and ETF stocks

There is a high probability that events will develop according to the 2008 scenario. The inversion of the yield curve and the fall in rates on 10-year Treasury bonds below 1% indicate increased risks of a recession. The Fed was forced to make an unscheduled easing of monetary policy, reducing the federal funds rate by 50 bps at once. Donald Trump believes that this is too little, and the US Central Bank will most likely not stop there, which creates downward pressure on the US dollar and is good news for fans of the precious metal.

The Fed is likely to be followed by other regulators. Money markets believe the ECB will cut its deposit rate by 10 bps in March and another 10 bps by the end of 2020. The Bank of England and the Bank of Japan have indicated their willingness to ease monetary policy, and the Reserve Bank of Australia has already done so. The devaluation of the main world currencies associated with monetary expansion plays into the hands of gold.

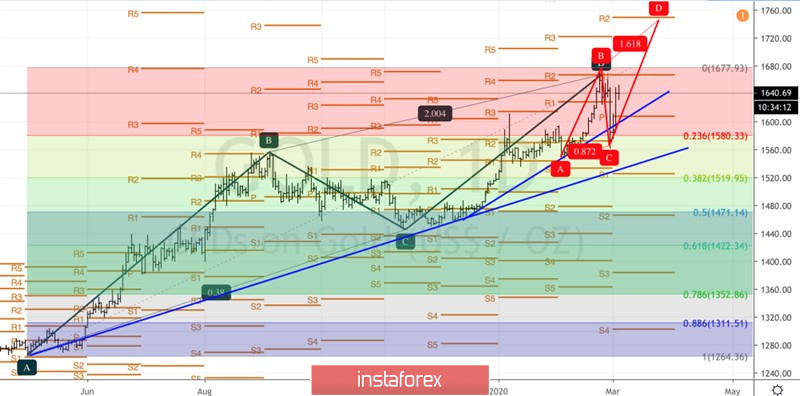

Technically, the inability of the precious metal bears to storm the trend line of the acceleration stage of the "surge and reversal with acceleration" pattern and support at $1,580 per ounce (23.6% of the last rising wave) indicates their weakness and increases the risks of activating the AB=CD model with a target of 161.8%.

Gold, the daily chart