Data on the services sector of the eurozone countries did not make adjustments to the market and buyers of risky assets did not manage to regain the resistance of 1.1190, after which the US dollar began to strengthen against the euro and the pound. Growth in activity in the service sector was observed in France and Italy, while the indicator in Germany declined.

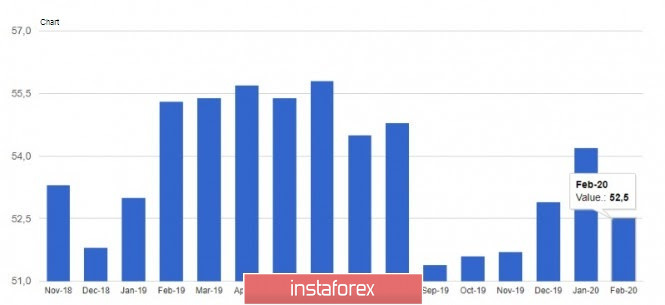

According to a report by Markit, the purchasing managers' index (PMI) for the Italian services sector rose to 52.1 points in February this year, compared to a January reading of 51.4 points. Economists had forecast it at 51.2. In France, the same index in February reached 52.5 points against 51.0 points in January, with the forecast at 52.6 points.

The German economy, which is currently experiencing difficult times, recorded a decline in activity in the service sector, although the index remained above 50 points, indicating growth. According to the report, the purchasing managers' index (PMI) for the German services sector in February fell to 52.5 points against 54.2 points in January and the forecast of 53.3 points.

Let me remind you that these values do not yet take into account the spread of coronavirus in the European territory, so it is not quite correct to expect an increase in indicators in March this year. Rather, the slowdown will affect not only the production sector, which is stagnating in both domestic and foreign markets but also the demand for services will significantly decrease.

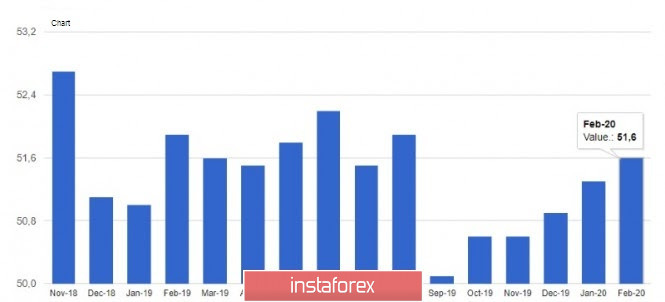

As for the euro area as a whole, the purchasing managers' index for the services sector rose to 52.6 points in February from 52.5 points in March. And the composite PMI, which also takes into account the manufacturing index, coincided with economists' forecasts and amounted to 51.6 points in February against 51.3 points in January.

The market was also not supported by data on retail sales growth in Germany in January this year after a significant drop in December. According to a report by the Bureau of Statistics Destatis, retail sales in Germany in January increased by 0.9% compared to December, which fully coincided with the forecasts of economists. Let me remind you that in December 2019, the volume of retail sales fell by 2.0% at once, which negatively affected the overall indicator of the economy. Compared to the same period of the previous year, retail sales increased by 1.8%.

As for the eurozone as a whole, the indicator has also recovered, which indicates an acceleration in household consumption. However, it is likely that due to the spread of coronavirus in the 2nd quarter, we should expect a reduction in this indicator. The report shows that retail sales in January 2020 increased by 0.6% compared to the previous month after falling by 1.1% in December.

From a technical point of view, nothing has changed significantly. The bears are aimed at supporting 1.1140, a breakout of which will lead to the lows of 1.1090 and 1.1040, from where large buyers of risky assets will only begin to act.

GBPUSD

The British pound remained trading in the channel of 1.2740-1.2850 after the report on the service sector, which continued its growth in February, although not at such a high pace. According to the data, the purchasing managers' index (PMI) for the UK services sector fell to 53.2 points in February this year, compared to 53.9 points in January. Economists had forecast a rise to 55.8 points, which affected buyers of the pound, which is about to take the level of 1.2795. It is for this range, which acts as the middle of the side channel, that the fight will continue. Breaking the upper limit around 1.2850 will strengthen demand for the pound, which will lead the pair to the highs of 1.2890 and 1.2930. A break of the lower border of the channel in the area of 1.2740 will return the trading instrument to the downward trend, opening a direct road to the lows of 1.2700 and 1.2660.