At the time of writing, Gold was trading in the red at the 1,787.17 level far below 1,796.43 today's high. In the short term, the pressure is still high as the Dollar Index has started to grow again.

DXY's further growth could force the yellow metal to drop deeper. Technically, the rate is located in the seller's territory, so a further drop is possible. Tomorrow, the FOMC, ISM Services PMI, and the ADP Non-Farm Employment Change could be decisive. These are seen as high-impact events and could bring high volatility. The Federal Reserve is expected to maintain its monetary policy unchanged in the November meeting.

In the short term, XAU/USD plunged after Euro-zone reported higher inflation. Yesterday, it has increased, even if the US ISM Manufacturing PMI has come in better than expected.

XAU/USD upside seems limited

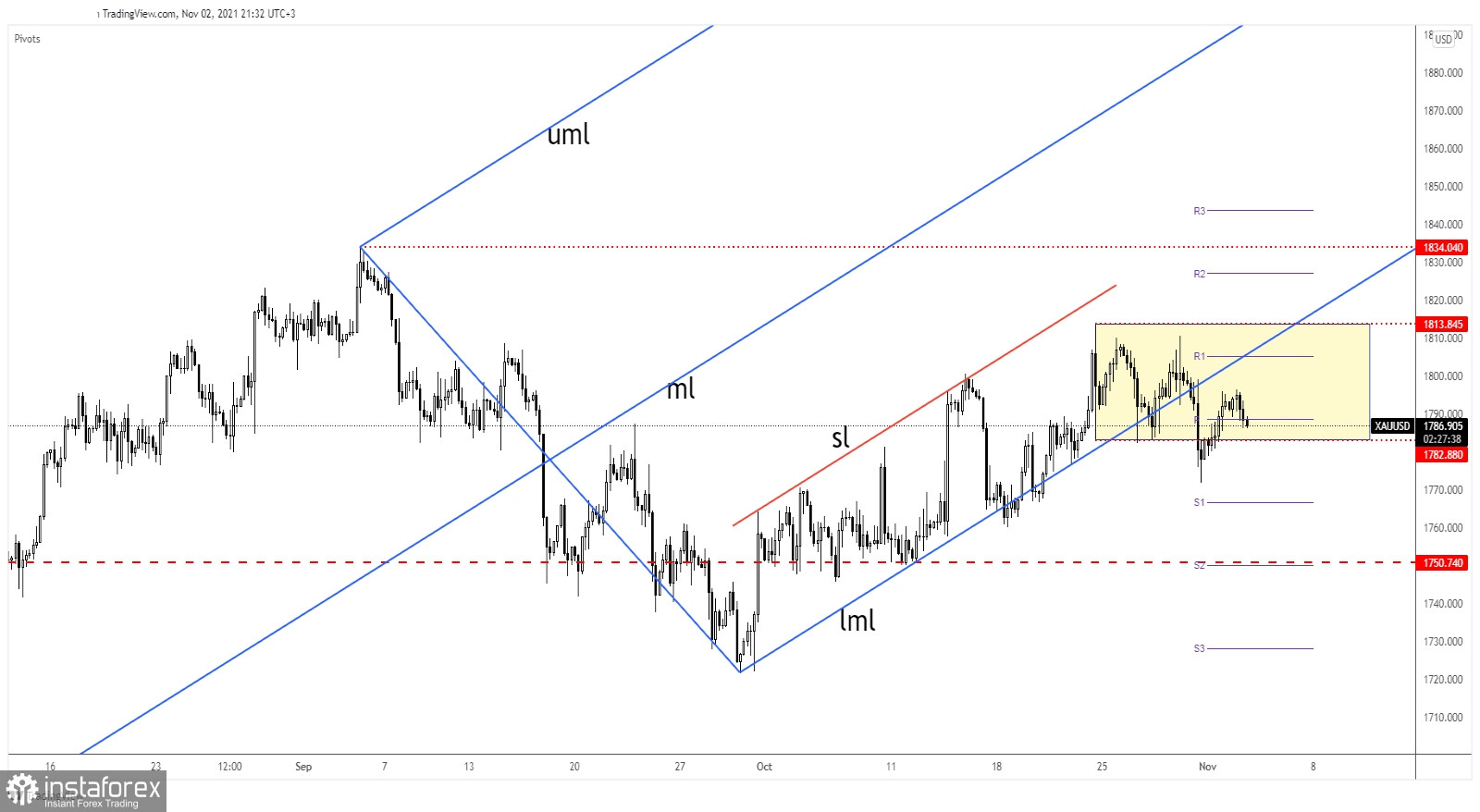

As you can see on the H4 chart, XAU/USD has rebounded but it has failed to approach and reach the Ascending Pitchfork's lower median line (lml). Gold failed to stay within the Ascending Pitchfork's body signaling that the buyers are exhausted and that the rate could develop a downside movement.

It has also dropped below 1,782.88 static support, from the temporary range, signaling a potential deeper drop.

Gold forecast

Its failure to approach and reach 1,813.84 high and its drop below the lower median line (lml) and under 1,782.88 signaled that the sellers could take the lead anytime. Failing to stabilize above 1,788.61 weekly pivot point and dropping under 1,782.88 could announce potential drops.

Only making a new higher high, a bullish closure above 1,796.43 may signal potential further growth.