The statements made by Eurozone Finance Ministers yesterday, as well as the good data on the growth of the ISM index for the US non-manufacturing sector, supported the US dollar. As a result, the EUR/USD pair bounced down from the 12th figure, but it is not experiencing a strong pressure yet.

Yesterday, Eurozone Finance Ministers made a number of statements, drawing attention to the use of coordinated measures in response to the coronavirus outbreak. They emphasized the possibility of expanding fiscal measures if necessary, as the current budget rules allow it.

In my past reviews, I have noted that many countries are taking various measures to help their economies. An example of this is the US Treasury Secretary, Steven Mnuchin, who joined forces with the US presidential administration in order to mitigate the economic impact of the coronavirus outbreak. Now, thanks to their efforts, an agreement was reached to provide assistance, as US lawmakers approved a $ 7.8 billion budget to use in the fight against the virus. Recall that the US Federal Reserve has lowered its interest rate recently, making lending more affordable. Moreover, the Finance Minister also said that the US presidential administration is working with a number of international partners, and is closely monitoring the state of the supply chains.

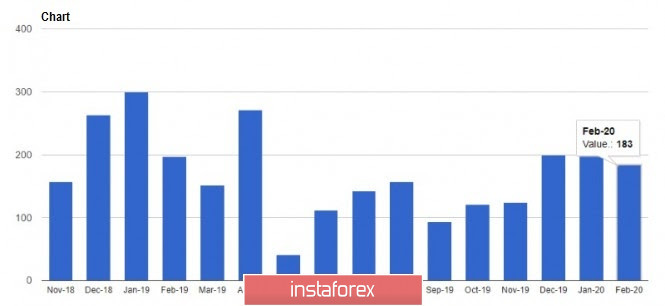

In other aspects, we should focus on the state of the US labor market, as it continues to produce job vacancies. Yesterday, ADP Research Institute and Moody's Analytics reported that the number of jobs in the US private sector increased by 183,000 in February 2020, while economists had expected it to be 155,000. The largest increase in jobs (more than 130,000) was observed in large companies. In addition, January's data was updated, as the number of new jobs in the US private sector turned out to be 209,000, instead of the 291,000 previously reported.

Meanwhile, the Markit and ISM data have diverged dramatically. The IHS Markit report indicated that the final purchasing managers' index (PMI) for the US services sector was 49.4 points in February, unchanged from the preliminary report. In January, the index was at 53.4 points. A value below 50 points indicates a decrease in activity. Most likely, the US service sector has declined due to the coronavirus outbreak and the uncertainty of economic and political prospects. As a result, the composite PMI in the US was 49.6 points in February, as compared to 53.3 points in January.

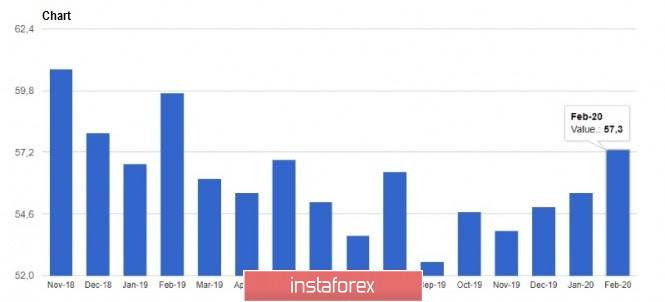

ISM, on the other hand, sees the situation a little differently. According to its report, the PMI for the US non-manufacturing sector rose from 55.5 points in January, to 57.3 points in February. It was expected to fall to 55 points.

The recorded increase was mainly due to the sharp jump in the new orders index, which rose from 56.2 points in January, to 63.1 points in February. The increase on the employment index has affected it as well, since it increased from 53.1 points to 55.6 points. As for the index of business activity in the non-manufacturing sector, it fell from 60.9 points in January, to 57.8 points in February.

The problem remains with the coronavirus, which has affected all the areas. Nevertheless, the rapid response and measures taken by various countries will most likely mitigate the economic consequences of the outbreak.

As for the technical picture of the EUR/USD pair, it is clear that very few people are willing to buy the dollar, even though those who believe in further growth of the risky assets have decreased. As a result, the pair will most likely spend its time in the side channel at 1.1095-1.1200, where going beyond which will determine the further direction of the trading instrument. The nearest support levels are 1.1040 and 1.0990, while the nearest resistance levels are 1.1240 and 1.1305.

CAD

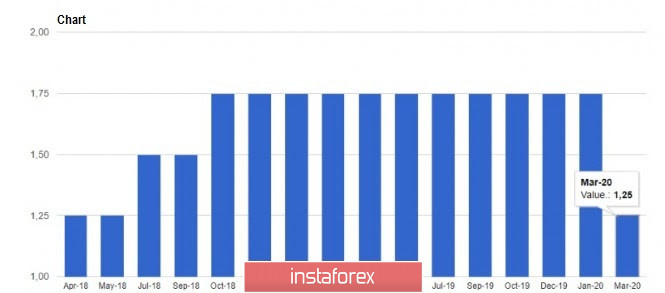

The loonie declined against the US dollar, after the Bank of Canada lowered its one-day interest rate target by 50 bps to 1.25%. Although this decision was quite expected, the Federal Reserve has taken similar actions, and the loonie's position weakened after a slight correction, which was observed against the strengthening of oil.

The Bank of Canada said that the coronavirus was a significant negative shock to the Canadian and global economies, so its economic prospect is now worse than what it was in January. Although the global economy showed signs of stabilization before the outbreak, business activity began to decline gradually, and supply chains were disrupted, which will negatively affect the consumer confidence and business confidence in the future. The Bank of Canada forecasts the GDP growth to be weaker in the first quarter of 2020 than expected, even though consumption growth was stronger than the forecast in the 4th quarter. Moreover, problems remain in the investment and exports, which continues to decline.

As for the technical picture of the USD/CAD pair, the problems on growth remain in the resistance area of 1.3430, where the bears were active at the beginning of this week. Meanwhile, the lower border of the side channel is located in the area of 1.3320, which will be defended by large buyers of the pair. A break of 1.3430 will lead the pair to the highs of 1.3470 and 1.3500.