Economic calendar (Universal time)

Today's economic calendar is quite calm and only the speech by the head of the Bank of England this evening (17:00) will bring revival to it.

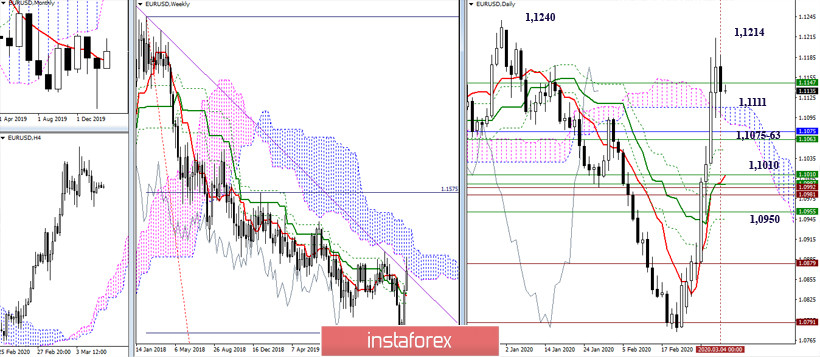

EUR / USD

After a successful ascent, the players to increase took a break. As a result, updating and overcoming the maximum extremes (the current 1.1214 and the previous 1.1240) is their first priority if there are plans to restore the upward movement. Currently, the daily cloud is used as support (1.1111 - 1.1090), strengthened slightly below the combination of the weekly Fibo Kijun (1.1063) and the monthly Tenkan (1.1075). Now, consolidating below the indicated supports and closing the week under these boundaries will serve as the basis for the formation of rebound from the encountered resistance of the lower boundary of the weekly cloud. In this case, the pair then rests in a fairly wide support area of 1.1010 - 1.0950 (daily cross + weekly Ichimoku cross + historical levels).

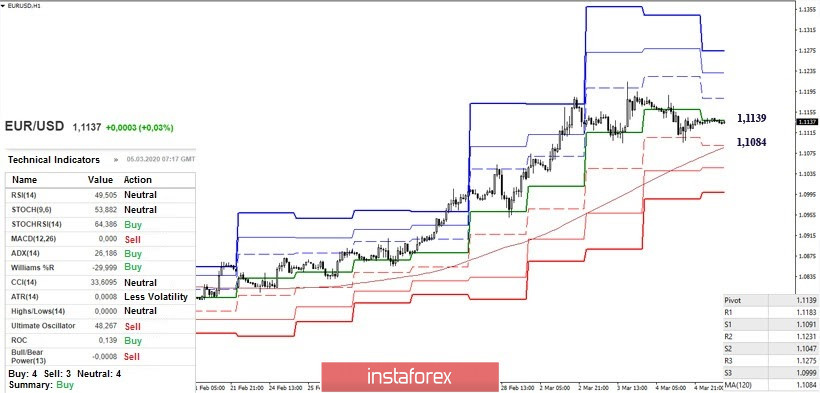

Players to upgrade lost support for the central Pivot level on H1 yesterday and still continue to work at this level, which is located at the level of 1.1139 today. A reference point for a further decline is now the weekly long-term trend (1.1084). Consolidating below will convey the advantage of lower halves to players to decline, for whom new perspectives and guidelines will appear. At the same time, support for the classic Pivot levels today are at 1.1091 - 1.1047 - 1.0999, while intraday resistance is located at 1.1183 - 1.1231 - 1.1275.

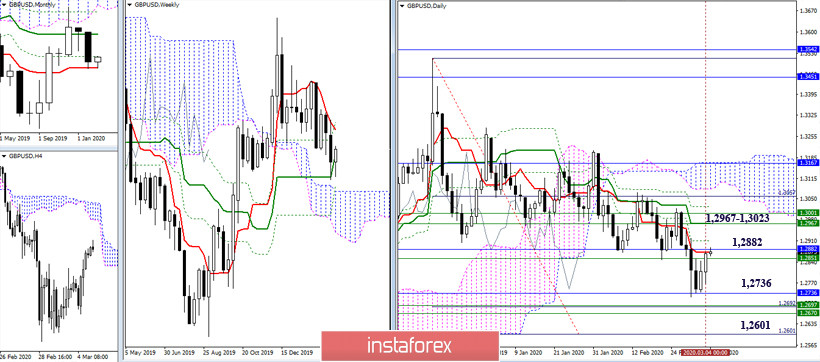

GBP / USD

The players to decline took a break having met the support of the weekly medium-term trend and the monthly short-term trend (1.2736) last week, and as a result of which, the initiative passed to the opponent. To date, players to increase have managed to rise to the resistance zone in the region of 1.2910 - 1.2851, led by monthly Fibo Kijun (1.2882). Thus, overcoming resistances will open the possibility for raising and testing the following lines located in the range 1.2967 - 1.3023 (final lines of the daily dead cross + weekly Tenkan + Fibo Kijun).

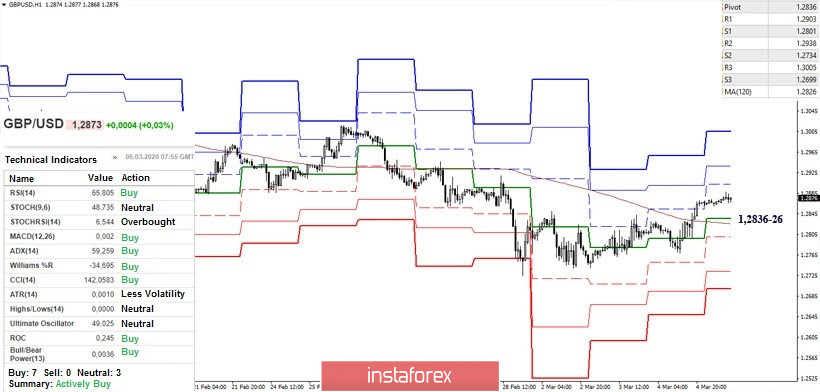

Players to upgrade in the lower halves have pulled ahead and now have a clear advantage here. The resistance lines of the classic Pivot levels 1.2903 - 1.2938 - 1.3005 serve as upward reference points within the day. The key lower support is concentrated in the area of 1.2836-26 (central Pivot level + weekly long-term trend). Consolidating below can change the existing balance of power and return bearish sentiment.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)