Hello, traders!

In yesterday's trading, the euro/dollar currency pair continued its upward movement and it turned out to be quite significant. Let's look at the price charts in more detail a little later. For now, let's talk about the main event of today and the whole week. Although the emergency reduction of the Federal Reserve's (FRS) refinancing rate by 50 bps at once may overshadow the significance of the US employment reports, becoming the main event of the week. Moreover, many economists assume that at the March meeting, the Federal Reserve will once again reduce the rate by 25 basis points.

It's all the fault of the ill-fated coronavirus (COVID-19), which can actually lead to serious problems in the world economy.

By the way, the ECB will not keep pace with the Fed and intends to keep rates unchanged, presumably, until the end of 2022. In my opinion, in the current situation, it is not necessary to make such long-term forecasts. The situation may change in the near future. Then the European regulator will have to take measures to protect the region's economy.

Now about the forecasts for the US labor market. Forecasts for the creation of new jobs in the non-agricultural sectors of the American economy are 175,000, which is much more modest compared to the January figure of 225,000. Although, as the former head of the Fed, Ms. Yellen has repeatedly argued that the US economy needs to create 100,000 new jobs every month.

Presumably, the decrease in the number of new jobs in February, compared to the previous month, is due to temperature factors (in January, the weather was warmer), and, of course, the spread of the coronavirus epidemic.

Unemployment in the United States is expected to remain at the same level of 3.6%, while average hourly earnings growth will increase by 0.3%. I would like to remind you that in January, wages increased by 0.2%. If this indicator is released at the level of the forecast value, it will be a positive moment for the US dollar.

It seems that the US currency has fallen into a bearish trend, at least in the pair with the euro. Based on this, we can assume that market participants will try to find negative points in labor reports, and we are unlikely to see global changes in euro/dollar. Maximum - correction, the depth of which will directly depend on specific numbers.

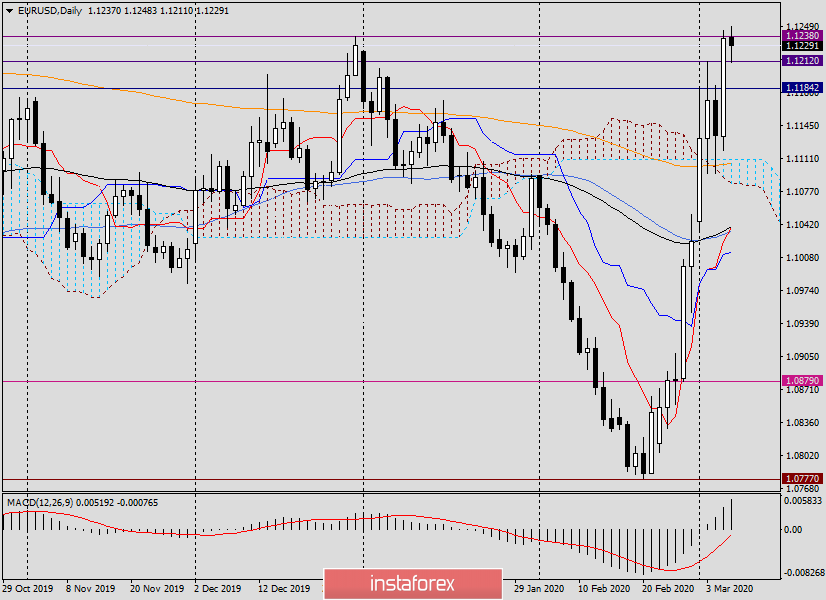

Daily

Despite the impressive growth shown by the pair in yesterday's trading, the Thursday session ended above the significant resistance level of 1.1238 and the players did not manage to increase the rate. The quote rose to 1.1244, however, it could not stay above 1.1238. After a slight pullback, the auction closed at 1.1236.

Well, "according to the law of the genre", everything will be decided today - on the last day of weekly trading and after the most important reports on employment in the United States. At the end of the review, the euro/dollar is trading near 1.1220. Closing the week above 1.1238 will be hindered by the 89 exponential moving average on weekly. We will analyze this chart on Monday, after the closing price. If the euro bulls manage to complete the trading of the current five-day period above 1.1242 (89 EMA), this will be a serious bid for further growth to the upper border of the Ichimoku indicator cloud, which passes at 1.1370.

If strong labor reports are released and the current five-day period closes below 1.1146, there will be doubts about the further ability of the quote to continue moving in the north direction.

I dare to assume that the euro/dollar pair will continue to grow today and finish trading on March 2-6 near 1.1250. At the very least, market sentiment is clearly not in favor of the US currency, and only exceptionally strong reports on the labor market will help the dollar slightly reduce losses, which, at the time of completion of this article, are very significant.

I will not offer any trading ideas today, it is not the best day for this. On Monday, we will calmly assess the situation and see what interesting signals will be for trading euro/dollar.

Alternatively, for those who certainly want to trade today, you can try buying after a short-term decline in the price zone of 1.1185-1.1170.

Good luck!