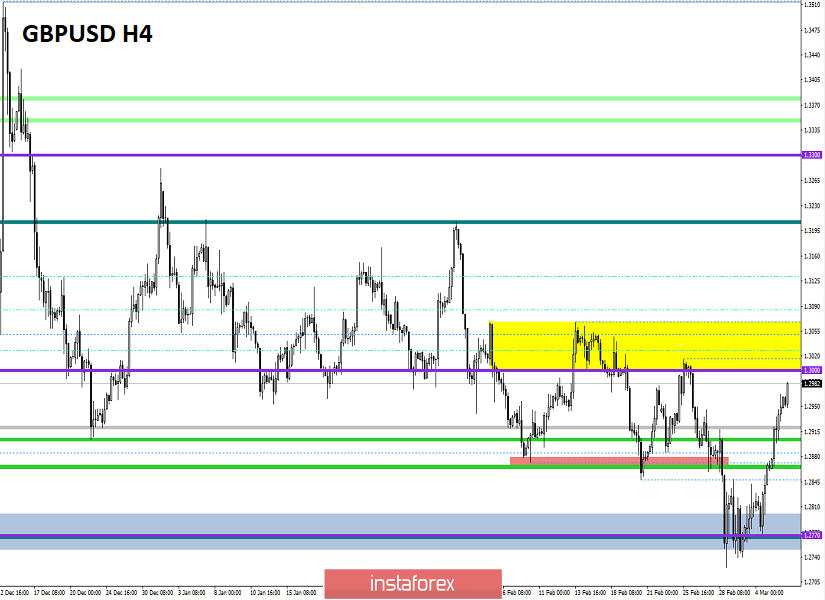

From the point of view of complex analysis, we see a movement within the range of 1.2770 // 1.2885 // 1.3000, and now let's talk about the details. The price development within the main borders has not gone away, the quote is still moving from one frame to another, while the activity is above average. If we make a reference to the laws of the past, then moving towards the frame of 1.3000 is no longer surprising, and the levels themselves have become floating, where minor corrections in their location are not exempted. In turn, focusing the price on the area of 1.2770 / 1.3000 confirms the fact that the proper volume of short positions has been maintained, and if we send it to the EUR/USD market counterpart, we will see how the correlation between trading instruments sharply subsided, which confirms the downward theory development once again. Thus, in order for the theory to fail, as it happened on the euro / dollar pair, we need to return at least to the area of 1.3200, and preferably higher. To confirm the theory of downward development and the transition to a new level, quotes need to overcome the range of 1.2770 // 1.2885 // 1.3000 in a downward direction and focus lower than 1.2725.

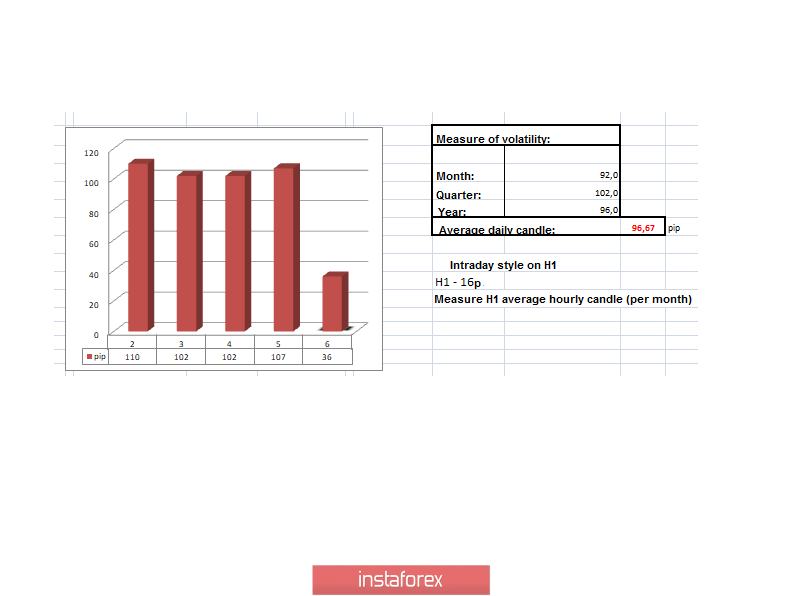

In terms of volatility, we see a stable acceleration, which cannot but rejoice with speculators, since the average daily value is systematically exceeded by the daily candlestick, in this case by 11%.

Details of volatility: Tuesday - 103 points; Wednesday - 115 points; Thursday - 86 points; Friday - 193 points; Monday - 110 points; Tuesday - 102 points; Wednesday - 102 points; Thursday - 107 points. The average daily indicator, relative to the dynamics of volatility is 96 points [see table of volatility at the end of the article].

Detailing minute by minute, we see that the round of upward movement came at the start of the European session and lasted until the end of the trading day.

As discussed in the previous review, intraday traders worked at local long positions even at a breakdown of the 1.2850 flat border, fixation points were in the region of 1.2910–1.2945.

Looking at the trading chart in general terms [the daily period], we see that the medium-term upward trend is still active. You should not forget that the recovery relative to this trend will come only after passing the level of 1.2725. Now, we are talking about changing the clock component relative to the period earlier at the end of last year.

The news background of the past day contained data on applications for unemployment benefits in the United States, where the expectations were almost the same. They were waiting for the growth of applications by 5 thousand, received + 4 thousand: Primary -3 thousand; Repeated +7 thousand. At the same time, data were released on US production orders, where they recorded a decline of 0.5%.

The reaction of the market to statistics was not in favor of the US dollar, as was the general market background.

In terms of general informational background, we have to finish the first phase of negotiations on trade interactions after Brexit, which were quite ambitious. So, according to Michel Barnier, the EU's chief negotiator for Brexit, the first round of negotiations was very intense and aimed at completely restructuring the close cooperation between Europe and the United Kingdom on a new legal basis.

"Our goal is to build a close partnership with the United Kingdom in the field of economy and security, to create a free trade zone covering all goods and services without duties and quotas. We launched 11 areas of negotiations with Great Britain in various areas, with the exception of foreign policy and defense, since the British side informed us that it does not want to discuss these topics. We will remain open to discuss them in the future, if the UK wants it." Michel Barnier said at a press conference on Thursday

At the same time, Mr. Barnier outlined four main blocks of disagreement, which included issues such as legally binding general rules in the field of competition and business regulation; refusal to accept obligations to implement the European Convention on Human Rights; refusal of information on various fields of cooperation into one association agreement; fishing issues.

As we see, the front of work is great and the parties are already moving to the second phase of negotiations on Brexit.

Today, in terms of the economic calendar, we have a report from the Department of Labor in the United States, where it is expected that only 165,000 new jobs will be created in the non-agricultural sector compared to the previous period, where 225,000 were created. At the same time, we will receive data on unemployment rate, where no changes are expected, as well as hourly average wage indicators with a possible slowdown from 3.1% to 2.9%

If the forecasts are confirmed, the dollar may come under pressure.

The upcoming trading week does not have a wide flow of statistics, but, as practice has shown, unplanned noise can be much more interesting and useful. From the main events, we have the final inflation data in the United States, as well as the ECB meeting.

The most interesting events displayed below --->

Wednesday, March 11

Great Britain 9:30 Universal time - Volume of industrial production (YoY) (Jan)

USA 12:30 Universal time - Inflation: Prev 2.3%

Thursday, March 12

ECB meeting, followed by a press conference

USA 13:30 Universal time - applications for unemployment benefits

Further development

Analyzing the current trading chart, we see that the quote has almost reached the upper boundary of the range 1.2770 // 1.2885 // 1.3000, where it does not exclude a temporary passage of the frame, as we wrote above. In fact, the risk of violating the theory of downward development is still negligible, and so there is no need to worry. Now, the main point is how the quote will behave within the level of 1.3000 and how strong the puncture will be and when the reverse move will occur. All these issues will be analyzed gradually, along with the course of the market.

From the point of view of the emotional mood, we see that the information background puts pressure on speculators, which leads to a surge in activity and, as a fact, to high volatility.

By detailing the time interval we have, we see that the night slowdown of 1.2945 / 1.2967 was broken with the arrival of Europeans on the market, but activity is still low.

In turn, intraday traders carefully analyze the behavior of quotes, considering the rise in price to the level of 1.3000. The next step will be to monitor fluctuations around the level of 1.3000, with a possible rebound from it.

Having a general picture of actions, we see that external noise puts pressure on the American currency, which leads to its weakening on all fronts. The movement towards 1.3000 is now something normal, but the next steps will depend on the behavior of the quote and whether it will be able to return to the area of the range border with a move towards 1.2885–1.2770.

Based on the above information, we derive trading recommendations:

- Local purchase positions, if any, are directed towards 1.3000–1.3020.

- Sales positions are considered later after a distinct slowdown, possibly within the level of 1.3000.

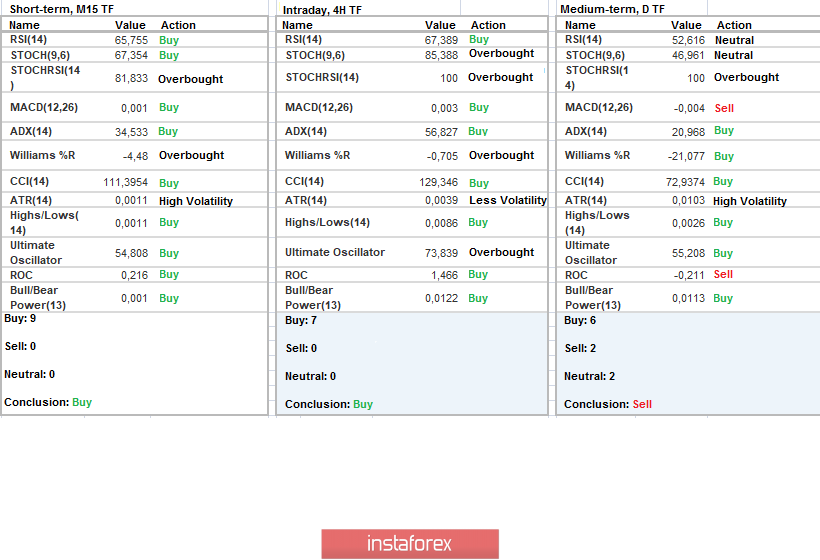

Indicator analysis

Analyzing a different sector of timeframes (TF), we see that the indicators of technical instruments relative to all the main periods signal purchases due to the return of the price to the area of the level of 1.3000.

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for Month / Quarter / Year.

(March 6 was built taking into account the time of publication of the article)

The current time volatility is 36 points, which is a low indicator for this time section. It is likely to assume that the market background and external noise will put pressure on speculators, which will result in increased activity.

Key levels

Resistance Zones: 1.3000; 1.3170 **; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support Areas: 1.2885 *; 1.2770 **; 1.2700 *; 1.2620; 1.2580 *; 1.2500 **; 1.2350 **; 1.2205 (+/- 10p.) *; 1.2150 **; 1,2000 ***; 1.1700; 1.1475 **.

* Periodic level

** Range Level

*** Psychological level

**** The article is built on the principle of conducting a transaction, with daily adjustment