The key event of the first week of March was an extraordinary reduction in the Federal funds rate from 1.75% to 1.25%. Back in late winter, FOMC officials said that it was too early to assess the impact of coronavirus on US GDP and assured of the strength of the US economy. In early spring, they unanimously reduced borrowing costs by 50 bps at once. As history shows, the Fed will not stop there: since 1989, after each of the 6 unscheduled acts of monetary expansion, the central bank continued what it started at the scheduled meeting. However, this did not always help save the stock market.

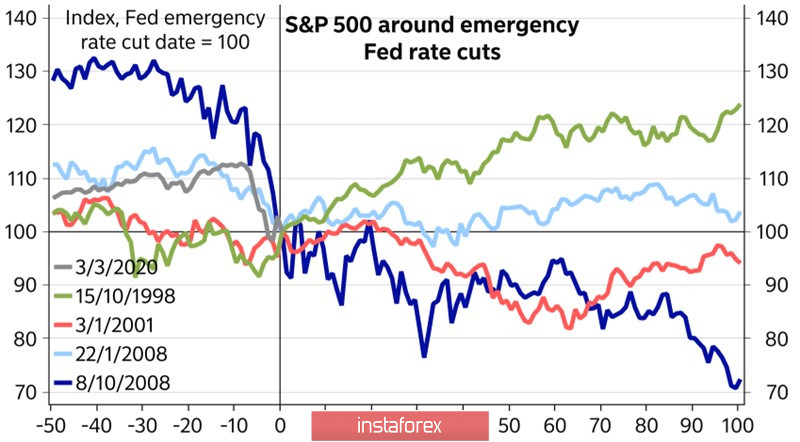

At the end of 2008, aggressive monetary easing did not prevent the S&P 500 from sales, but in 1998, 2001, and early 2008, the Fed was able to stabilize the market. What can we expect now?

Impact of the Fed's aggressive monetary expansion on the S&P 500

Judging by the initial reaction of US stock indices, which sank by more than 3%, we can assume that 50 bps is not enough for investors. CME derivatives believe that the Federal funds rate may drop to 0.25% at the end of the year, so the Fed has a margin of safety. Will it take so much aggression? We will get an answer to this question in the next few weeks. For now, we can say that the depth of monetary policy easing is a key bullish driver for EUR/USD.

The euro seems to have forgotten about the weakness of the eurozone economy, the problems in the EU-Britain negotiations, and the risks of a trade war between the European Union and the United States hanging like a sword of Damocles over its head. US bond yields are falling significantly faster than their German counterparts, and the spread has narrowed to the lowest level since 2017, which has deprived the dollar of its main trump card - playing on the difference. Carry traders close deals and return to the funding currencies represented by the euro and yen. At the same time, the collapse of the S&P 500 contributes to the outflow of capital from the States and the weakness of the US dollar.

Will anything change in the week of March 13? At first glance, the rich economic calendar for the eurozone, taking into account its internal weakness, increases the risks of a EUR/USD pullback. Indeed, the forecasts for German foreign trade and European industrial production are by no means comforting, which, paired with the ECB's intention to ease monetary policy, makes euro fans hold their horses. The money market is absolutely confident of reducing the deposit rate by 10 bps in March and another 10 bps by the end of the year. There are rumors of an expansion of QE and another round of cheap loans in the form of LTRO.

Christine Lagarde and her colleagues are interested in cooling the EUR/USD bulls, as revaluation slows inflation. Will it work? I believe that little will depend on frankfurt alone. Investors will continue to react to the behavior of US stock indices and to changes in the probability of the Fed's monetary expansion.

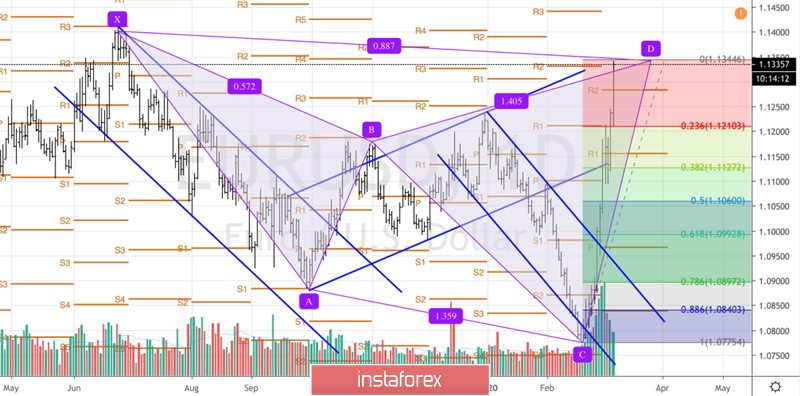

Technically, the main currency pair very quickly reached the target of 88.6% on the "Shark" pattern. A break in the resistance at 1.134 is fraught with a continuation of the rally, at least to the next target of 113%. On the contrary, the rebound will increase the risks of correction to 1.12 and below.

EUR/USD, the daily chart